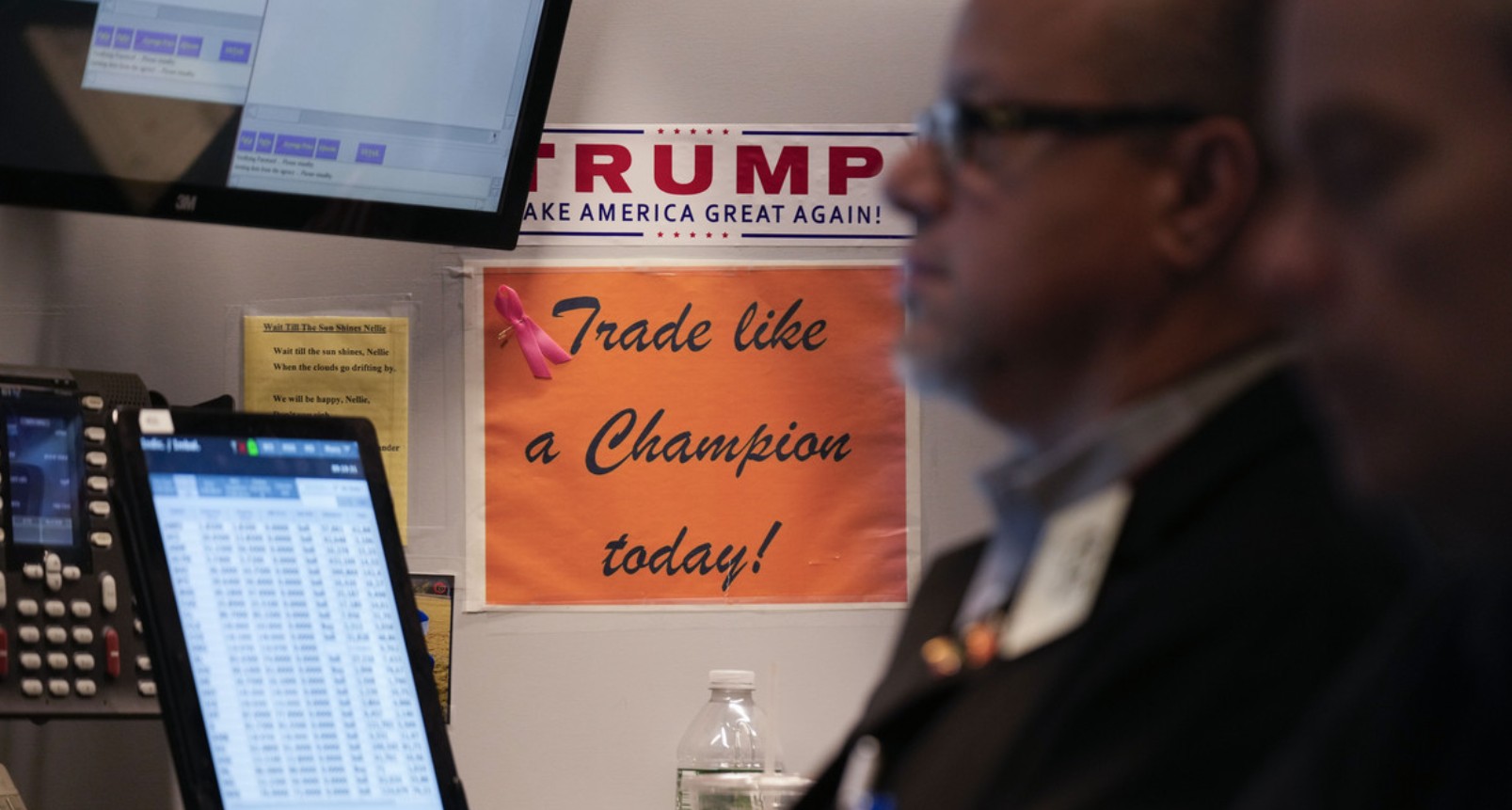

‘People are really bulled up’: Stock surge has some on Wall Street worried

Now, some on Wall Street are beginning to sound the alarm that the fast times can’t last.

JPMorgan Chase CEO Jamie Dimon and others have warned that investors are plowing cash into stocks with inflated prices. Hedge fund giant Elliott Management said the blistering rise in crypto over the last year, with bitcoin up 89 percent, is the stuff of bubbles. So-called memestocks — companies like GameStop, whose shares tend to be driven by investor hype — have returned. And on top of that, economists say Trump’s plans for tariffs and an immigration crackdown — along with the dizzying pace of his policy moves — could roil the markets by stoking inflation and fueling uncertainty.

“For good or bad, depending on your politics, we’re back to the chaos presidency,” said Jim Chanos, a hedge fund manager who famously bet against Enron and other failing companies. “Whatever you might think about the Biden administration, if you were a market participant, you generally didn’t need to check your Twitter feed the first thing in the morning when you woke up just to see what was said. But we’re back to that, and with that, comes probably more volatility.”

It isn’t just Trump, of course. The markets are coming off back-to-back banner years fed by a mix of pandemic stimulus money, wild optimism about artificial intelligence, and a supersized interest rate cut by the Federal Reserve last year. But the brewing anxiety over an overvalued market now portends potential problems for the White House.

Trump — who is fond of touting market highs as indications of his success as America’s chief executive — is fixated on lifting up businesses and consumers. A stock market slide could undercut his reputation as a pro-growth president and scramble his administration’s economic plans if it’s forced to deal with the fallout.

“Everyone who puts on the nightly news or even watches Twitter knows what the stock market does every day,” said Ed Hill, a veteran financial industry lobbyist. “It’s become a preferred measure of the economy, even though we all know it doesn’t really reflect the economy. People are going to be very sensitive. This administration particularly is going to be very sensitive to markets.”

To be sure, naysayers are nothing new on Wall Street or in crypto, and Trump’s allies argue that the president’s plans will boost the markets over time.

Hal Lambert, a Republican donor and founder of investment management firm Point Bridge Capital, said the combination of Elon Musk’s cost-cutting campaign, the expected extension of the 2017 tax cuts, and lower oil prices represent major economic windfalls to come. And in the meantime, he said, U.S. stock investors aren’t going anywhere.

“People aren’t going to sit around and hold money markets, and they’re not going to sit around and buy three [or] four percent Treasuries,” Lambert said. “They’re going to keep investing in the equity markets.”

Indeed, investors aren’t slowing down much. The benchmark index for U.S. stocks, the S&P 500, closed at a new all-time high Wednesday. And crypto has continued to surge, with bitcoin — the world’s most valuable crypto token — remaining at sky-high valuations after breaking through $100,000 earlier this year.

Most Wall Street banks and research shops still believe investors are in for a generally positive 2025, as do everyday buyers themselves. More than half of consumers are expecting stocks to increase over the course of 2025, according to the Conference Board.