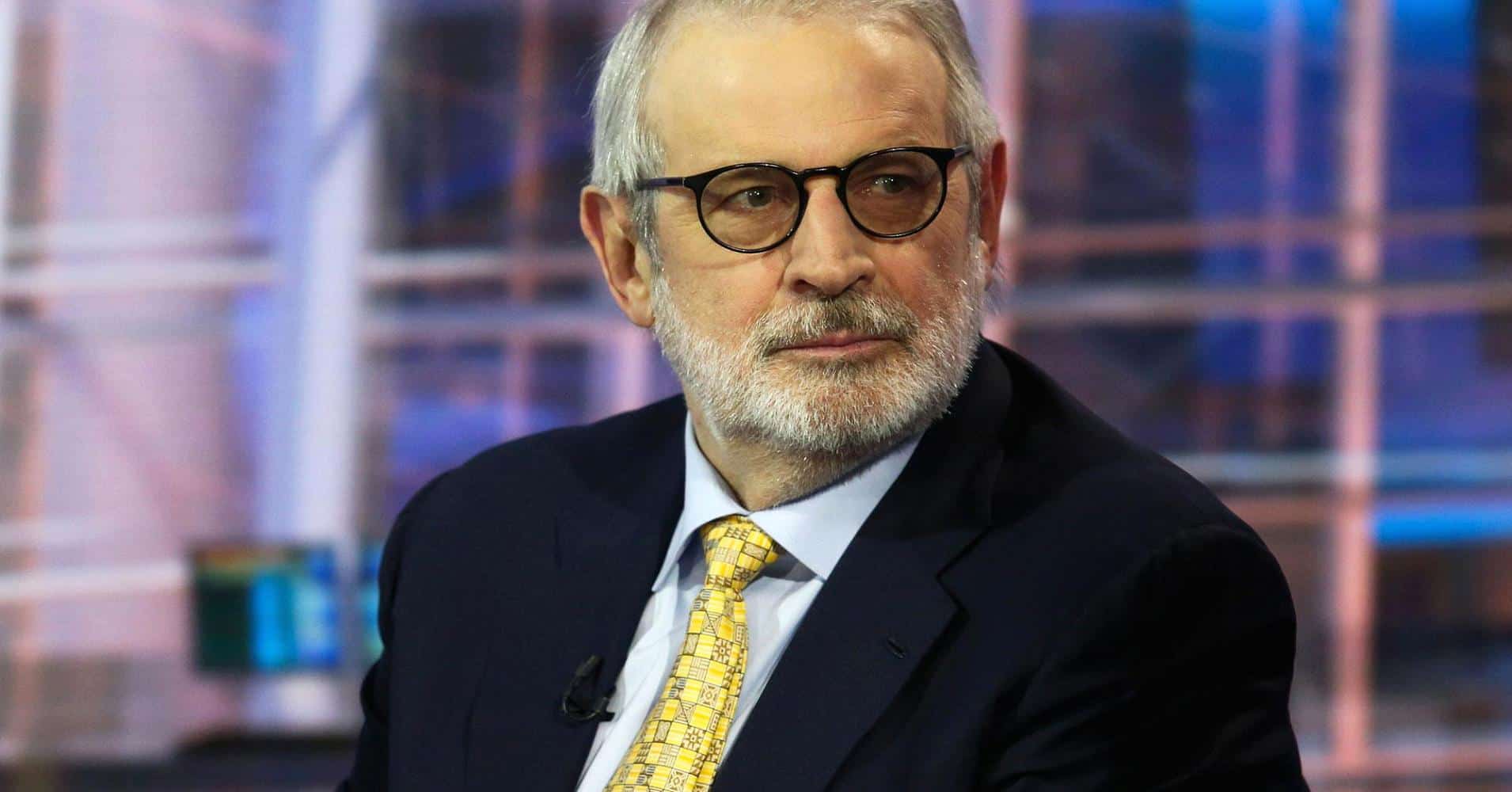

David Stockman is intensifying his bear case.

President Ronald Reagan’s Office of Management and Budget director blames a bull market that’s getting longer in the tooth — paired with headwinds ranging from President Donald Trump’s leadership to fiscal policy decisions to questionable earnings.

“I call this a daredevil market. It’s all risk and very little reward in the path ahead,” Stockman said Tuesday on CNBC’s “Futures Now.” “This market is just way, way over-priced for reality.”

His thoughts came as the Nasdaq was reaching all-time highs again, while S&P 500 rose slightly but the Dow failed to extend its win streak to three days in a row.

“The S&P 500 could easily drop to 1,600 because earnings could drop to $75 a share the next time we have a recession,” Stockman warned. “We’re about eight or nine years into this expansion. Everything is crazily priced. I mean the S&P 500 at 24 times at the end, tippy top of a business cycle.”

One of his biggest gripes with the bulls is the notion that President Donald Trump’s tax cuts are providing a fundamental lift to stocks.

“These tax cuts are going to add to the deficit in the 10th year of an expansion. It’s just irresponsible crazy,” he said. “It’s all going to stock buybacks and M&A deals anyway. That doesn’t cause the economy to grow. It’s just a short-term boost to the stock market that doesn’t last.”

Stockman has made similar bearish calls in the past, but they haven’t materialized. Yet, he’s not backing down.

“There are some huge surprises lurking out there because we’ve had eight years of monetary expansion that is just off the charts of history,” he said.

When pressed for when a massive sell-off could hit stocks, he didn’t give a time frame.

“When the catalyst finally comes, it’s hard to say,” Stockman said. “No one can ever define what the black swan is because that is why it’s called a black swan.”