Schrödinger announced it will release its third quarter 2025 financial results on November 5, 2025, followed by a live webcast and conference call for investors.

The company has attracted increasing industry attention as a pioneer in applying artificial intelligence to accelerate drug discovery and reshape biotechnology innovation.

We’ll explore how recognition of Schrödinger’s AI leadership amid growing sector focus may influence its long-term investment outlook.

Schrödinger Investment Narrative Recap

To be a shareholder of Schrödinger, you need to believe the company’s AI-driven software can become essential to drug discovery, leading to scalable, recurring revenues and clinical milestones. The upcoming third quarter 2025 results announcement and investor call, while relevant for short-term sentiment, does not materially change the main near-term catalyst, new clinical data for SGR-1505, nor does it resolve the biggest risk of sluggish new client acquisition amid biotech sector headwinds.

The most closely related recent announcement is Schrödinger’s update on initial clinical results for SGR-1505, a MALT1 inhibitor, which showed early efficacy and received FDA Fast Track designation this June. This progress in the clinic positions SGR-1505 as a primary driver for milestone payments and licensing, supporting management’s focus on revenue growth from drug discovery and anchoring the short-term investment outlook.

However, investors should also be mindful that, in contrast to the excitement around new clinical milestones, ongoing challenges in expanding the customer base persist and…

Schrödinger’s narrative projects $396.6 million revenue and $34.8 million earnings by 2028. This requires 18.6% yearly revenue growth and a $216.1 million increase in earnings from the current level of -$181.3 million.

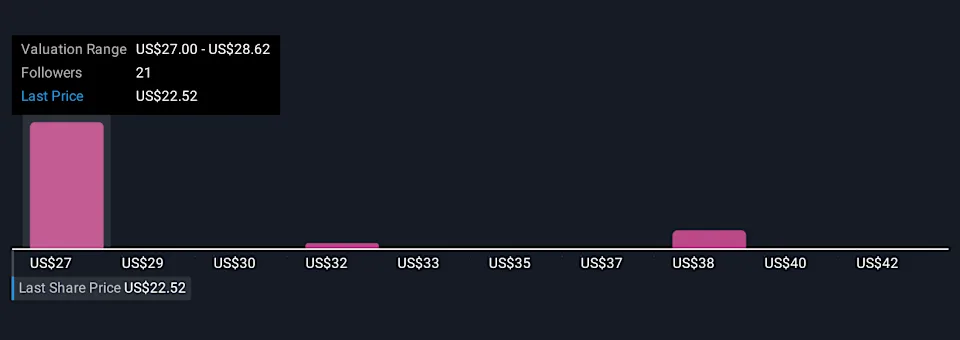

Uncover how Schrödinger’s forecasts yield a $27.30 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Six independent valuations from the Simply Wall St Community place fair value for Schrödinger between US$27.00 and US$43.20 per share. While some see upside, many remain focused on the risk that slow new client acquisition could constrain long-term revenue growth and influence market sentiment ahead of earnings; explore the range of outlooks shaping this debate.