Issued on behalf of CyberCatch Holdings, Inc.

With regulators turning up the heat, CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) offers one of the only AI-powered solutions built to keep small businesses contract-ready and compliant.

In small businesses across America, an urgent countdown is ticking.

Over a million U.S. businesses in certain segments that are the target of cyber attackers are now on the clock.[1]

Federal regulations now demand proof of cybersecurity readiness, such as in the defense, manufacturing and healthcare sectors.

Comply with new cyber rules or risk everything.

No contract. No business. Such as in the defense sector.

And most small and mid-sized businesses who are the majority in these sectors are NOT prepared.

They don’t have the staff.

They don’t have the tools.

And they don’t have time.

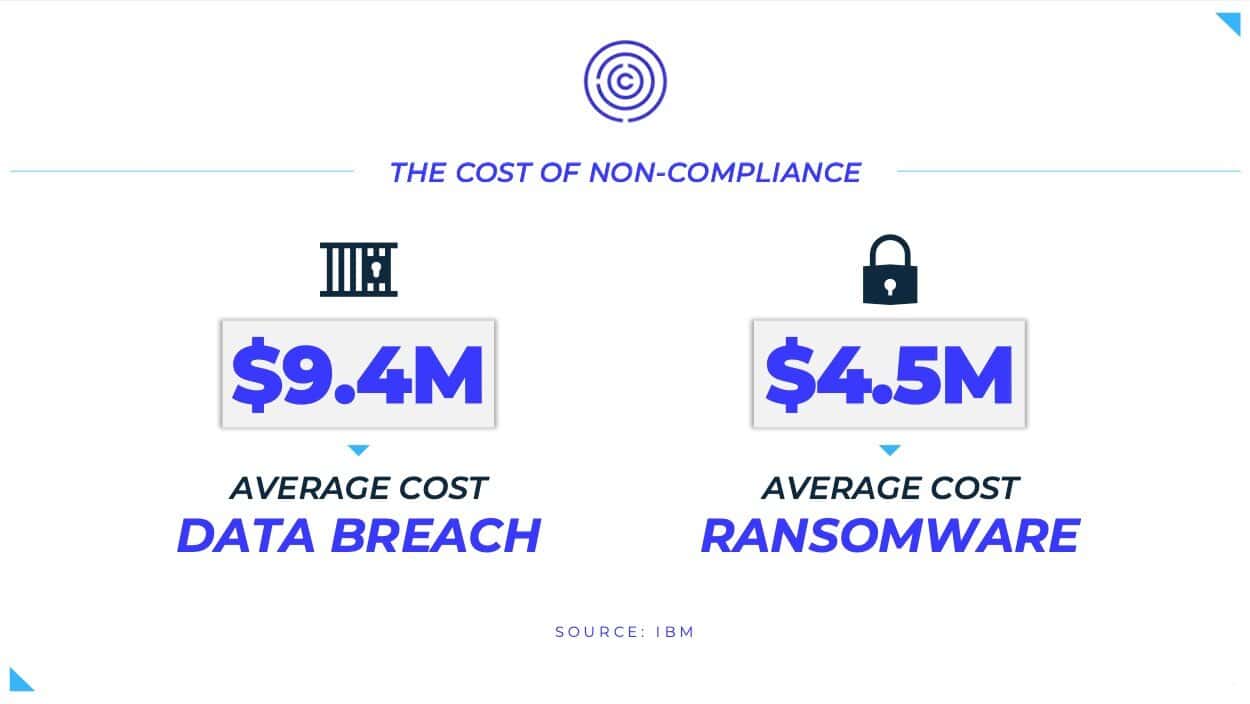

43% of all cyberattacks target companies just like these.

Only 14% are ready. [2]

And 60% are unable to recover from a ransomware attack and shut down permanently

That’s when a new kind of AI-powered solution steps in.

It benchmarks the defense in place and compares to compliance requirements. It guides how to quickly eliminate the gaps without breaking the bank. And attain full compliance and security. It then tests the defense and the cybersecurity controls so fixes can be made promptly and deficiencies eliminated. Then it provides no-application cyber insurance coverage at a discount for extra peace of mind for the small business.

No consultants. No delays. No costly surprises.

Because when fear meets regulation, the right solution doesn’t just sell.

It scales fast.

That’s exactly what’s happening now.

According to Fortune Business Insights, the cybersecurity solutions market for small and mid-sized businesses (SMBs) is forecast to hit $50.2 billion by 2030, growing at a 13.4% annual rate.[3]

This isn’t a someday story. The dollars are already moving — and one company is positioned at the center of it.

CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) was built for this moment.

