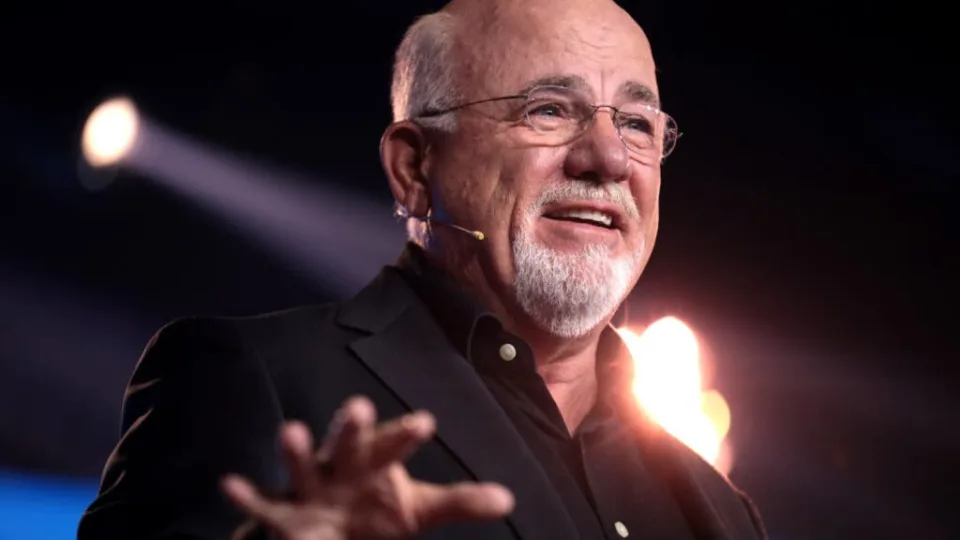

In an interview with Fox Business on April 3, personal finance icon Dave Ramsey addressed criticisms from millennials and Gen Z amid discussions on social media and recent coverage by The Wall Street Journal (WSJ).

The WSJ piece highlighted a trend among people younger than 40, suggesting a significant portion believes Ramsey’s financial advice does not align with their economic realities. This sentiment is echoed on platforms like TikTok, where the hashtag #daveramseywouldn’tapprove is being used to showcase decisions that deliberately counter his financial guidance.

During the conversation, co-host Dagen McDowell pointed to the growing trend of public dissent among younger generations toward Ramsey’s teachings. Despite this, Ramsey emphasized the positive attributes of these generations, calling them “excellent generations.” He lauded many millennials and Gen Zers for their diligence, financial savvy and adherence to principles of saving, investing and supporting the free enterprise system. Ramsey mentioned the young employees at Ramsey Solutions, describing them as hardworking people who exemplify the virtues of financial responsibility and independence.

Ramsey also offered a critique of a segment of these younger cohorts. He expressed his frustration, saying, “Then there’s a segment of them that just sucks. They’re just awful. I mean, their participation trophy, they live in their mother’s basement, and they can’t figure out why they can’t buy a house because they don’t work, you know, stuff like that.” These are the attitudes and work ethic he perceives as problematic among the younger generations.

Despite facing backlash and skepticism on social media and in articles, Ramsey defended his 35-year record of providing financial advice. He acknowledged the role of social media in amplifying dissent but also recognized its capacity to spark meaningful conversations about personal finance. “I’m really good clickbait,” he said.

According to Bank of America Corp.’s annual Better Money Habits survey, 85% of Gen Zers identify at least one obstacle on their path to financial success, with the rising cost of living being the primary concern for 53% of these respondents. The data offers a window into the strategies that young people employ to navigate the financial challenges of today’s economy.

The financial challenges faced today span across generations — they’re not confined to Gen Z and millennials. Rising living costs, inflation and job security concerns are universal issues affecting many people’s ability to maintain financial stability. Recognizing that these struggles are widespread is the first step toward addressing them constructively.

Seeking guidance from a financial adviser can be an essential move for anyone striving to improve their financial situation. These professionals offer personalized advice to help people navigate financial planning, budgeting, saving and investing.