Stock Markets

Last week, the Nasdaq reached a new milestone when it briefly surpassed the 20,000 level. Growth stocks underperformed against value stocks for the third consecutive week, partly due gains by Tesla (12.08%) and Google parent Alphabet (9.44%) shares. Between Tuesday and Wednesday, Alphabet recorded its largest two-day gain since 2015. Thus far, the stock market’s winning formula has been rising corporate profits, solid economic growth, and the start of easing by central banks. While the outlook remains positive, inflation is proving tenacious in the fourth quarter, raising uncertainty concerning the next moves central banks will take.

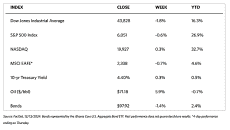

Except for the Nasdaq, all major indexes were down for the week. The 30-stock Dow Jones Industrial Average lost 1.82% and the Total Stock Market fell by 0.90%. The broad S&P 500 Index slid by 0.64% and the NYSE Composite gave up 1.88%. The technology-heavy Nasdaq Stock Market Composite bucked the trend and rose by 0.34%. The CBOE Volatility Index (VIX), the accepted indicator of investor risk perception, climbed by 8.14% this week.

U.S. Economy

Wednesday provided the highlight of this week’s economic calendar with the Labor Department releasing the headline and core (excluding food and energy) consumer price inflation (CPI). Both indicators rose by 0.3% in November, in line with consensus expectations. Core prices increased 3.3% year-over-year in November and remained unchanged since the prior month, Overall inflation modestly grew to 2.7% up from October’s 2.6%. Almost 40% of the total price increase in November is attributable to higher shelter costs, while few of the index components decreased during the month. Producer price inflation likewise accelerated slightly in November, from 0.3% to 0.4%.

The following day, the Labor Department reported a surprise increase in weekly initial jobless claims to a two-month high of 242,000. Seasonal factors around the Thanksgiving holiday accounted for some of the increase. However, continuing claims also rose and persisted near three-year highs, indicating that some unemployed individuals are taking longer to find a job. The jobs data signaled a softening labor market following the preceding week’s report of an increase in November’s unemployment rate.

As a result of the week’s economic data, investors’ expectations for a rate cut at the upcoming Federal Reserve meeting appeared to have solidified. The CME FedWatch Tool showed that futures markets on Friday priced in a 97.1% chance of the Fed cutting rates at its upcoming meeting, higher than the 86.0% registered at the end of the preceding week. The Fed’s two-day meeting will begin on Tuesday, December 17. The new rate decision is expected to be made on the following day.

Metals and Mining

News that the People’s Bank of China (PBOC) increased its official gold reserve by 6 tons triggered investor buying that raised gold to a five-week high. The purchase, though smaller than previous orders, demonstrates that the Chinese central bank maintains an active presence in the market. Demand from central banks has been a major factor in the recent surge of gold prices to record highs. Analysts forecast that central bank gold buying will drive the price of this metal to $3,000 per ounce in 2025. The official sector demand will be the most significant factor that will influence prices in the coming year, according to Wells Fargo’s 2025 outlook. Furthermore, geopolitical uncertainties remain high and the threat of global war continues to impact the markets, causing investors to flee to gold, which carries no third-party political risks.

The spot prices of precious metals ended mixed for the week. Gold closed at $2,648.23 per troy ounce, 0.56% higher than last week’s closing price of $2,633.37. Silver settled at $30.55 per troy ounce, 1.36% lower than its close last week at $30.97. Platinum ended the week at $926.91 per troy ounce, 0.50% lower than last week’s closing price of $931.55. Palladium ended at $956.42 per troy ounce this week, 0.40% than last week’s close at $960.29. The three-month LME prices of industrial metals mostly fell. Copper came from $9,074.50 last week to close at $9,052.50 per metric ton this week for a loss of 0.24%. Aluminum, which ended at $2,639.00 last week, settled this week at $2,605.00 per metric ton for a decline of 1.29%. Zinc, which closed last week at $3,118.50, ended this week at $3,095.50 per metric ton, down by 0.74%. Tin, whose last weekly close was at $29,165.00, settled this week at $29,097.00 per metric ton for a decline of 0.23%.

Energy and Oil

OPEC has revised its global oil demand forecast for 2024 and 2025 for the fifth time. Next year’s growth outlook is seen at 1.45 million barrels per day with changes almost wholly driven by a downgrade of consumption growth across the Middle East. However, with the potential threat of sanctions front and center this week, it appears that gold has become immune from the pains of the OPEC+ meeting. Some geopolitical risks have been added by other concerns such as the new G7 sanctions on Russia’s shadow fleet, Chinese concerns about buying Iranian crude with Trump ascending into office, and looming nuclear sanctions in Tehran. The Brent has risen back to $74 per barrel, posting its first weekly gain since November.