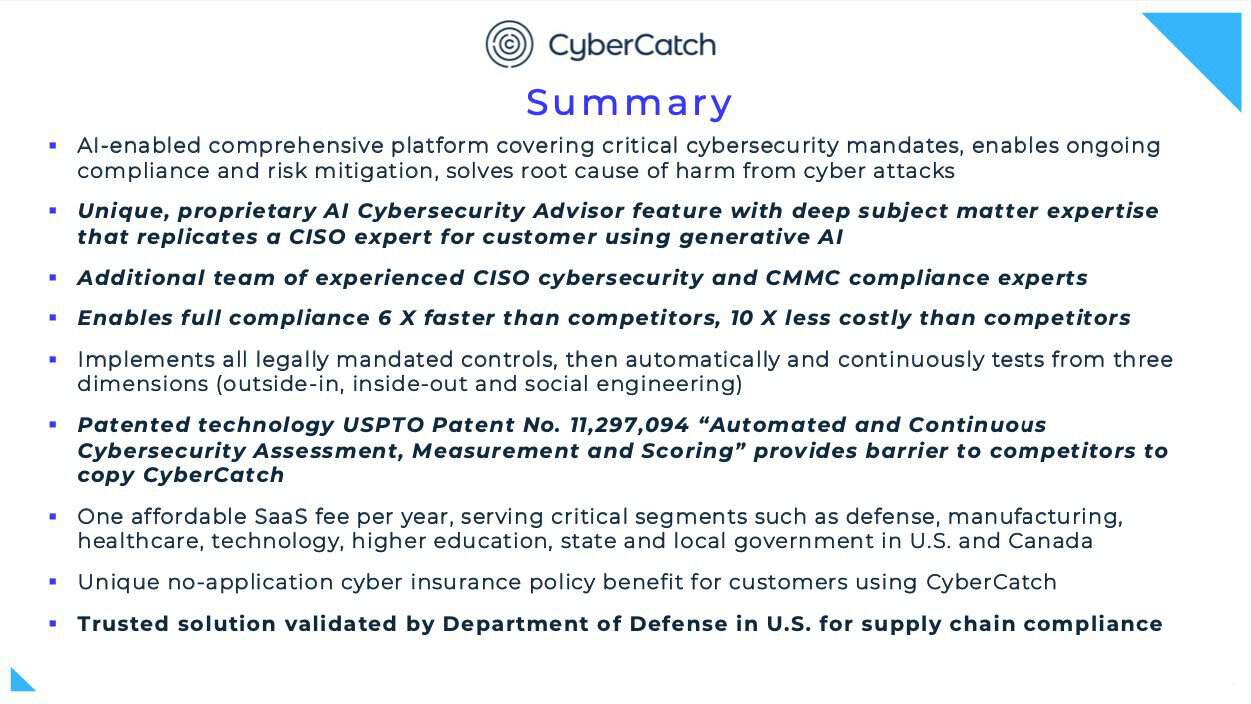

Founded by cybersecurity and compliance experts, CyberCatch delivers an end-to-end SaaS solution tailored for the exact pain points hitting small and mid-sized businesses.

Unlike piecemeal tools or expensive consultants, CyberCatch integrates continuous compliance, risk mitigation, vulnerability detection, controls testing, phishing defense, and awareness training into one seamless platform — fully automated and audit-ready.

The company has already deployed its technology across sectors where regulatory pressure is rising fast: healthcare, defense contracting, financial services, education, and manufacturing.

Its growth strategy is both sectoral and geographic, with customized compliance modules for cybersecurity requirements and frameworks such as CMMC, NIST 800-171, NIST CSF 2.0, HIPAA, HICP, FTC Safeguards, and emerging international standards across Canada, the EU, and beyond.

Recent partnerships such as with Startup Science and Learn.Net have positioned CyberCatch as a preferred vendor in critical verticals where compliance is no longer optional.

With a platform built to scale and a problem growing larger by the day, CyberCatch is stepping into a defining moment.

And for investors, this may be the part of the story where traction turns into value.

WHY INVEST?

Built for the Underserved Majority

CyberCatch focuses on small and mid-sized businesses — the segment facing the biggest compliance burden and the fewest effective solutions.

All-in-One AI Compliance Engine

The platform automates risk detection, employee training, and regulatory compliance in one seamless, self-guided system. No consultants. No complexity.

Patented Technology

CyberCatch’s unique platform technology solution comprised of automated and continuous cybersecurity compliance assessment, measurement and testing, is protected via patent from the USPTO.

Real-World Traction in Regulated Sectors

CyberCatch is already deployed in healthcare, defense, education, and finance — all industries where compliance isn’t optional.

Accepted in NVIDIA Inception Program

Acceptance into the NVIDIA Inception Program, an elite group of startup and early stage companies with exclusive benefits from NVIDIA, is a key milestone, as CyberCatch moves from using generative AI to using agentic AI and quantum computing to accelerate success.[4]

Strategic Sales Partnerships

Growing sales partnerships such as Learn.Net, and Startup Science — placing CyberCatch in position to accelerate sales via channel partnership, and more expected soon.

Early in a Multi-Billion-Dollar Shift

With cyber mandates tightening under CMMC, NIST 800-171, NIST CSF 2.0, HIPAA, HICP, and FTC Safeguards, CyberCatch is positioned at the leading edge of a market that’s about to break wide open.

NOW… With investor attention growing, it’s worth looking closer at what CyberCatch actually delivers — and how it differs from the pack.

