The Bitcoin halving is a recurring, periodic event programmed into the Bitcoin protocol, designed to ensure its scarcity and, by extension, its value over time. Each halving, the number of new Bitcoin emitted as mining rewards for each new block reduces by half. Halving events are projected to occur through 2140, when Bitcoin reaches its total supply limit of 21 million.

The halving event is closely watched by a range of network participants, including institutions, traders, and individual investors. The upcoming fourth halving is unique in the Bitcoin ecosystem, marked by a substantial increase in institutional engagement since the last halving occurred in 2020 — along with the integration of traditional financial products such as exchange-traded funds or ETFs. The combined effect of reduced block rewards and significant portions of Bitcoin being bought up and held by institutional long-term investors has led to talk of a compounding supply shock. This, along with the fact that previous halvings have preceded substantial price jumps for Bitcoin, has led many to believe that the halving will lead to a market upswing.

What is the Bitcoin halving?

The Bitcoin halving refers to the event that reduces the rate at which new Bitcoins are issued by 50%. This halving event occurs after every 210,000 blocks have been mined, approximately every four years.

The main purpose of the halving is to control Bitcoin inflation by reducing the pace at which new Bitcoins are introduced into the market. This design is a direct response to the inflationary tendency often seen in traditional fiat currencies, where governments can print currency without limits, leading to depreciation in value.

The role of miners in the Bitcoin network

Miners play an essential role in the Bitcoin network, which operates on a proof-of-work consensus mechanism. Miners contribute to network security through the mining process, which involves solving complex mathematical algorithms to validate transactions and add them to the Bitcoin blockchain. The mining process not only secures the network against fraudulent transactions and attacks, but also results in the circulation of new Bitcoins as a reward for the miners’ efforts.

Miners, mostly large scale commercial productions, invest substantial resources in the form of hardware and electricity. While it was once possible to mine Bitcoin with a home computer, the introduction of specialized ASIC mining hardware significantly increased the difficulty of mining, making home mining virtually impossible.

The significance of block rewards on the Bitcoin ecosystem

Block rewards are the incentive mechanism that encourages miners to dedicate computing power to the network. These rewards consist of newly issued Bitcoins given to miners when they successfully solve a block. By rewarding miners, the Bitcoin network ensures that it remains secure and resilient against attacks. The more miners participate, the more decentralized and secure the network becomes. Block rewards are also the only mechanism for net new Bitcoin to enter the market, so the amount miners receive and subsequently decide to sell has important implications for overall supply.

When does Bitcoin halving occur?

Bitcoin halving is an event that occurs approximately every four years. This reduction in block rewards effectively halves the rate at which new Bitcoins are released into circulation.

Previous Bitcoin halving events

First halving: November 28, 2012

The first Bitcoin halving occurred when the block reward was reduced from 50 Bitcoins per block to 25 Bitcoins. This event marked the beginning of Bitcoin’s journey as a deflationary asset.

Second halving: July 9, 2016

The second halving further reduced the block reward from 25 Bitcoins to 12.5 Bitcoins per block.

Third halving: May 11, 2020

The most recent halving reduced the block reward from 12.5 to 6.25 Bitcoins per block.

The actual time between halvings can vary slightly, but on average the time between each halving event has indeed hovered around the four-year mark.

Future Bitcoin halving dates

Given that halving events occur every 210,000 blocks and considering the ten-minute average time to mine a single block, future halvings can be predicted with reasonable accuracy. Slight deviations in the actual timing of halvings are possible due to the variable time it takes to mine blocks.

Fourth halving: The Bitcoin fourth halving is anticipated to occur around mid-April 2024, reducing the block reward from 6.25 Bitcoins to 3.125 Bitcoins per block.

Fifth halving and beyond: Future halvings will continue at intervals of approximately 210,000 blocks, or roughly every four years, reducing the block reward until the maximum supply of 21 million Bitcoins has been reached. This is estimated to happen in the year 2140.

The Bitcoin protocol is designed to produce a block approximately every 10 minutes. Due to the increasing efficiency and computational power of mining equipment, blocks can sometimes be found at slightly faster rates. To maintain the roughly four-year interval between halvings, the Bitcoin network adjusts the difficulty of mining every 2016 blocks, or approximately every two weeks, to ensure that the average time to discover a block remains close to 10 minutes.

Many other cryptocurrencies, like Litecoin, have adopted similar halving mechanisms, inspired by Bitcoin’s model, to control the supply of their tokens. The specifics of these events, such as the frequency of halvings and the percentage reduction, can vary significantly from one cryptocurrency to another.

