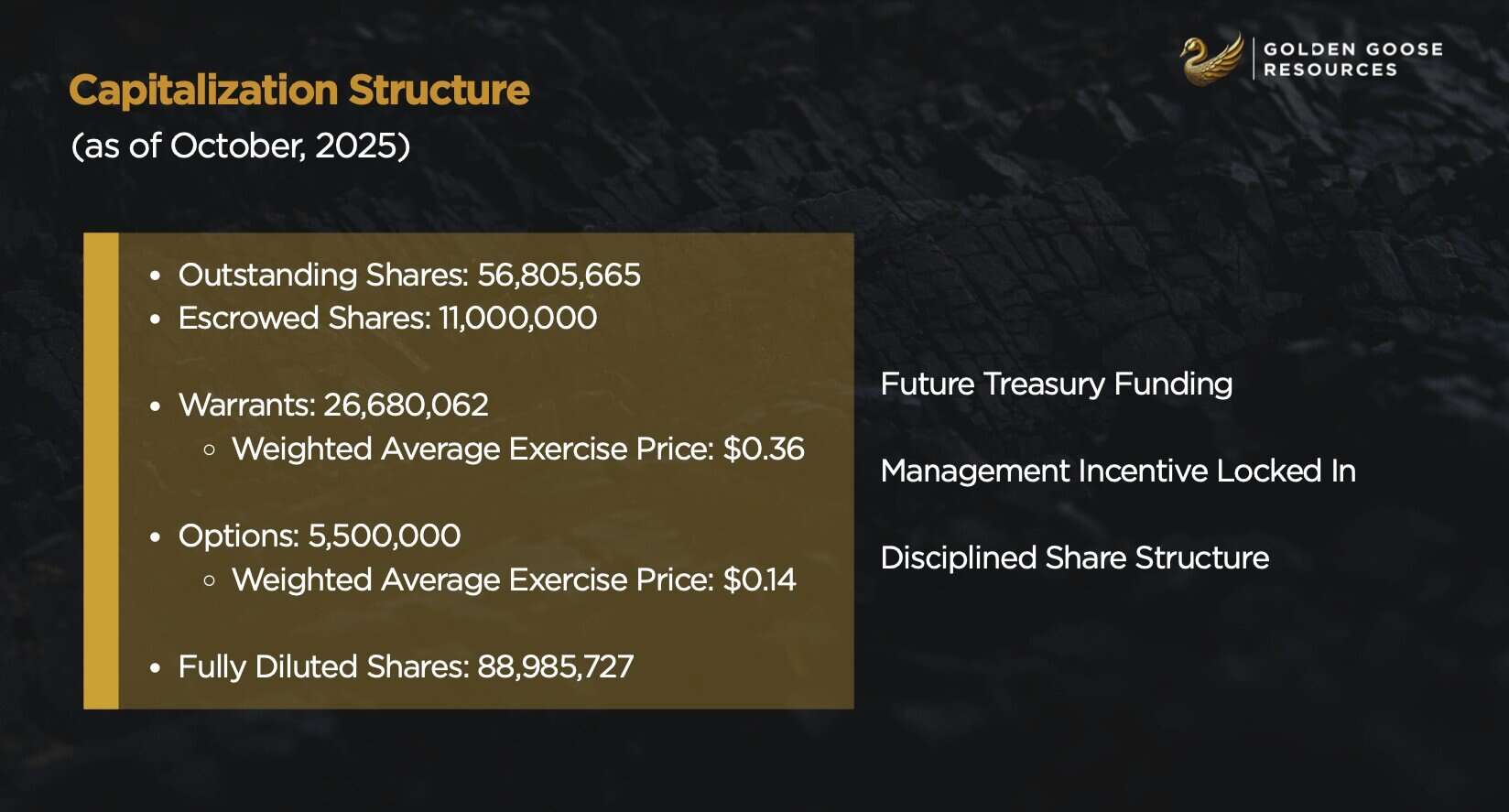

Golden Goose Resources (CSE: GGR): High-grade gold flagship in Argentina. Fresh exploration next to a 4.1-million-ounce deposit in Quebec. And lithium upside.