Natural Gas

For the report week from Wednesday, December 4 to Wednesday, December 11, 2024, the Henry Hub spot price rofsse by $0.28 from $2.83 per million British thermal units (MMBtu) to $3.11/MMBtu. Regarding Henry Hub futures, the price of the January 2025 NYMEX contract rose by $0.34, from $3.043/MMBtu at the start of the report week to $3.378/MMBtu by the week’s end. The price of the 12-month strip averaging January 2025 through December 2025 futures contracts rose by $0.12 to $3.282/MMBtu. Natural gas spot prices rose at most major pricing locations along with the Henry Hub this report week. Price changes ranged from a decrease of $0.38 at Northwest Sumas to an increase of $1.86 at Algonquin Citygate.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.02 to a weekly average of $15.04/MMBtu. Natural gas futures for delivery at the Title Trade Facility (TTF) in the Netherlands decreased by $0.71 to a weekly average of $14.11/MMBtu. In the week last year corresponding to this report week (from December 6 to December 13, 2023), the prices were $15.77/MMBtu in East Asia and $11.73/MMBtu at the TTF.

World Markets

European stock lost ground this week. The pan-European STOXX Europe 600 ended 0.77% lower in local currency terms as investors were uncertain whether the European Central Bank (ECB) has been easing monetary policy fast enough to support the struggling economy. The major stock indexes were mixed. France’s CAC 40 Index dipped by 0.23%, Germany’s DAX squeezed out a modest gain of 0.10%, and Italy’s FTSE MIB climbed by 0.40%. The UK’s FTSE 100 Index declined by 0.10%. The European Central Bank (ECB) lowered its key deposit rate by a quarter of a percental point to 3.0%. This is the ECB’s fourth rate reduction this year. The central bank also revised its outlooks for growth and inflation. ECB officials announced that it will keep the door open to further ease monetary policy and will maintain a meeting-by-meeting approach to policy decisions. Meanwhile, the UK economy has significantly slowed after its strong start in the year. Real gross domestic product (GDP) shrank unexpectedly by 0.1% sequentially in October due to the weakening of production output. The economy underwent a contraction of the same magnitude in September. Output in the services sector was flat in both months. The Bank of England (BoE) is widely expected to hold interest rates steady at its upcoming policy meeting, and cautiously proceed next year due to stubbornly high services inflation.

Japan’s equities registered modest gains this week. The Nikkei 225 Index rose by 0.97% and the broader TOPIX Index gained by 0.71%. China’s announcement of more proactive rascal measures and moderately looser monetary policy boosted regional market sentiment. Speculation grew on the domestic monetary front that the Bank of Japan (BoJ) may suspend an interest rate hike at its meeting scheduled for December 18-19. This led the yen to soften to about the middle of the JPY 153 range against the US dollar, from the prior week’s JPY 150 level. The yield on the 10-year Japanese government bond fell to about 1.04%, from 1.06% at the end of the previous week. On the economic front, the final GDP data showed that Japan’s economy grew by 0.3% quarter-on-quarter in the three months to September. This exceeds the 0.2% consensus expectation as indicated by preliminary data. The BoJ’s tankan survey (a gauge of sentiment among big manufacturers) showed support for the country’s economic outlook as it edged higher in the fourth quarter. Indications are that there were more companies that said they were optimistic about business conditions than companies that said they were pessimistic.

Chinese stocks lost ground last week as investors were underwhelmed by recent policy announcements. The Shanghai Composite Index dipped by 0.36% and the blue-chip CSI 300 fell by 1.01%. The Hong Kong benchmark Hang Seng Index gained 0.53%. At the annual Central Economic Work Conference, a high-level meeting wherein top officials plan the economic agenda for the next year, China pledged to implement a more proactive fiscal policy and increase the budget deficit in 2025. Officials said that the central government will continue issuing ultra-long special Treasury bonds to fund major projects. However, the report after the two-day conference provided no details which further dampened investor sentiment. China’s economy remained stuck in deflation, according to inflation data released earlier in the week. The consumer price index rose by a lower-than-consensus 0.2% in November from a year earlier. Core inflation (excluding volatile food and energy costs) inched up to 0.3%, from 0.2% in October. The producer price index dipped by 2.5% year-on-year, easing from the previous month’s 2.9% slide and marking the 26th straight monthly decline despite the government’s efforts to boost domestic demand in recent months.

The Week Ahead

In the coming week, the important economic reports scheduled for release include the PCE inflation data, GDP second revision for the third quarter, and the results of the FOMC meeting.

Key Topics to Watch

- Empire State manufacturing survey for Dec.

- S&P flash U.S. services PMI for Dec.

- S&P flash U.S. manufacturing PMI for Dec.

- U.S. retail sales for Nov.

- Retail sales minus autos for Nov.

- Industrial production for Nov.

- Capacity utilization for Nov.

- Home builder confidence index for Dec.

- Housing starts for Nov.

- Building permits for Nov.

- FOMC interest-rate decision

- Fed Chair Powell press conference

- Initial jobless claims for Dec. 14

- GDP (second revision) for Q3

- Philadelphia Fed manufacturing survey for Dec.

- Existing home sales for Nov.

- U.S. leading economic indicators for Nov.

- Personal income (nominal) for Nov.

- Personal spending (nominal) for Nov.

- PCE index for Nov.

- PCE (year-over-year)

- Core PCE index for Nov.

- Core PCE (year-over-year)

- Consumer sentiment (final) for Dec.

Markets Index Wrap-Up