Shares have taken a beating recently. In fact, President Trump declared trade war on a new front Thursday, proposing a 5% tariff on all goods imported from Mexico, beginning June 10. In lieu of agreement between the U.S. and its neighbor to the south, the tariff would gradually increase to 25% by October. That’s on top of continued tension with China.

This continued global economic uncertainty sent investors looking for security in bonds. Short-term rates moved so low on Wednesday that the yield on 3-month bills T-bills was 14 basis points below 10-year notes, which is a level of inversion that hasn’t been experienced since the Financial Crisis. Bond investors are not always right, obviously, but an inverted yield curve is generally viewed as a signal that a recession could materialize in the next year or so.

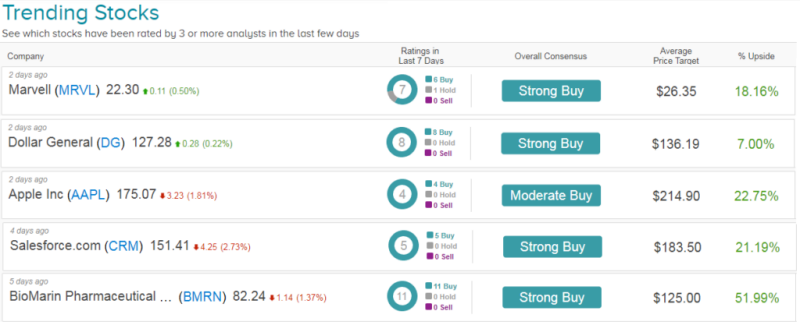

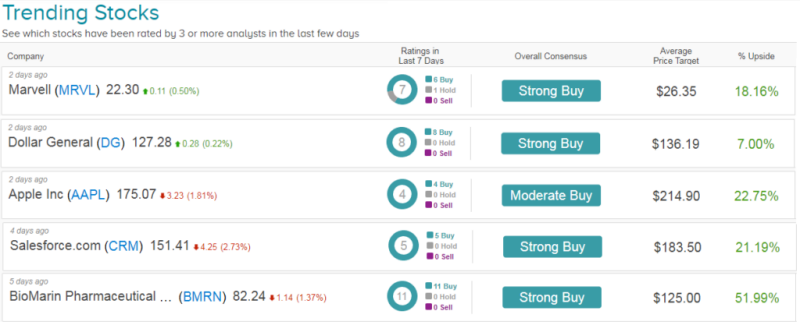

However not all is lost. There are still plenty of compelling investing opportunities out there. You just have to know where to look. Here we delve into the Street’s best-rating trending stocks right now. In other words, these are five of the stocks that have received the most buy ratings from analysts over the last seven days.

So what is driving this particularly bullish Street sentiment? Let’s take a closer look at these five top stocks:

1. BioMarin Pharmaceutical Inc

BioMarin is buzzing right now. This pharma company has just received 11 back-to-back analyst buy ratings in just the last week. Analysts applauded a critical update from BioMarin’s Ph. I/II clinical study of valrox in patients with hemophilia A as well as initial data from the Ph. III study.

Valrox is BioMarin’s gene therapy for hemophilia A, which management anticipates should receive regulatory approval in the third quarter of 2020. Working backwards, this would suggest an application submission in Q1’20. “We expect these data to support accelerated approval, and drive adoption” writes top-rated Cowen & Co analyst Phil Nadeau on May 28. He has a $150 price target on shares, indicating significant upside potential of 82%.

“While valrox’s launch trajectory remains uncertain, there is little question that Hem A is a large market and BioMarin estimates that overall there are 117K hemophilia A patients in its territories with 18K in North America alone” points out the analyst.

This means that even modest penetration with a price point around $2MM would represent significant revenue, as ~$1B in sales could be achieved for every 500 adult patients treated. “Therefore valrox should soon become a growth driver for BioMarin” sums up Nadeau. See what other Top Analysts are saying about BMRN.

2. Dollar General Corp

Leading US discount retailer Dollar General has rallied 5% in the last five days, bringing its total year-to-date gain to an impressive 18%. The company has just reported stellar results for the first quarter with both comps and margins modestly above expectations.

The result: eight consecutive buy ratings from the Street. “We remain buyers given our bullishness on DG’s defensive growth characteristics” writes RBC Capital analyst Scot Ciccarelli. “While mix and transportation costs continue to weigh on GMs and investments in initiatives like DG Fresh and Fast Track will pressure SG&A this year, these strategies (and several others) are helping drive solid sales growth” explains the analyst.

While the year is clearly off to a good start, he believes management maintained guidance given the absorption of recent tariff increases, ongoing tariff uncertainty and 3/4 of the year still in front of us. Nonetheless, Ciccarelli still decides to boost his price target from $133 to $139 (9% upside potential).

