Renewable energy costs in Asia last year were 13% cheaper than coal and are expected to be 32% cheaper by 2030, according to a new study.

Source: Wood Mackenzie Asia Pacific Power & Renewable Services

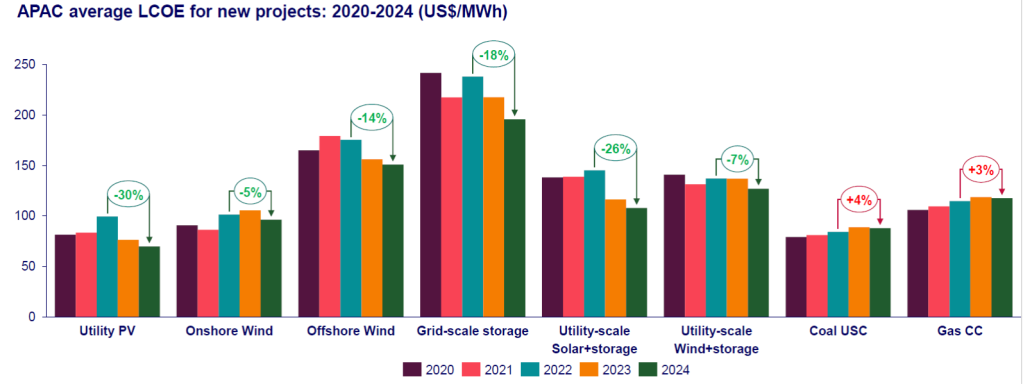

According to Wood Mackenzie’s latest analysis of the levelized cost of electricity (LCOE) for the Asia Pacific (APAC) region, the LCOE from renewables reached a historic low in 2023. This is significant because it marks a shift toward making renewables increasingly competitive with coal, a mainstay in APAC’s energy mix. The driving force behind this trend is the substantial reduction in capital costs for renewable energy projects.

China leads the pack with a 40-70% cost reduction in utility-scale solar, onshore wind, and offshore wind compared to other Asia Pacific markets. China is expected to maintain a 50% cost advantage in renewable energy up to 2050.

Solar is cheapest and falling

The significant drop in solar power costs, by 23% in 2023, signals the end of supply chain disruptions and inflationary pressures. As a result, utility solar is now the cheapest power source in 11 out of 15 APAC countries. New-build solar project costs are expected to fall by another 20% by 2030 due to lower module prices and an oversupply from China.

This drop in solar costs, particularly in 2023-24, puts pressure on coal and gas and highlights a 23% decrease in LCOE for utility PV across the Asia Pacific, driven by a 29% decline in capital costs.

Distributed solar, such as residential rooftop solar, saw a 26% decrease in 2023. This makes distributed solar 12% cheaper on average than residential power prices, unlocking substantial potential for rooftop solar.

Distributed solar is becoming increasingly enticing for customers in many Asia Pacific markets, with costs now 30% below rising residential tariffs in countries like China and Australia. However, markets with subsidized residential power tariffs, such as India, might have to wait until 2030 or later to see competitive prices for distributed solar.

Wind power isn’t far behind

While solar is surging ahead in terms of cost-effectiveness, onshore wind isn’t far behind despite costs being 38% more than solar in 2023. With a forecasted 30% cost reduction by 2030 as cheaper Chinese turbines gain market share, Australia and Southeast Asia stand to benefit from low-cost wind power equipment imports.

However, there will be less of an impact on markets with limited uptake of Chinese turbines such as Japan and South Korea, which focus more on domestic supply chains.

WoodMac also underscores the growing competitiveness of offshore wind with fossil fuels in APAC. With an 11% cost reduction in 2023, offshore wind costs are now competitive with coal along China’s coast and are expected to undercut gas in Japan and the Taiwan region by 2027 and 2028, respectively. Falling capital costs and tech improvements are opening up new markets for offshore wind in India, Southeast Asia, and Australia over the next five to 10 years.

In contrast with falling renewables costs, coal and gas generation expenses have increased by 12% since 2020 and are projected to rise through 2050, primarily due to carbon pricing mechanisms.

While developed APAC markets anticipate a significant hike in carbon prices, reaching US$20-55/tonne by 2030, Southeast Asia and India are expected to see lower carbon prices.

This trend suggests that gas power, with costs remaining above US$100/MWh on average until 2050, will gradually lose its cost competitiveness with offshore wind over the next decade.

Alex Whitworth, vice president, head of Asia Pacific Power Research at Wood Mackenzie, concluded:

Solar power costs have reached an historic low in the Asia Pacific region in 2023, reversing fears of permanent cost inflation. But while low costs support a continued boom in renewables investments, there is concern among investors on profitability, grid integration, backup, and energy storage.

Government policies will play a crucial role going forward to support upgrading grid reliability, transmission capacity, and promoting battery storage to manage the intermittent nature of renewables.