Impact of the Bitcoin halving on the cryptocurrency ecosystem

In the months leading up to a Bitcoin halving, the crypto market often enters a period of heightened anticipation and speculation. Many investors attempt to “price in” the expected reduction in supply, leading to increased volatility and, in some cases, a pre-halving price surge.

Price trends around historical halving events

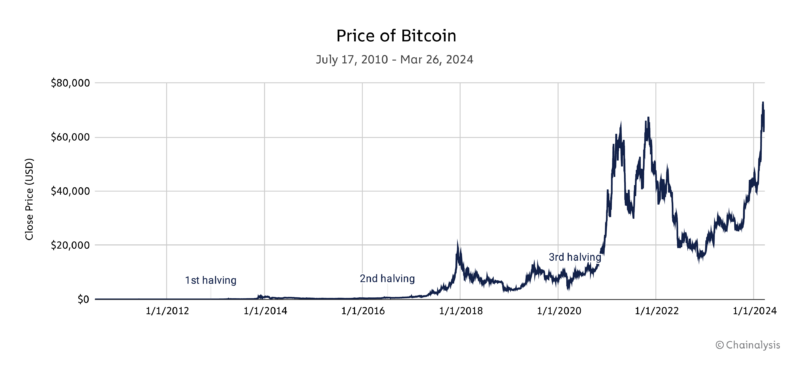

Historically, the price of Bitcoin has shown a pattern of increasing in value following a halving event.

After the 2012 halving, the price of Bitcoin saw a significant increase, rising from $12 in November 2012 to over $1,000 in November 2013.

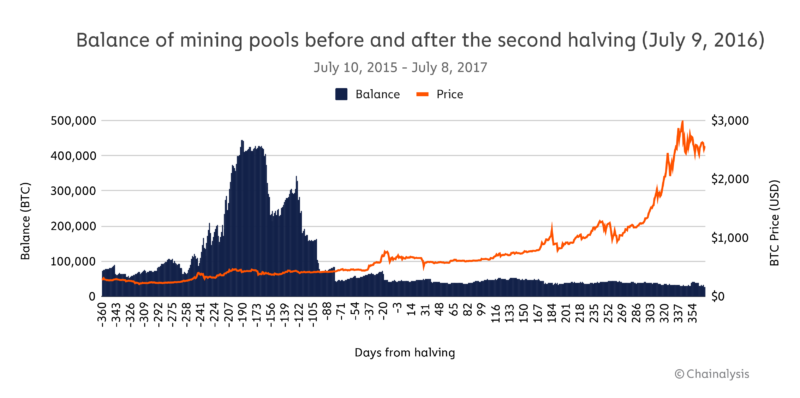

A similar pattern emerged following the 2016 halving, with the price of Bitcoin increasing from $650 in July 2016 to approximately $2,500 in July 2017, and eventually reaching a new all-time high of $19,700 in December 2017.

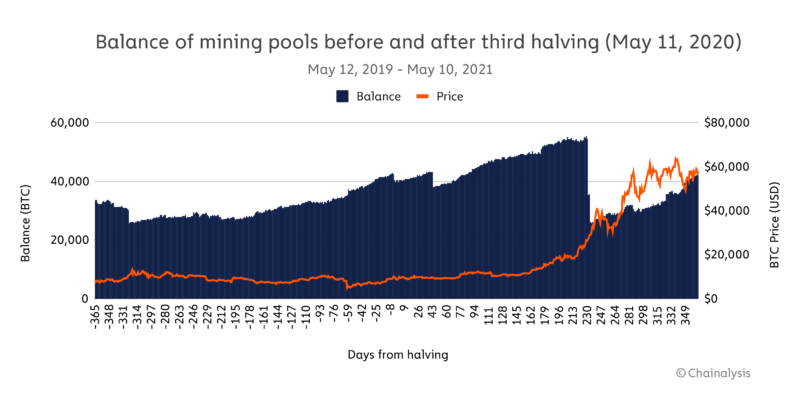

After the 2020 halving, bitcoin’s price moved upwards from around $8,000 in May 2020 to a new all-time high of over $69,000 in April 2021.

