Gold pared gains from a new all-time high, as trade-war worries bolstered haven demand and there were continued signs of short-term tightness in the market.

Bullion rallied as much as 1.4% to exceed $2,882.36 an ounce before paring some gains after Bloomberg reported that US allies expect President Donald Trump’s administration to present a long-awaited plan to end Russia’s war on Ukraine at the Munich Security Conference in Germany next week.

Bullion prices still held at elevated levels, supported by concerns about the fallout of trade wars, particularly between the US and China. Markets are also waiting to see if there are any ripple effects for US monetary policy if tariffs reignite inflation.

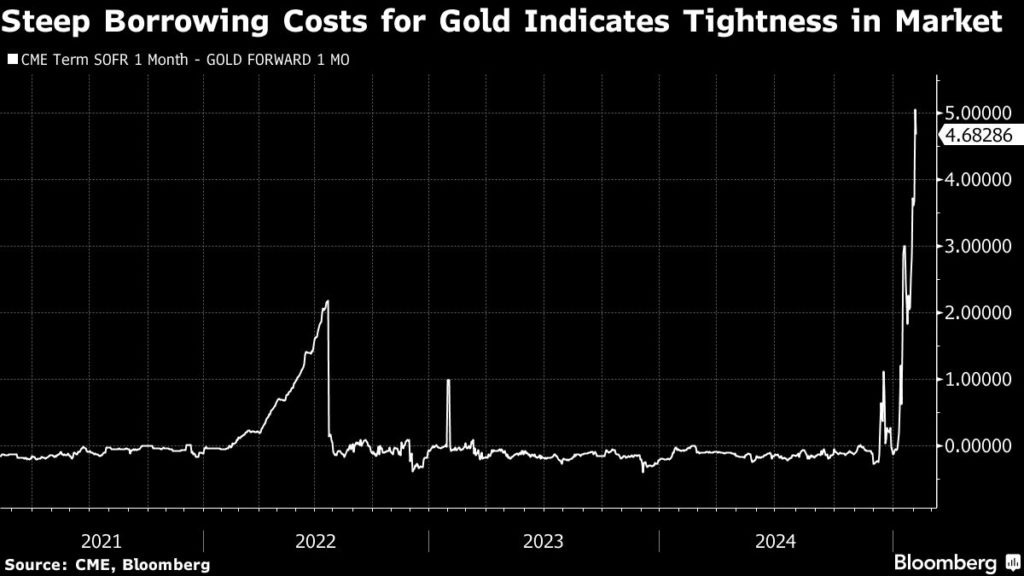

There are indications of increased demand for gold as major dealers seek to shift metal to the US before any tariffs are imposed. One month so-called lease rates in London have jumped to about 4.7%, far above previous levels of close to zero. The rate reflects the return that holders of bullion in London’s vaults can get by loaning their metal out to other buyers on a short-term basis.

Bloomberg last week reported that the rush for gold has led to weekslong queues to withdraw bullion from the Bank of England — where many central banks around the world hold reserves — to deposit with private banks. Gold has also been flowing into depositories of New York’s Comex exchange.

That has added to tightness in the market, according to Rhona O’Connell, head of market analysis for EMEA and Asia at StoneX Group Inc.

The typical 400-ounce bars that are traded in London aren’t suited for the Comex market, where traders must deliver 100-ounce or kilobars, but they can be refined in places like Switzerland.

“Metal is still going into Comex warehouses and elsewhere in the States,” said O’Connell. Authorities could possibly even intervene by lending out gold if the situation became drastic enough, she said.

“If it gets much tighter or threatens to become disorderly I would not be surprised if the official sector injected liquidity, because one thing that central banks won’t tolerate is a disorderly gold market.”

The dollar extended losses, following a US jobs report on Tuesday that pointed to a gradual slowdown in the labor market. A weaker greenback makes commodities like gold cheaper for most buyers.

Spot gold gained 1% to $2,873.69 an ounce as of 12:40 p.m. in New York. Silver, platinum and palladium also rose.