Big tech players Amazon and Facebook have rocketed to new records, but smaller names are no slouches when it comes to the tech rally.

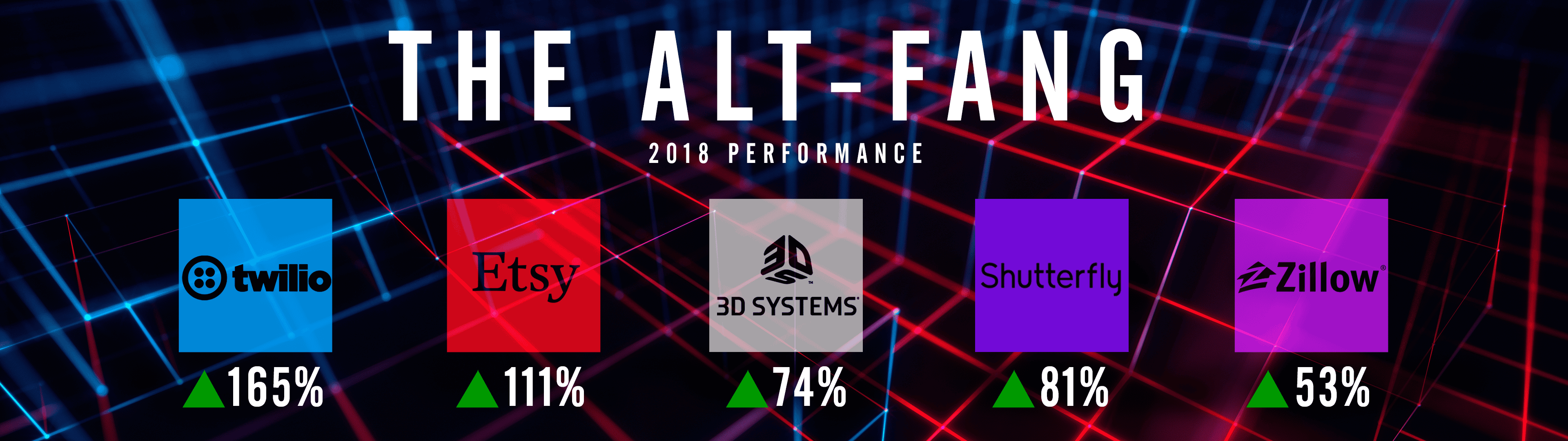

Stocks such as Twilio, Etsy, 3D Systems, Shutterfly and Zillow, which have a fraction of the market cap of FANG, have surged by at least 50 percent in the year to date.

After a massive runup, only one looks like a buy to Matt Maley, equity strategist at Miller Tabak.

“The one that stands out to me is 3D systems,” Maley told CNBC’s “Trading Nation.” “When you get these huge moves in these kind of stocks, the big worry, of course, is that: Is it a bubble? And will the stock or group burst? The thing is, with 3D it already has burst.”

3D rocketed 270 percent in 2012 and another 161 percent in 2013, reaching a record high in early 2014 before crashing in the next two years. Its shares plummeted 90 percent from the end of 2013 through 2015.

“It’s already had its massive breakdown,” added Maley. “However, in the last year or so, the stock’s seen a nice rally. It’s made a nice higher low and now it’s breaking above its trend line going back to those 2014 highs.”

Its shares have rallied nearly 75 percent in 2018, though they are still a 23 percent rally from their 52-week highs set in July last year. Shares are still 84 percent below their intraday high set in early January 2014.

Chad Morganlander, portfolio manager at Washington Crossing Advisors, is far more cautious on the space and advises taking a few chips off the table.

“This represents a speculative frothy market. We would actually shy away from small-cap tech at this point,” Morganlander said on Tuesday’s “Trading Nation.” “The tech names have all run and chased after the FANG stocks … but this, we believe, though is now more of a speculative rush, a speculative fervor.”

Nasdaq components Etsy, Shutterfly and Zillow are up 116 percent, 82 percent and 56 percent, respectively, in the year to date. Twilio has surged 171 percent in 2018.