The stock market was broadly lower Tuesday but pared losses as the major indexes fell from record highs. FANG stock Facebook (FB) was sharply less after a rare analyst downgrade. Meanwhile, Leaderboard stock Workday (WDAY) will announce its Q2 results after the market close.

The tech-heavy Nasdaq composite fell 0.2% after losing as much as 0.8%. Meanwhile, the S&P 500 and Dow Jones industrial average fell 0.2% each.

Among the Dow stocks, Nike (NKE) fell nearly 3% after the company made controversial football player Colin Kaepernick the face of its latest “Just Do It” ad campaign. Shares fell below a flat base’s 81.10 buy point — according to MarketSmith chart analysis — and are nearing their 50-day moving average line for the first time since the Aug. 9 breakout.

Meanwhile, Apple (AAPL) eased lower, potentially snapping its current eight-day win streak. Shares are nearing their 20% to 25% profit-taking level from a flat base’s 194.30 buy point.

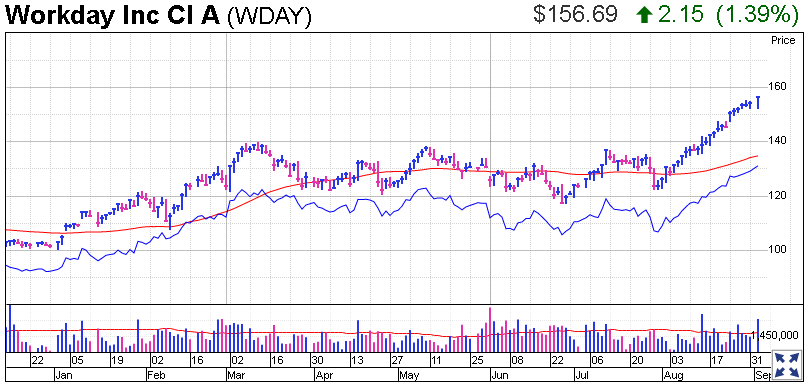

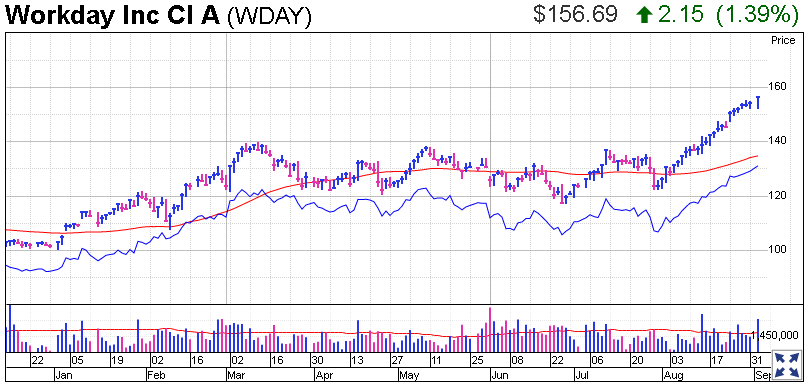

Among companies reporting earnings, top software stock Workday will report its Q2 results after the market close. Analysts expect the company to earn 26 cents per share on revenue of $663 million. Shares are about 10% above a cup with handle’s 137.53 entry.

Friday’s IBD Stock of the Day Ulta Beauty (ULTA) rose about 3% and is reclaiming a 261.50 buy point. The stock broke out Friday after its quarterly earnings report.

Among the FANG stocks, Facebook declined almost 3% after being downgraded from buy to neutral at MoffettNathanson. The price target was reduced from 200 to 175. The analyst commented that the company’s deceleration in growth in conjunction with continued regulatory scrutiny is a “toxic brew” for any stock. The social media giant has been unable to regain any ground after July 26’s 19% earnings sell-off.

Meanwhile, Amazon.com (AMZN) hit another record high with a 1% rise.

Tesla Falls

Electric automaker Tesla (TSLA) fell almost 2% after it missed a production goal of 6,000 Model 3 vehicles per week by the end of August. Still, the company’s Q3 target appears reachable, according to Elektrek. Meanwhile, Goldman Sachs resumed coverage on the stock with a sell rating and a 210 price target — a 30% discount to Friday’s closing price.