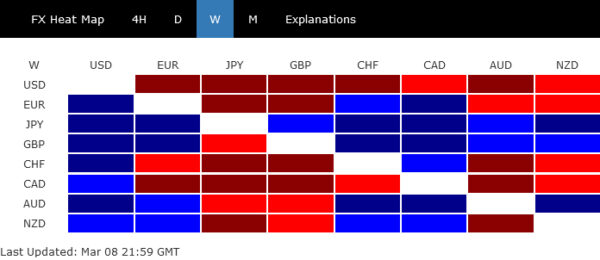

Dollar and Yen had contrasting fortune last week, responding to divergent central bank expectations. Dollar found itself as the week’s worst performer, a reflection of solidified expectations for Fed’s first rate cut in June, reinforced by Fed Chair Jerome Powell’s semiannual testimony. The cooling job US market is seen as unlikely to stand in the way. On the flip side, Yen staged a powerful rally, driven by a growing consensus around BoJ’s rate increase this month, making Yen the best performer.

Currency markets offered a mixed tableau elsewhere. British pound secured its position as the week’s second-strongest currency, benefiting from overarching risk-on sentiment and specific gains against Euro. Australian and New Zealand dollars also saw an uptick, with Aussie additionally buoyed by improved trade relations with China.

On the other hand, Canadian Dollar was the second worst next to the greenback despite BoC dropping no hint on rate cut yet. Swiss Franc was the third worst as a safe haven currency. Euro ended mixed only despite having strong rally against the greenback. ECB was clear that rate cuts are coming, with more officials pointing to June as the timeline.

On a broader scale, global financial markets reflected continuation of risk-on sentiment, with key indices like S&P 500, NASDAQ, CAC, DAX, and Nikkei achieving new records. However, some signs of market exhaustion hint at possible adjustments on the horizon. Elsewhere, Gold and Bitcoin reached new peaks too, with Gold’s rise partly attributed to China’s strategic gold acquisitions amid geopolitical tensions and domestic economic pressures.

Dollar and Yields Slide as June Rate Cut by Fed Becomes More Probable

Developments in the US last week were starting to cement market’s anticipation for Fed to embark on interest rate cuts at June meeting. A critical moment came during Fed Chair Jerome Powell’s semiannual congressional testimony, where he subtly hinted at Fed is “not far from” the point of comfort needed to ease monetary policy. Powell’s call for “a little bit more data” before initiating rate cuts has notably shifted market sentiments, framing a cut within Q2 as increasingly plausible.

The release of a ‘goldilocks’ non-farm payroll report further solidified this stance, portraying a cooling labor market that still manages to avoid a deep chill. The data, revealing slower wage growth and a slight uptick in unemployment, suggests that the job market wouldn’t hinder Fed from beginning its rate reduction journey.

Market pricing, mirrored in fed funds futures, resonates with these developments. The likelihood of Fed holding steady through its next meeting has dwindled to around 20%, while the probability of initiating rate cuts hovers around 80%. This alignment isn’t radically different from a week prior, yet the conviction among market participants has deepened.

In the stock markets, while S&P 500 reached new records, it appears to be grappling for further momentum. Considering bearish divergence condition in D MACD, strong resistance could be seen from 138.2% projection of 3808.86 to 4607.07 from 4103.78 at 5206.91 to limit upside. Break of 5056.82 will start a near term correction back to 55 D EMA (now at 4915.46).

10-year yield’s steep decline last week suggests that corrective rebound from 3.785 has completed at 4.354 already. Deeper fall will remain in favor as long as 55 D EMA (now at 4.178) holds. Nevertheless, strong support is likely between 3.785 low and 4.000 psychological level to contain downside. Breakout from range of 3.785/4.354 is not envisaged for now.

Amidst this backdrop, Dollar Index had a pronounced decline, catalyzed by the buoyant risk-on market sentiment, weakness in US treasury yields, and the solidifying expectations of a Fed June rate. The break of 102.90 support indicates that rebound from 100.61 has completed much earlier than expected at 104.97. Near term risk will stay on the downside as long as 55 D EMA (now at 103.65) holds. Deeper decline would be seen back towards 100.61 support. But strong support should emerge above 99.57 low to bring rebound, to continue medium term sideway pattern.

