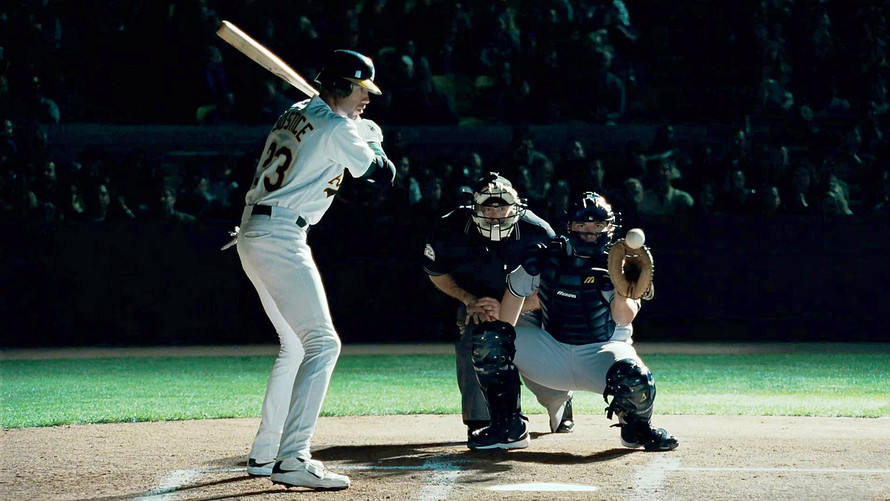

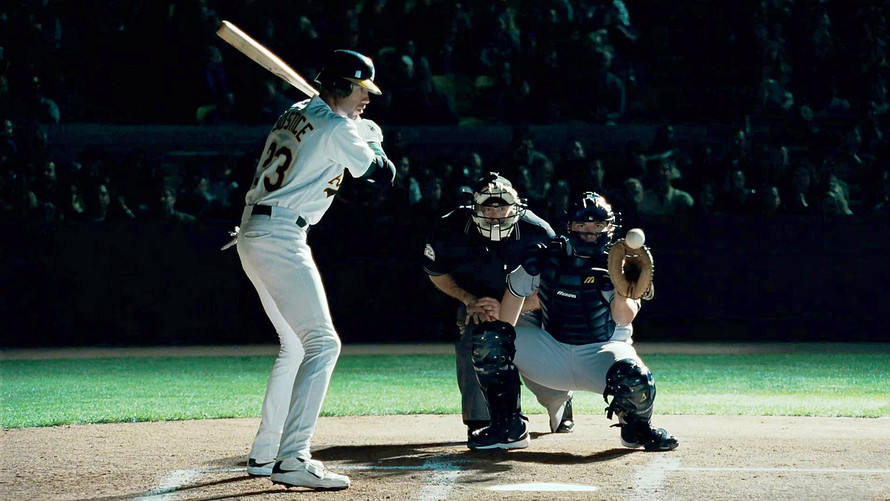

A long-running bull market in stocks may be about to enter its final inning.

Morgan Stanley reiterated its cautious view on equities, arguing that a “rolling bear market” wasn’t yet over, and that it could soon impact the parts of the market that have been holding up successfully.

Specifically, the investment bank said that small-capitalization stocks — which have benefited from the uncertainty surrounding trade policy, given their high levels of domestic revenue exposure — could be about to turn.

Michael Wilson, Morgan Stanley’s chief U.S. equity strategist, said he was “a bit leery about the fact that small caps have become a perceived safe haven in the event of trade conflicts,” and that this “perception may now be overpriced.”

Small-capitalization stocks, as benchmarked by the Russell 2000 index RUT, +0.77% , are up 8.9% over the course of 2018. The S&P 500 SPX, +0.49% is up 5% this year, while the Dow Jones Industrial Average DJIA, -0.03% is up 1.9%.

The Nasdaq Composite Index COMP, +1.24% has been the best performer among the major indexes; it’s up 11.8% year to date. However, this is due almost entirely to outsize gains in a few huge companies, which have been enough to lift the index — and by extension, have helped to support the overall market. Specifically, Amazon.com Inc. AMZN, +2.07% has jumped more than 50% thus far this year, while Apple Inc. AAPL, +2.92% is up 21%. The iPhone maker, the largest stock on the market, ended at a record high on Wednesday, boosted by strong quarterly results.

Not all of the market’s biggest drivers have had results on the level of Apple’s, however. Netflix Inc. NFLX, +1.81% disappointed in its latest quarter, and the stock has dropped 20% from its most recent peak, a drop that puts the video-streaming giant into bear-market territory, even as it remains up 76% for the year.

Facebook Inc. FB, +2.75% suffered its worst day ever in the wake of its results last month, and is now down 2.2% for the year, and it’s off more than 20% from its own all-time peak. The plummet in Facebook underlined how vulnerable the overall market could be in the event that further cracks appear in the uptrend of growth stocks, which have lifted the market for years.

The so-called FAANG stocks — a quintet that refers to Facebook, Amazon, Apple and Netflix, along with Google parent Alphabet GOOG, +0.50% GOOGL, +0.66% — have by themselves contributed a sizable proportion of the overall market’s gain this year. All five are in either the technology or the consumer-discretionary sectors, and, as Morgan Stanley’s Wilson noted, “within the U.S. market, we have noticed a significant divergence between the perceived weakest links and the stronger ones. From a sector standpoint, it’s really down to just technology and consumer discretionary [maintaining strength].”

“Our call was that these groups are likely to get hit next and, indeed, we think a meaningful correction in these asset categories began late last month. The bad news is that these sectors make up almost 40% of the S&P 500 and close to half of the Nasdaq Composite Index, so the correction will leave a mark on the broader U.S. indexes if we’re right.”

He added, “if we are right and U.S. large-cap growth stocks and small-cap stocks finally take their turn in the rolling bear market, we would view it as the final inning of the game we expected this year. Just remember that those last innings can bring a lot of excitement and anguish, too, depending on which team you are rooting for.”

According to Wilson, Morgan Stanley recently sold 25% of its large-cap growth position, rotating that into large-cap value strategies. In addition, the investment bank reduced its small-cap equity holding positions by 30%, putting that into cash equivalents.