Stock Markets

Last week was marked by light and choppy trading due to a holiday-shortened trading week. U.S. markets were closed on Friday together with most of the other markets in the Americas, in observance of the Good Friday holiday and the Passover that started on Wednesday evening. Also noticeable was a slight pause by investors after the previous week’s end-of-quarter “window dressing.” This is the activity performed by some institutional investors wherein they adjust their holdings in advance of their quarterly public disclosure.

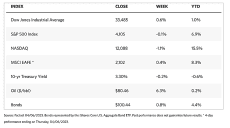

The major indexes were generally up for the week that just ended, although some of their component sectors lost ground. The Dow Jones Industrial Average (DJIA) ascended by 1.91% although its transportation average was down by 1.15%. Nevertheless, the Dow Jones total stock market index was still up by 1.02%. The broad S&P 500 Index also was up by 1.34%, but within this market, the MidCap 400 and SmallCap 600 fell by 0.88% and 0.82% respectively. The technology-heavy Nasdaq Stock Market Composite gained by 0.62% while the NYSE Composite performed slightly better, rising by 1.17% for the week. Predictably, the CBOE Volatility metric slid lower by 3.26%, indicating reducing risk perception among stock investors.

U.S. Economy

Last week, the markets closed early, a bit too soon to react to the nonfarm payrolls report released by the Labor Department for March. On Monday, the Institute for Supply Management’s (ISM’s) gauge of March factory activity reversed a modest uptick in February and descended back to almost its three-year low. The ISM’s gauge for the services sector which was released two days later suggested that the services sector was still expanding, albeit at a rate that was significantly slower than expected. There appears good reason for concerns about a recession to deepen, and hopes for lower interest rates to grow, based on the Labor Department report released on Tuesday. The report indicated that job openings declined much more than expected in February, falling to 9.9 million, a level last reached in May 2021. However, the number of people quitting their jobs grew from 3.9 million to 4.0 million. According to economists, the number of people voluntarily leaving their jobs is a more reliable indicator of the overall health of the labor market.

Pessimistic statements from a Federal Reserve official and a leading bank executive also weighed down investor sentiment. At an economic conference, Cleveland Fed President Loretta Mester disclosed that she expected the federal funds rate to go above 5% and remain at that level, while JPMorgan Chase Chairman and CEO Jamie Dimon warned in a letter to shareholders that the banking crisis is not yet over and “that there will be repercussions from it for years to come.” The weak economic data push U.S. Treasury yields lower, and, since bond prices and yields move in opposite directions, bond prices moved up. Bonds in the energy sector were early outperformers on news of a production cut by OPEC and other oil-producing nations, while U.S. and Yankee banks – banks domiciled in the U.S. but with most of their operations abroad – lagged the broader market.

Overall, it is likely that a soft recession may lie in the future of the U.S. economy, based on three emerging trends. First, the labor market is showing signs of faltering. Second, manufacturing and services activity continues to fall. Third, the housing sector appears to be softening. The most likely scenario is for a mild recession, possibly beginning in mid-2023.

Metals and Mining

There is so much uncertainty dominating the financial markets, as may be testified by comments among financial experts that a recession is likely to materialize in the months to come. In the impending flight to safe-haven assets, gold may experience continued buying pressure. At present, gold has hit a new record high above $2,000 an ounce, and silver is starting to tread at the $25 per ounce level. Gold and silver have significantly benefited from a steep drop in bond yields this past week, which in turn weighs on the U.S. dollar. If the U.S. dollar finds some momentum, it may cause investors to take some profits on their bullish gold positions. Also, even if the U.S. labor market has been surprisingly resilient since early 2022, analysts observe that signs are showing that the tide is starting to shift in the labor market, highlighting weakness and raising fears of a recession. This might usher in further dollar weakness and a corresponding upside for precious metals.

In the week just ended, gold came from its previous close at $1,969.28 to end at $2,007.91 per troy ounce, up by 1.96%. Silver rose by 3.65% from the previous week’s close at $24.10 to this week’s close at $24.98 per troy ounce. Platinum climbed by 1.67% to close this week at $1,011.80 per troy ounce from the earlier week’s close at $995.22. Palladium, which was priced one week ago at $1,463.77, closed this week at $1,470.06 per troy ounce, a gain of 0.43%. The three-month LME prices of base metals all fell over the week. Copper came from $8,993.00 one week ago to settle this week at $8,800.00 per metric tonne, descending by 2.15%. Zinc closed at $2,779.00 per metric tonne this week, lower by 4.91% from the previous week’s price of $2,922.50. Aluminum descended by 3.29% from the previous week’s close at $2,413.00 to this week’s close at $2,333.50 per metric tonne. Tin began at its prior week’s close of $25,835.00 to settle this week at $24,308.00 per metric tonne for a loss of 5.91%.