Issued on behalf of Golden Goose Resources Corp.

In mining, your neighbors matter.

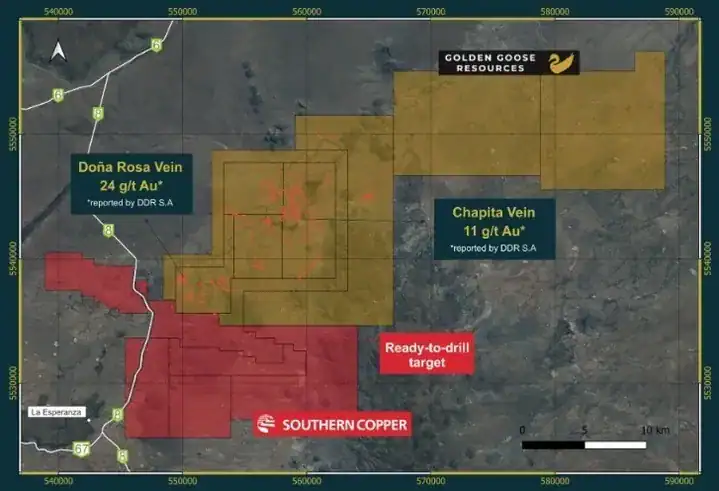

Golden Goose Resources (CSE: GGR) has a flagship gold project in Argentina delivering 24 g/t intercepts[1]. Southern Copper, one of the world’s largest copper producers, is drilling right next door.

