Nvidia (NVDA) reported its fourth quarter earnings after the bell on Wednesday, beating analysts’ expectations on the top and bottom lines and issuing solid Q1 guidance.

Nvidia’s stock was up as much as 2% on the news; near 6:00 p.m. ET, the stock was up closer to 0.7%.

Nvidia’s earnings come as the company girds itself for potential 25% tariffs on chips imported into the US and the threat of increased export controls on its shipments to China. The AI giant is also contending with the fallout from claims that Chinese startup DeepSeek developed its AI models using less powerful Nvidia chips than its US rivals, putting into question whether Big Tech companies are over-investing in AI.

For the quarter, Nvidia reported earnings per share (EPS) of $0.89 on revenue of $39.3 billion. Wall Street was expecting EPS of $0.84 on revenue of $38.2 billion. The company said it expects Q1 revenue of $43 billion plus or minus 2%, better than the $42.3 billion expected.

Data center revenue clocked in at $35.6 billion versus expectations of $34 billion in the quarter.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter,” CEO Jensen Huang said in a statement. “AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

According to Nvidia CFO Colette Kress, cloud service providers made up 50% of Nvidia’s data center revenue in the quarter. The company reported similar results in Q3.

The company’s Blackwell line of chips contributed billions in sales for the quarter, Kress said.

“We delivered $11.0 billion of Blackwell architecture revenue in the fourth quarter of fiscal 2025, the fastest product ramp in our company’s history.”

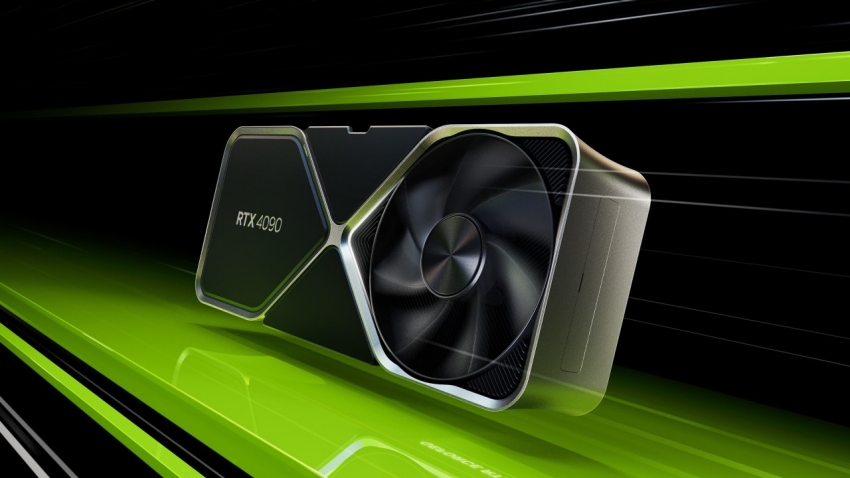

Nvidia’s gaming revenue, however, fell 11% year over year in Q4 due to supply constraints around its latest gaming chips.

Nvidia is the reigning champion of AI chips, and it’s not losing that crown anytime soon. Its chips are the envy of Silicon Valley and beyond, and its competitors are still far from overtaking its performance advantage.

Big Tech companies Amazon (AMZN), Google (GOOG, GOOGL), Meta (META), and Microsoft (MSFT) are spending billions of dollars building out their AI data centers, and a chunk of that is going straight to Nvidia.

But shares of those same companies are also struggling in the early months of 2025.

Google parent Alphabet is off more than 8% year to date, Amazon is down 2.5%, Microsoft has fallen 5.3%, and Apple (AAPL) has dropped more than 4%.

Meta is the sole outlier in the group, with shares up over 14%.

Huang also alluded to fears that DeepSeek’s AI models, which were developed using lower-powered Nvidia chips while still matching the performance of top US-made AI models, would hurt Nvidia’s sales.

“Demand for Blackwell is amazing as reasoning AI adds another scaling law — increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” he said.

Nvidia is staring down President Trump’s threat of 25% tariffs on chips imported into the US, which could force it to either raise prices or eat some of the cost of the tariffs, cutting into margins. Nvidia works with TSMC to build its processors, which produces many of those chips in Taiwan.

Trump has also threatened to put further export restrictions on Nvidia chips destined for China, which would cut into the company’s revenue from the region.

Wall Street has also raised concerns about the impact of Amazon, Google, Microsoft, and Meta using their own custom AI chips versus those developed by Nvidia. If those companies’ chips can match Nvidia’s in performance, the thinking goes, they’ll be less dependent on Nvidia’s offerings.

But Morgan Stanley Research analyst Joseph Moore cautioned overreacting to the potential of these ASICS, or application-specific integrated circuits.

“Spending time with 20-25 Nvidia alternatives over the years, most of which failed to get traction, we saw initial enthusiasm based on price and potential performance, which [brought] an initial deployment,” Moore wrote. “Then there is almost always a pull back to Nvidia, which has the most mature ecosystem, and the alternatives are put on hold, sometimes never to return.”

Google’s and Amazon’s chips have proven to be the exception to that rule so far, but Moore says Nvidia is still gaining share in the AI space.