However, the highest price target comes from Buckingham Research’s Bob Summers. Post-earnings the analyst boosted his price target considerably, from $125 to $152 (19% upside potential) citing the ‘powerful combination’ of a strong quarter and beneficial macro backdrop for discount retailers.

3. Salesforce.com Inc

Salesforce calls itself the world’s #1 customer relationship management platform. And now it’s crunch-time for the stock. On June 4, CRM will release its earnings results for the fiscal first quarter. Ahead of the print, analysts are optimistic about CRM’s outlook. Indeed five analysts have reiterated their buy ratings on the stock in the last week.

Moness analyst Brian White sees prices spiking 29% to $195 in the coming months. He tells investors: “In a volatile market environment driven by growing trade tensions with China and now decisively spilling over into parts of the tech world, we believe SaaS vendors such as Salesforce remain attractive with a subscription-based model and strong secular cloud trends.”

As for earnings, White is predicting strong 1Q:FY20 revenue forecast of $3.683 billion (up 23% YoY; Street is at $3.682 billion) and non-GAAP EPS estimate of $0.61 (Street is also at $0.61). Looking into 2Q:FY20, he is projecting sales of $3.921 billion with non-GAAP EPS rising to $0.69.

A similarly bullish perspective comes from Piper Jaffray’s Alex Zukin: “We view CRM as the most attractive risk/reward in our coverage universe today.” Following positive checks with corporate tech buyers, he writes “Our checks suggest the company delivered results at or near internal plan” for the fiscal first-quarter.

Plus CRM shares have dropped 8% in May- underperformed other software stocks in the analyst’s coverage universe. That makes now an appealing time to buy-in. As a result, Zukin reiterates his Salesforce buy rating and $180 price target (19% upside potential).

4. Apple Inc

Trade tensions have wreaked havoc with Apple- sending prices plunging 13% in May. But that has done little to dent the Street’s enthusiasm for Apple stock. Indeed, in the last seven days, four analysts have reiterated their AAPL Buy ratings. One of these analysts is five-star Tigress Financial analyst Ivan Feinseth.

“We reiterate our Strong Buy rating on AAPL as it continues to create value from its ecosystem with the launch of its key Services initiatives and view the recent U.S.-China trade-related weakness as a major buying opportunity” advises Feinseth. According to the analyst, AAPL’s Services business segment continues to emerge as one of the company’s future drivers of growth and profitability. That’s with new initiatives like a gaming platform, a credit card, a news service, and a video streaming service.

These should provide more continuity to its ecosystem and further monetize the close to one billion iPhone user base, says Feinseth. He doesn’t offer a price target, but he does write: “We believe significant upside in the shares exists from current levels.” The stock is on both the firm’s Research Focus List and its Focus Opportunity Portfolio.

Meanwhile Webush’s Daniel Ives delves further into the US-China impact on Apple. He has a buy rating on the stock with a $235 price target (34% upside potential). “We continue to strongly believe that for a company that employees over 1 million Chinese workers with its flagship Foxconn factory and is a major strategic player within the China technology ecosystem that from a supply chain perspective Apple will not have major roadblocks ahead despite the loud noise” writes the analyst.

In fact, Ives believes the biggest risk comes from pro-China sentiment negatively impacting demand, but argues that this situation is currently contained at around 3% to 5% of Chinese iPhone sales.

“Taking a step back, we ultimately believe there is a low likelihood that Apple and its iPhones feel the brunt of the tariffs given its strategic importance domestically as well as Cook’s ability to navigate these issues in the past” he concludes.

5. Marvell Technology Group

Shares in semiconductor manufacturing stock Marvell have exploded by 38% year-to-date. And now the company has just released its first quarter results. MRVL’s F1Q20 results were better than expected, but F2Q20 guidance was below expectations. The report reveals soft storage demand, although MRVL continues to expect a recovery in C2H20.

However strong 5G momentum is keeping analysts and investors on-side. Most notably, MRVL announced two new 5G wireless base station design wins, which together are expected to increase MRVL’s content per a base station by ~$500. As a result, six analysts have published buy ratings on Marvell in the last seven days, vs just 1 hold rating.

“With two new 5G wireless base station design wins announced (first win generating rev in F4Q20) and a continued focus on high growth end markets with the Aquantia and Avera acquisitions and the divestiture of its WiFi business, we maintain our Buy and $28 PT” cheers Needham’s Quinn Bolton. From current levels that works out at 26% upside potential.

Rosenblatt’s Hans Mosesmann backs up Bolton’s estimates. He has just ramped up his price target from $24 to $28, explaining: “All in, we believe Marvell’s strategic positioning has improved at a much faster than expected rate and as a result, we are increasing our PT to $28 from $24.”