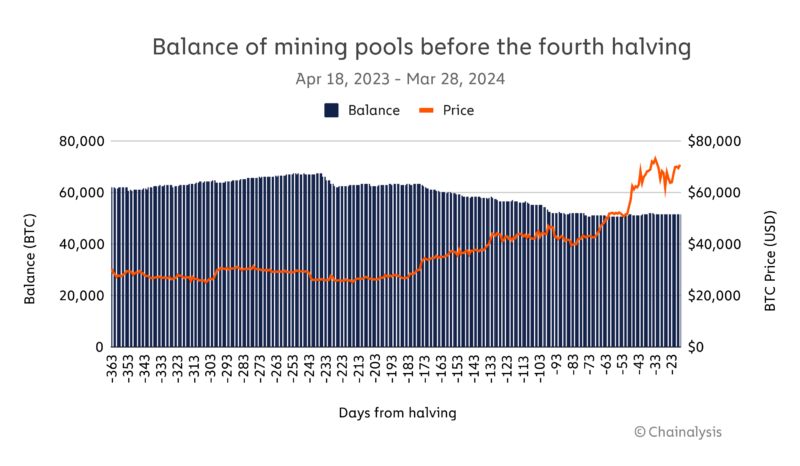

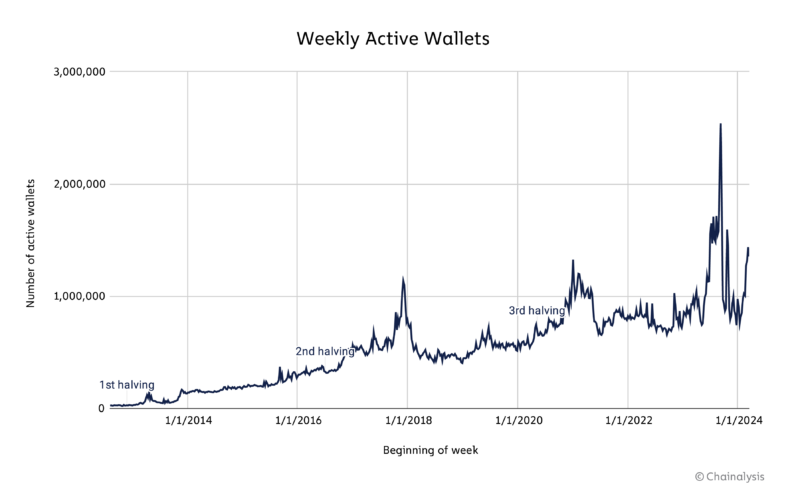

These trends suggest that historically, the price of Bitcoin increases within a year after the halving, but is then followed by a price adjustment period. Unlike the previous halving cycles, Bitcoin reached a new all-time high in March 2024, about a month prior to its upcoming fourth halving.

Supply and demand dynamics

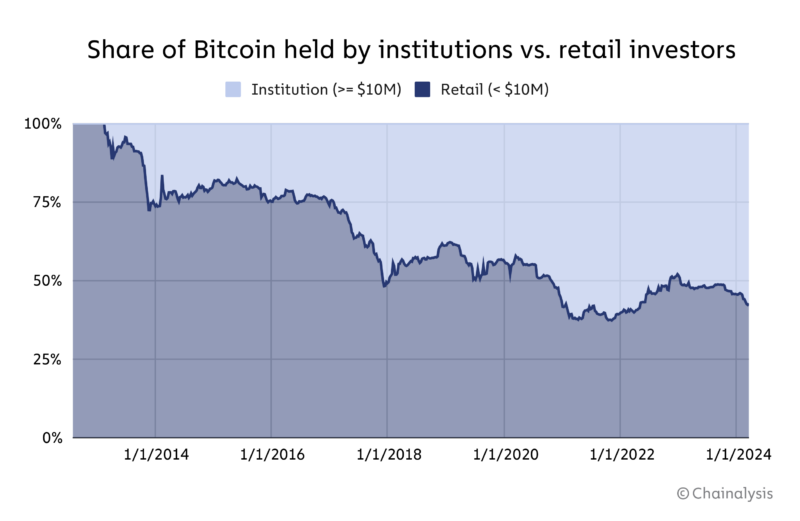

The halving events directly influence Bitcoin’s supply by reducing the rate at which new Bitcoins are created. This, coupled with a steady or increasing demand, especially from institutional investors and retail adoption, tends to push the price upwards. The anticipation of this supply squeeze may lead to increased holding behavior among existing Bitcoin owners, further reducing the liquid supply available on exchanges.

