TOKYO — JERA, Japan’s biggest producer of fossil fuel power, plans to extract valuable metals from old electric-vehicle batteries, aiming for a roughly 90% recovery rate, Nikkei has learned.

With 80% of Japan’s used EVs exported overseas, recycling old batteries could keep more resources like lithium, cobalt and nickel in the country to improve economic security. The U.S., European Union and China are all moving to ensure their own supply chains for these metals are secure.

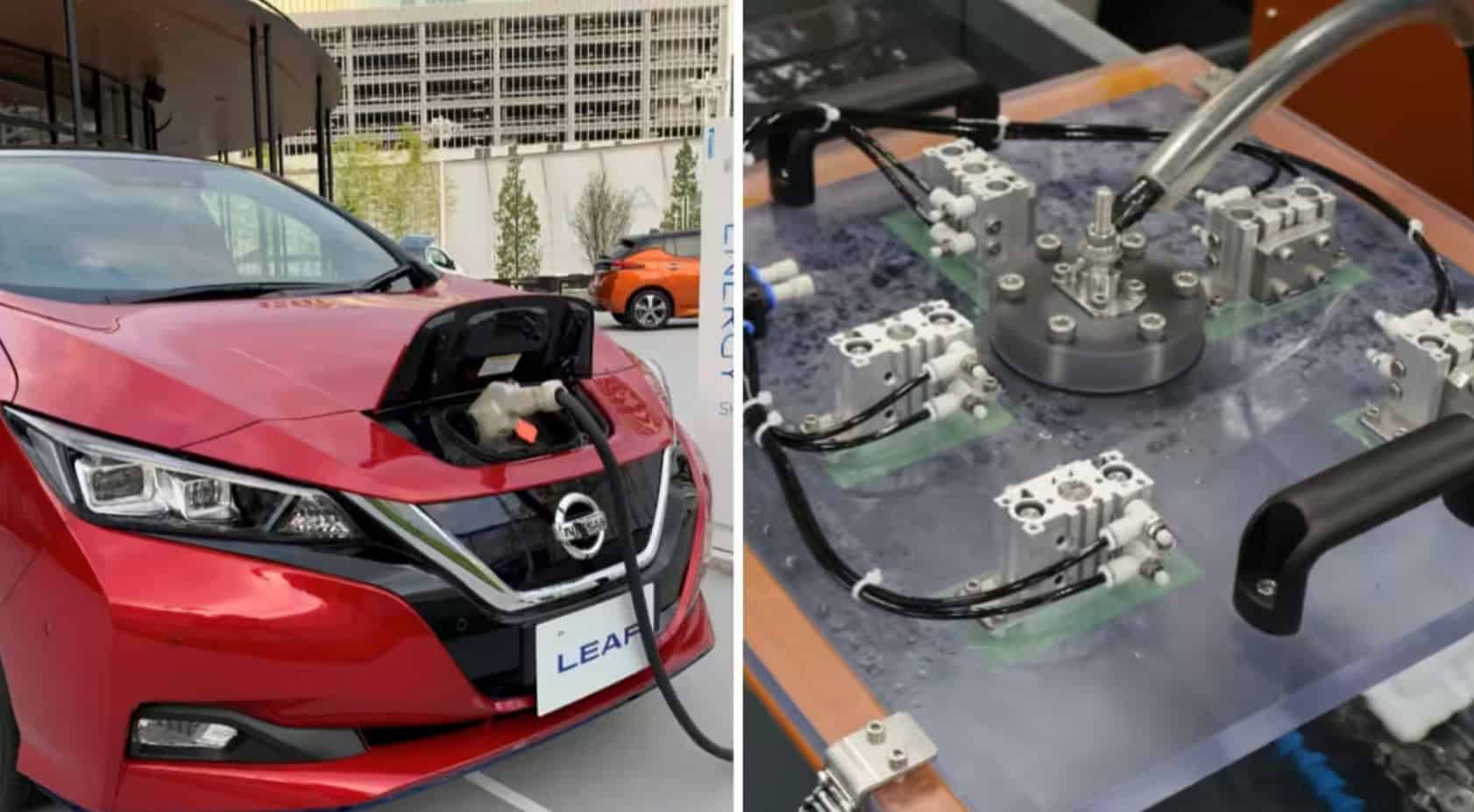

EV batteries are a treasure trove of industrial metals. One vehicle’s batteries can contain around 200 kilograms of metals, equivalent to the amount in several thousand smartphones.

Recycling batteries is not new, but recovery rates for conventional heat-based methods of extracting nickel and cobalt have struggled to surpass about 60%.

JERA is developing a method that immerses the materials. A high voltage is applied, creating a shock wave that frees the recoverable metals.

This method does not involve heat processing, so it emits half as much carbon dioxide during recycling, people familiar with the technology say.

JERA seeks to build a recycling plant in Japan in the early 2030s. The company’s method, if it becomes commercially available, also could find a market in the European Union, which has strict regulations on battery recycling.

JERA is a joint venture of TEPCO Fuel & Power, part of the Tokyo Electric Power group, and Nagoya-based Chubu Electric Power.

Around 20,000 EVs worth of end-of-life automotive lithium-ion batteries are discarded in Japan each year. That amount is forecast to reach the equivalent of 150,000 EVs in 2030.

With demand for batteries expected to grow, Japan will need an estimated 100,000 tonnes of lithium and roughly 20,000 tonnes of cobalt in 2030. Recovering more of these resources is vital for a nation dependent on imports for nearly all of its supplies of rare metals.

But Japan has been slow to enact requirements for recovery and recycling.

“At this rate, Japan is likely to miss out on a potential market,” the Japan Research Institute think tank warns.

The institute estimates that the Japanese market for battery reuse and recycling could be worth 2.4 trillion yen ($16.1 billion) in 2050.

Other Japanese companies are investing in recycling technology. Sumitomo Metal Mining plans to open two Japanese plants for recovering battery metals in 2026. JX Advanced Metals aims to extract 30,000 tonnes of nickel, cobalt and other materials a year in 2035 using an improved version of heat processing that has a 90% recovery rate.