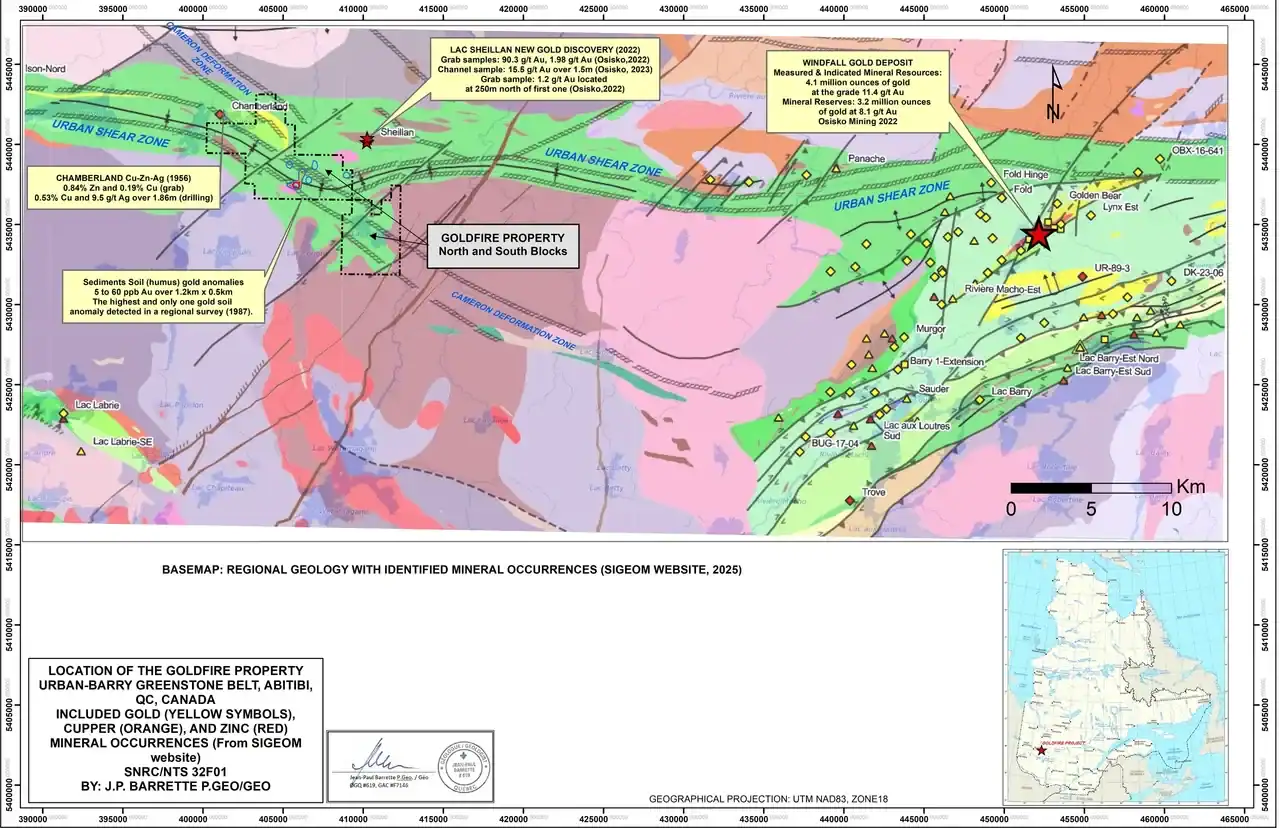

And in Quebec? They just wrapped Phase 2 exploration at Goldfire, 83 claims sitting adjacent to Gold Fields’ 4.1-million-ounce Windfall deposit. 170 samples are at the lab[2].

Here’s why BOTH of Golden Goose’s addresses matter.

Argentina: The Flagship High-Grade Gold Project

When one of the world’s largest copper producers is drilling beside you, you’re in the right district.

La Esperanza isn’t a concept. It’s delivered numbers.

Channel samples returned 24 g/t gold over 2 meters. Another hit 13.1 g/t over 5 meters. These aren’t grab samples from surface float. These are systematic channel samples from trenches.

The property covers 44,400 hectares of year-round workable terrain in Rio Negro Province. Over 10 kilometers of low-sulphidation epithermal gold veins (the type that often produces high grades) have been mapped and sampled. Historical work excavated 30 trenches, exposing nearly 3 kilometers of mineralized structure.

In total? 1,674 rock samples collected. Rock chips, channel samples, float samples. Real data. Real access.

Here’s what validates the address: Southern Copper, one of the world’s largest copper producers, holds a ready-to-drill target directly bordering Golden Goose Resources’ claims. When majors are active in your backyard, it confirms you’re in the right geological neighborhood.

The logistics matter too. Two kilometers from a provincial road on gentle terrain. This isn’t fly-in exploration. It’s ground you can work twelve months a year.

La Esperanza sits in the Norpatagonian Massif, a region known for hosting high-grade precious metal deposits. The geology checks out. The grades are there. The infrastructure is workable.

This is the flagship.

Meanwhile in Quebec: Fresh Results Next Door to 4.1 Million Ounces

The address tells half the story. The other half just went to the lab.

While La Esperanza anchors the portfolio, Goldfire in Quebec is heating up.

The property sits in Quebec’s Urban-Barry volcanic belt, directly adjacent to Gold Fields’ Windfall mine. That’s 4.1 million ounces of high-grade gold with construction nearly complete[3]. When a major like Gold Fields invests an additional $1.57 billion as part of an acquisition that led to securing full control of the mine[4] and with plans to produce 300,000 ounces annually[5], you pay attention to the neighbors.

Golden Goose Resources just wrapped Phase 2 exploration across its 4,680-hectare property[6]. The team mapped substantial alteration systems (the geological fingerprints that often signal gold nearby) in both the northern and southern zones.

What did they find? Sulphides: pyrite, pyrrhotite, chalcopyrite. Hosted in the same types of rocks that carry gold at Windfall. Quartz-carbonate veins with sulphides. Structural features that align with known mineralization trends.