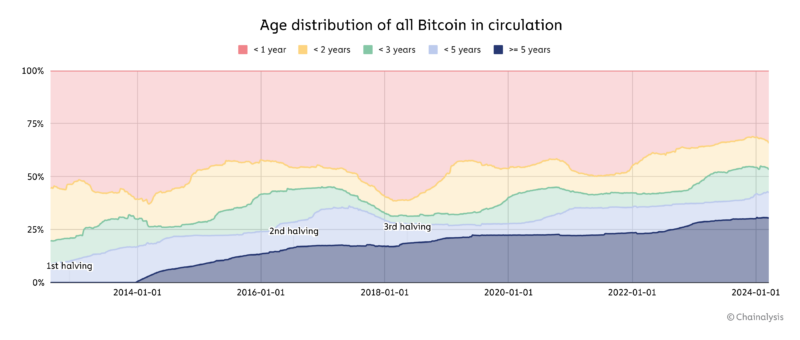

The percentage of Bitcoin held by long-term investors (more than 3 years) has shown consistent growth after each halving. Approximately one year after the first halving, the share of Bitcoin held for long-term investors increased by about 73%. The period following the second and third halvings showed modest increases, continuing an overall upward trend.

The involvement of ETFs in this halving cycle introduces a new dynamic, potentially heightening the halving’s impact compared to previous events. This halving could lead to even greater supply shock, driven by the combination of reduced mining rewards and increased institutional buying spurred by the ETFs outpacing the creation of new coins. In turn, this could drastically lower the amount of Bitcoin available for trading, increasing price volatility.

The percentage of Bitcoin held by institutions (clusters that hold more than $10 million) has increased after each halving. Institutions now hold the majority of bitcoin in circulation.

Effects on Bitcoin miners and profitability

For miners, the halving events reduce the immediate reward for mining new blocks. This can lead to a temporary decrease in profitability, especially for miners with higher operational costs.

However, the price increases following halvings have historically allowed miners to recover revenue despite the reduced block rewards.

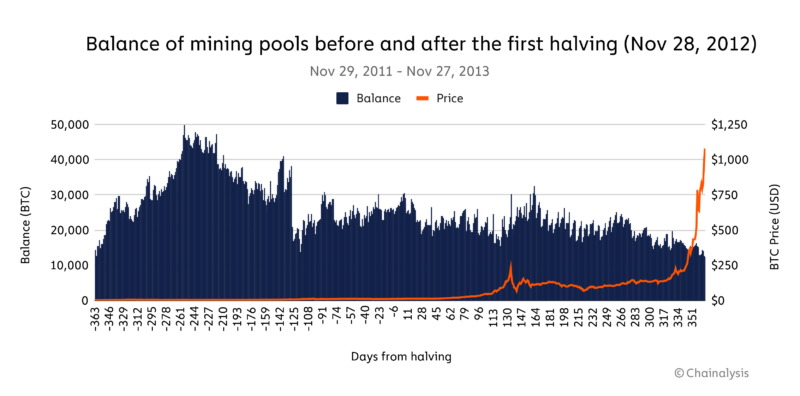

The aggregate balance of mining pools decreased starting around 3-6 months before the first and second halving occurred. This decline is attributed to miners presumably building cash liquidity in anticipation of the reduction in block rewards.

After the first and second halving, the price increased within one year, resulting in a recovery of revenue for miners as the block rewards decreased.

The third halving exhibited a different pattern compared to the first and second halvings. Established miners seemed to have waited until the bull run to sell their reserves, rather than selling them before the halvings. This could be due to the expectation that the price of Bitcoin would increase following the halving based on the prior two events, making it more profitable to hold for longer.

As of the present, ahead of the fourth halving, the reserves have decreased by approximately 23% compared to October 18, 2023, which is approximately 180 days before the anticipated halving date in mid-April. However, this reduction is not as significant as observed during the first and second halvings. This might be attributed to the expectation, similar to the third halving, of cashing out after a further price increase post-halving, or it could be due to the recent significant increase in the price of Bitcoin, allowing for the preparation of short-term strain without the need to sell as much Bitcoin as during the first and second halvings.

What the fourth Bitcoin halving means for crypto

The fundamental mechanics of this halving compared to prior halvings are unchanged: Reducing Bitcoin’s issuance rate to increase scarcity. However, the broader context in which this upcoming halving occurs is markedly different, with implications extending beyond supply mechanics.

With the backdrop of historic institutional engagement, there’s an unprecedented level of anticipation. Institutions have not just entered the market, they are now shaping its trajectory, bringing with them a new level of credibility, stability, and interest from mainstream finance. Bitcoin’s increasing integration into the global economy is paving brand new paths for demand and utility.

The consistent rise in weekly active wallets post-halving demonstrates the growing usage and adoption of Bitcoin.

This halving event is just one part of the piece defining the next phase of Bitcoin’s evolution, potentially impacting pricing, adoption, and solidifying its role within the larger financial landscape of the world.