The CyberCatch Advantage

CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) is not just another cyber tool. It is a full, cloud-based continuous compliance and cyber risk mitigation stack built for small and mid-sized businesses that lack time, staff, and deep budgets. One subscription covers every critical task.

|

Key Feature |

Why It Matters to SMBs |

| Cost-Savings Compliance | AI-powered, benchmarks to compliance mandates, identifies gaps and helps quickly eliminate non-compliance and attainment of cyber risk mitigation without breaking the bank. |

| Continuous Compliance and Risk Mitigation | Automated three-dimensional testing of the cybersecurity controls, outside-in, inside-out and social engineering. Flags weak spots, and walks users through quick, step-by-step fixes. |

| Employee Training | Automated phishing drills and bite-size lessons that turn staff from risk points into a first line of defense and competent human firewall. |

| AI-powered System Security Plan Builder | Generates clean, regulator-ready reports that match sector-specific templates automatically. |

| Instant Insurance Access | Pass the platform’s checks and receive no-application cyber insurance policy coverage on the spot, no long forms required, and save money with discounted premium. |

One platform. One bill. One login. Instead of juggling five vendors and five invoices, CyberCatch handles it all in a single, automated workflow that keeps businesses contract-ready and secure.

Early Traction and the Road Ahead

CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) is well past proof of concept. Regulated organizations are already relying on the platform to keep contracts, avoid fines, and stay online. Here are just a a couple of examples:

Defense Contracting

More than 221,00 suppliers to the Pentagon face the looming CMMC deadline. One software firm adopted CyberCatch, attained full compliance, closed open vulnerabilities, achieved early CMMC certification and won a multimillion-dollar DoD contract.

Education and Public Sector

A K–12 school district suffered a costly ransomware attack and immediately reached out to CyberCatch for help. In addition to expert guidance on full recovery, the CyberCatch solution quickly benchmarked and identified the non-compliance with NIST CSF 2.0 and the missing cybersecurity controls to prevent a recurrence of the ransomware attack.

Leadership with Policy and Industry Credibility

CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) is led by some of the most respected names in cybersecurity, compliance, and public-sector technology.

Founder, Chairman, and CEO Sai Huda previously led FIS’s risk, information security, and compliance business and co-authored Canada’s national cybersecurity standard. He’s also the author of Next Level Cybersecurity — a widely respected industry guidebook.

His leadership team includes former cybersecurity leaders from Allstate, Citigroup, FIS, and the U.S. Department of Defense. CyberCatch’s board is backed by notable figures such as Tom Ridge, the first U.S. Secretary of Homeland Security, and technology veterans from the Pentagon, DARPA, Gartner, and Ridge Global.

This leadership isn’t just for show. It reflects CyberCatch’s credibility with regulatory agencies and its traction in tightly governed markets like defense, healthcare, and financial services.

As a public issuer on both the TSX Venture and OTCQB exchanges, CyberCatch offers exposure to a high-growth segment with a fully regulated, transparent structure. And its patented platform — protected by U.S. Patent No. 11,297,094 — adds a further moat in a crowded space.

Investors looking for expert-led, small-cap exposure to cybersecurity and compliance may want to keep watching this ticker.

What Happens Next Could Define the Entire Sector

New mandates are coming into force.

Old systems are being pushed out.

And a wave of demand is rising — from the nearly one billion U.S. businesses needing to attain compliance and cyber risk mitigation.

CyberCatch Holdings, Inc. (TSXV: CYBE) (OTCQB: CYBHF) is positioned at the center of that shift — with a patented platform, seasoned leadership, and growing traction in some of the most regulated sectors in the economy.

For investors looking to stay ahead of the compliance curve, this may be the ticker to watch.

Visit www.cybercatch.com to explore the platform, meet the team, and track updates as this story unfolds.

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. This article is being distributed by USA News Group on behalf of Baystreet.ca Media Corp. (“BAY”). USA News Group is a wholy owned entity of Market IQ Media Group Inc. (“MIQ”). MIQ has not been paid a fee for the distribution of this article, but the owner of MIQ also co-owns BAY. BAY has been paid a fee for CyberCatch Holdings, Inc. advertising and digital media from Creative Digital Media Group (“CDMG”) (fifty five thousand dollars USD for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of CyberCatch Holdings, Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ/BAY does not own any shares of CyberCatch Holdings, Inc. but reserve the right to buy and sell, and will buy and sell shares of CyberCatch Holdings, Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ has been approved on behalf of CyberCatch Holdings, Inc. by CDMG; this is a paid advertisement, we currently own shares of CyberCatch Holdings, Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://www.uscybersecurity.net/csmag/cybersecurity-compliance-defending-your-small-business/

[2] https://www.sba.gov/blog/2023/2023-09/cyber-safety-tips-small-business-owners

[3] https://www.globenewswire.com/news-release/2025/06/13/3099071/0/en/Cybersecurity-Solutions-for-SMBs-Market-is-expected-to-triple-reaching-USD-70-billion-by-2034-Exactitude-Consultancy.html

[4] https://finance.yahoo.com/news/cybercatch-announces-acceptance-nvidia-inception-110000036.html