For Dollar Index to break through 99.57, risk-on sentiment would need to intensify further, as manifested by S&P 500 rising through 161.8% projection of 3808.86 to 4607.07 from 4103.78 at 5395.28. At the same time, 10-year yield would need to break through 3.785 support decisively. This scenario, however, remains unlikely in the immediate term.

Anticipation Builds for BoJ Hike This Month, Yen Skyrockets

This week has also been particularly groundbreaking for Japan as the financial markets adjust to the growing anticipation of imminent BoJ rate hike, as early as on March 19. The probability of this move, as inferred from overnight indexed swaps, has surged dramatically from a mere 30% last week to an overwhelming 80% at one point.

A key driver behind this shift is the latest reports from the annual Spring wages negotiations, showing unions securing the highest wage hikes in more than three decades. These developments suggest a solid continuation of wage growth, spurred by increasing living costs and deepening labor shortage. This scenario aligns closely with BoJ’s long-awaited wage-price spiral dynamics.

Reuters also reported an increasing consensus among BoJ policymakers toward ending the era of negative interest rates this month. Besides, this monumental shift is anticipated to prompt a comprehensive overhaul of Japan’s quantitative easing program.

Nikkei as been resilient to the news so far and hit new record high above 40k psychological level. Nevertheless, upside momentum is starting to diminish as see in D MACD. Strong resistance might come from 261.8% projection of 30538.28 to 33853.46 from 32205.38 at 41017.01 to limit upside and bring pull back. Meanwhile, break of 38876.80 would start a corrective back towards 55 D EMA (now at 36852.58). That might come as a reaction to BoJ’s rate hike.

Yen ended as the week’s strongest performer, benefiting not only from the recalibrated BoJ rate hike expectations but also from the decline in global benchmark yields. Specifically, Germany’s 10-year yield receded from prior week’s close of 2.421 to 2.266, and UK’s from 4.214 to 4.060, whereas Japan’s 10-year yield edged higher from 0.720 to 0.735.

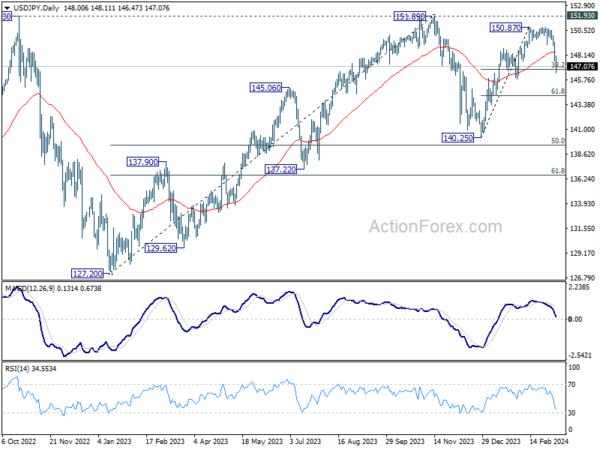

USD/JPY was the biggest mover of the week, down -303 points or -2.06%. Technically, the pressing question is whether fall from 150.87 is a correction to rise from 140.25, or the third leg of the medium term consolidation from 151.89. Sustained break of 38.2% retracement of 140.25 to 150.87 at 146.81 will favor the latter case. In this bearish development, USD/JPY would decline further through 61.8% retracement at 144.30, and probably below towards 140.25 support.

China’s Strategic Gold Accumulation Fuels Record Price Rally

Gold’s rally to new record high last week is multifaceted. It can be attributed not just to the weakening Dollar and the anticipation surrounding major global central banks’ impending rate cuts, but also to China as a pivotal player.

PBoC’s continued expansion of its gold reserves for the sixteenth consecutive month in February underscores a broader strategy of reserve diversification and geopolitical hedging. With an additional 390k troy ounces added last month, China’s central bank now boasts approximately 2257 tonnes of Gold, marking a significant stance in the face of persistent US and Western tensions.