Energy and Oil

After the surprising rally in oil prices seen at the beginning of this past week, the subsequent increases have been sluggish despite the notable stock draws in both the U.S. crude and product inventories. In light of the resurging U.S. demand after a weak first quarter and OPEC+ showing a resolve to curb production, supply-side factors seem to indicate the existence of a further upside. Simultaneously, macroeconomic concerns might once more cut short what should be an impending bull market, particularly if the U.S. labor market data douse expectations of a resurging economy. It appears that recession fears have begun to weigh on diesel prices, seeing how the premium of diesel against Brent or WTI has been shrinking for the past six months. Diesel’s cyclical sensitivity makes it vulnerable to declines in business activity and lower manufacturing orders.

Natural Gas

For the week starting Wednesday, March 29, and ending Wednesday, April 5, 2023, the Henry Hub spot price rose $0.22 from $1.95 per million British thermal units (MMBtu) at the start of the report week to $2.17/MMBtu by its end. The April 2023 NYMEX contract expired by the week’s end at $1.991/MMBtu. The May 2023 NYMEX contract price decreased to $2.155/MMBtu, down by $0.03 throughout the week. The price of the 12-month strip averaging May 2023 through April 2024 futures contracts declined by $0.08 to $3.000/MMBtu.

International natural gas futures prices increased during this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia rose by $0.24 to a weekly average of $12.96/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, rose by $1.48 to a weekly average of $14.96/MMBtu. In the corresponding week last year (i.e., the week ending April 6, 2022), the prices were $33.99/MMBtu in East Asia and $36.25/MMBtu at the TTF.

World Markets

European shares gained ground as concerns of a deeper banking crisis faded. The pan-European STOXX Europe 600 Index closed the five-day trading week ending April 6 with a 0.90% increase. Major stock indexes were mixed on slow trading. Three European Central Bank (ECB) officials have issued statements over the week hinting at more rate hikes ahead. ECB President Christine Lagarde, Vice President Luis de Guindos, and Chief Economist Philip Lane opined that inflationary pressures necessitate further interest rate hikes in the future. Other policymakers, however, said that while rates may continue to rise, they are also possibly close to their peak. This group includes Bank of France Governor François Villeroy de Galhau, Bank of Lithuania Governor Gediminas Šimkus, and Bank of Greece Governor Yannis Stournaras.

Japanese stocks lost some ground over the shortened trading week. The Nikkei 225 Index fell by 1.9% and the broader TOPIX Index declined by 2.1% through Thursday’s trading. Data have been released that suggested the U.S. economy may be slowing down, which is raising fears that a global recession may take place. Investors also speculate about the potential repercussions of Japan’s recent announcement of export restrictions on certain types of semiconductor manufacturing equipment, particularly on Japan’s relations with China, its largest trading partner. There is also speculation about a possible change in the ultra-loose monetary policy of the Bank of Japan (BoJ) under Governor Kazuo Ueda, who assumed the post on April 9. During the week, a former BoJ official suggested that the central bank could tweak its yield curve control framework without prior warning. On this note, the 10-year Japanese government bond rose to 0.46%, from 0.32% at the end of the previous week, tracking the rise in global bond yields. The yen strengthened to about JPY 131.3 against the U.S. dollar from about JPY 132,8 the prior week.

Chinese stocks gained ground during the holiday-truncated week as a recovery in services activity and the property sector boosted invested sentiment. The Shanghai Stock Exchange Index rose by 1.22% and the blue-chip CSI 300 advanced by 1.13% in local currency terms. Markets in Hong Kong and China were closed on Wednesday in observance of the Qingming Festival, also known as Tomb Sweeping Day, when Chinese people honor their ancestors by cleaning and placing offerings on their tombs. China’s new home sales climbed by 55.7% in March, up from 31.9% in February. Increased demand was due to several stimulus measures that China’s central and local governments implemented at the end of 2022 to drive homebuying sentiment. While sales growth is expected to improve for the rest of 2023, many analysts believe that prospects for China’s property market will remain subdued for the longer term.

The Week Ahead

Among the important economic data to be released in the coming week are several inflation indicators, including CPI, PPI, and their core equivalents.

Key Topics to Watch

- Wholesale inventories

- NFIB optimism index

- Chicago Fed President Goolsbee speaks

- Philadelphia Fed President Harker speaks

- Minneapolis Fed President Kashkari speaks

- Consumer price index

- Core CPI

- CPI year over year

- Core CPI year over year

- Richmond Fed President Barkin speaks

- San Francisco Fed President Daly speaks

- Treasury Budget

- Minutes of FOMC meeting

- Producer price index

- Core PPI

- PPI year over year

- Core PPI year over year

- Initial jobless claims

- Continuing jobless claims

- S. retail sales

- Retail sales minus autos

- Import price index

- Import prices minus fuel

- Fed Gov. Waller speaks

- Industrial production

- Capacity utilization

- Business inventories

- Consumer sentiment

Markets Index Wrap Up