Personal finance expert Dave Ramsey has raised concerns about the growing popularity of adjustable-rate mortgages (ARMs). In a recent episode of “The Ramsey Show,” Ramsey didn’t hold back in describing ARMs as a “ticket to foreclosure” rather than a pathway to homeownership.

In the episode, co-host George Kamel brought up a “passive-aggressive” question posted on Experian regarding whether adjustable-rate mortgages could help people purchase homes. Ramsey made it clear that he saw a potentially insidious motive behind the question. He questioned the vested interests of organizations like Experian in promoting ARMs, implying that their goal is to get people into debt and keep them there. When people take out mortgages, their credit scores are checked and monitored, and Experian —one of the major credit reporting agencies — benefits from this activity.

Ramsey mocks the idea of purchasing an ARM when interest rates are on the rise. He asks a rhetorical question — “If you buy a mortgage that adjusts, in an increasing interest rate environment, what are you expecting it to adjust to? Up. Well, that’s dumber than a rock on the surface.”

Don’t Miss:

- This Jeff Bezos-backed platform has made real estate investing as easy as ordering stuff on Amazon. Read how you can invest as little as $100 in its rental properties.

- Elon Musk is looking to bring thousands of new tech workers to Austin. Here’s how to invest in the city’s growth beforehand.

According to a survey, 40% of Americans said they would get an adjustable-rate mortgage. Despite their apparent allure for some desperate buyers, Ramsey has strong reservations about ARMs, and his concerns are not without merit.

He explains ARMs involve a “bait-and-switch” mechanism. When borrowers initiate their ARM, they are assigned an index that already carries a higher rate than what they could secure with a fixed-rate mortgage at that time. For your ARM rate to remain stable during renewal, broader interest rates must decrease, which is often a rare occurrence.

ARMs can adjust upward rapidly when benchmark rates rise but move much more slowly when the Federal Reserve announces rate cuts. This dynamic makes it almost certain that your adjustable mortgage rate will increase during your first renewal, potentially straining your finances.

Ramsey is emphatic in his assessment, stating that ARMs rank among the most significant financial traps ever devised. If the Federal Reserve continues to increase rates, as it has in recent history, ARMs can quickly become unaffordable. Homeowners who fall behind on payments risk defaulting on their mortgage and, ultimately, foreclosure.

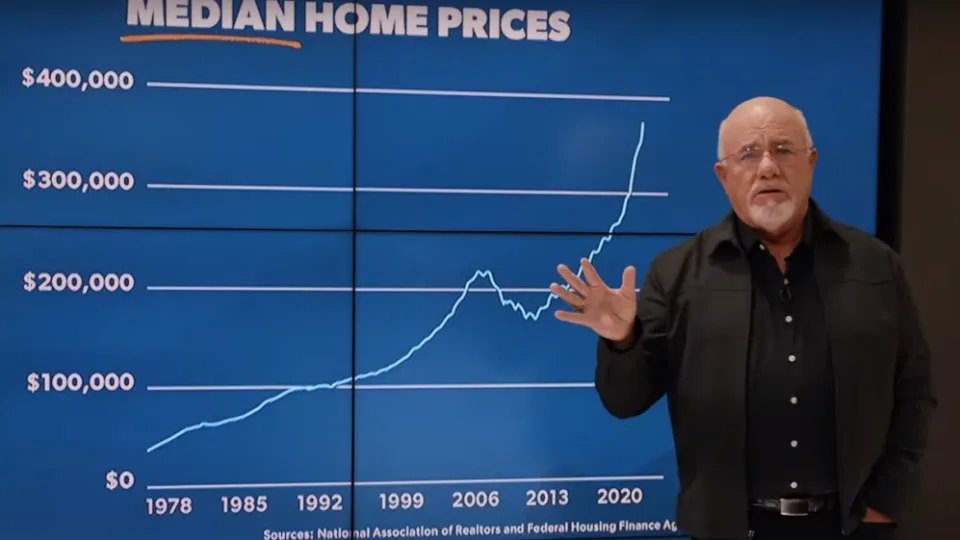

Much of Ramsey’s skepticism about ARMs is grounded in his experience in the real estate industry, particularly during the 1980s. This period witnessed a dramatic surge in interest rates, with rates reaching a staggering 17%. This situation led to a banking crisis, as many financial institutions found themselves paying high-interest rates to depositors while receiving lower payments from borrowers locked into fixed-rate mortgages.

This tumultuous period, often referred to as the savings and loans crisis, resulted in several lenders going bankrupt. To mitigate such risks, banks introduced adjustable-rate mortgages, effectively transferring the risk from the lender to the borrower.

Ramsey maintains that this shift had little to do with assisting prospective homebuyers and everything to do with banks safeguarding their interests. He argues that banks have a long-standing history of prioritizing their financial well-being over the welfare of borrowers.