Furthermore, China’s domestic market has shown a marked increase in Gold demand, propelled by economic uncertainties. This surge is evidenced by Swiss exports to China, a reliable barometer of Chinese interest in gold, which saw a more than twofold increase in January from the previous month to 77.8 tonnes. Shipments to Hong Kong also saw a nearly sevenfold rise to 44.6 tonnes.

Technically, Gold’s outlook will stay bullish as long as 2123.45 support holds. Next target is cluster projection level around 2260, 100% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 and 100% projection of 1614.60 to 2062.95 from 1810.26 at 2259.15.

In the long term picture, rise from 1614.60 is currently seen as the fifth leg of the five wave uptrend from 1046.27 (2015 low). Sustained trading above 61.8% projection of 1160.17 to 2074.84 from 1614.60 at 2179.86 will pave the way to 100% projection at 2529.27 in the medium term.

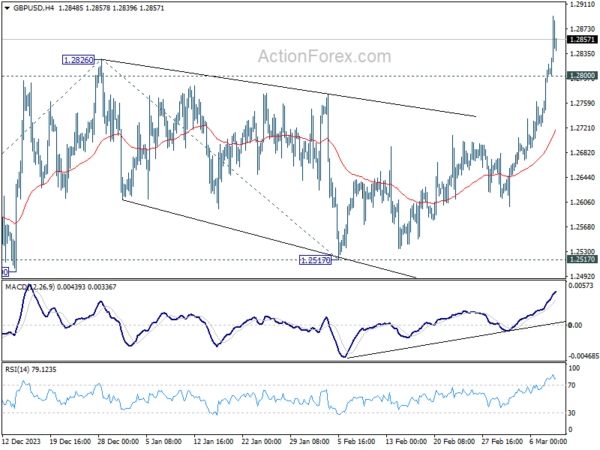

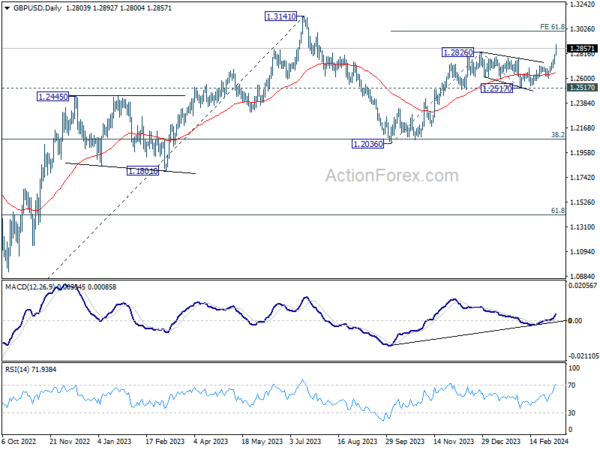

GBP/USD Weekly Outlook

GBP/USD broke through 1.2826 resistance to resume the whole rally from 1.2063. Initial bias stays on the upside this week for 61.8% projection of 1.2036 to 1.2826 from 1.2517 at 1.3005. On the downside, below 1.2800 minor support will turn intraday bias neutral first. But further rise will remain in favor as long as 55 4H EMA (now at 1.2718) holds.

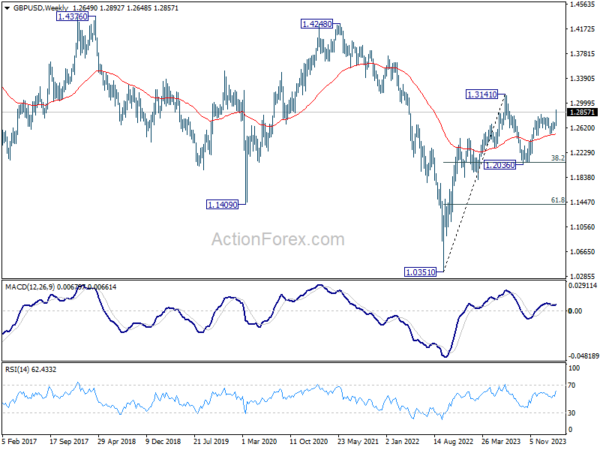

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which is still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.