170 samples are now at the lab. Laboratory analysis underway.

“Our initial work at Goldfire has validated key structural and alteration features that align with known mineralization trends in the Windfall camp. These early findings strengthen our confidence in the property’s potential and set the stage for the next phase of systematic exploration.”

– Dustin Nanos, CEO of Golden Goose Resources.

The infrastructure story matters. Gold Fields is building hydroelectric power and planning a mill. Roads are improving. Access is getting better.

Not bad for a property most people haven’t heard of yet.

This is an early-entry opportunity in one of Canada’s most active gold camps.

Lithium: The Growth Upside

One commodity for stability. One for the battery boom.

The El Quemado project adds battery metals exposure without betting the entire company on it.

The El Quemado project adds battery metals exposure without betting the entire company on it.

Sitting in Argentina’s lithium triangle (the region producing much of the world’s lithium supply), El Quemado spans 8,000 hectares of lithium-rich pegmatites within a larger 58,000-hectare concession package. Rock samples have returned 1.05% to 2.02% lithium oxide. Additional critical minerals identified: niobium, tantalum, rare earth elements.

The district is considered one of Argentina’s most prospective pegmatite regions.

It’s early-stage. But it gives Golden Goose Resources dual-commodity exposure. Gold for proven value, lithium for growth potential.

The Opportunity at a Glance

Five FACTS that matter:

- Argentina Flagship: Channel samples up to 24 g/t Au across 10+ km of mapped epithermal gold veins at La Esperanza.

- Major Validation: Southern Copper holds ready-to-drill ground directly next to La Esperanza claims.

- Quebec Fresh Data: Phase 2 complete at Goldfire, adjacent to Gold Fields’ 4.1M oz Windfall. 170 samples at lab, results pending.

- Lithium Upside: 8,000 hectares of pegmatites returning up to 2.02% lithium oxide within 58,000 hectares of total concessions in the lithium triangle.

- Experienced Team: Leadership includes geologists with Ph.D.s, former investment bankers from RBC and BMO, and executives from major mining operations.

Stay Ahead of the Assays

Lab results from Quebec are coming. Argentina has proven high-grade intercepts. Lithium adds diversification.

The story is moving.

Click here to visit the company’s official website, to stay in touch with updates when assay results drop and exploration advances.

About Golden Goose Resources Corp.

Golden Goose Resources is a mineral exploration company focused on gold and lithium projects in Canada and Argentina. The company holds the Goldfire Project (4,680 hectares) in Quebec’s Windfall camp, the La Esperanza gold project (44,400 hectares) in Argentina, and a controlling interest in the El Quemado lithium project (58,000 hectares) in Argentina’s lithium triangle.

Ticker: CSE: GGR

Website: goldengooseresources.com

Contact: Dustin@Goldengooseresources.com | 1-587-577-9878

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). This article is is being distributed for Maynard Communications (“MAY”), who has been paid a fee for an advertising campaign. MIQ has not been paid a fee for Golden Goose Resources Corp. advertising or digital media, but expects to be paid a fee from (“MAY”). There may be 3rd parties who may have shares of Golden Goose Resources Corp, and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Golden Goose Resources Corp. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Golden Goose Resources Corp. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ has been approved by Golden Goose Resources Corp.; this is a paid advertisement, we currently own shares of Golden Goose Resources Corp. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES:

[1] https://goldengooseresources.com/la-esperanza-prospect

[2] https://www.thenewswire.com/preview?id=1LpMFQN01&key=6c1b4e

[3] https://www.goldfields.com/in-the-news-article.php?articleID=13791

[4] https://www.reuters.com/markets/deals/gold-fields-acquire-osisko-mining-about-16-bln-2024-08-12/

[5] https://www.goldfields.com/canada-operations.php

[6] https://www.thenewswire.com/preview?id=1LpMFQN01&key=6c1b4e