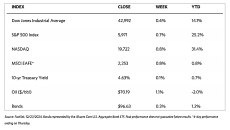

Stock Markets

Markets recovered some ground by the end of the week and chalked up some modest gains. The 30-stock Dow Jones Industrial Average (DJIA) added 0.35% while the Total Stock Market charted a 0.57% gain. The broad S&P 500 Index rose by 0.67% although the SmallCap 600 fell by 0.02%. The technology-heavy Nasdaq Stock Market Composite gained by 0.76%, and the NYSE Composite ticked up by 0.62%. The investor risk perception indicator, the CBOE Volatility Index (VIX) fell by 13.13% for the week.

The week was relatively quiet as the country celebrated the Christmas holiday. It began with a continuation of the preceding Friday’s move in a rally largely driven by large-cap growth stocks. The technology-heavy Nasdaq Composite led the way and the Russell 1000 Growth Index outpaced its value counterpart through Tuesday. However, the trend reversed midweek with the market’s closure on Wednesday, Christmas day, as most indexes declined in the days following where most of the early gains were returned.

U.S. Economy

The Conference Board reported on Monday that its index of U.S. consumer confidence fell to 104.7 in December from 112,8 in November. According to Dana M. Peterson, chief economist at the Conference Board, “The recent rebound in consumer confidence was not sustained in December as the Index dropped back to the middle of the range that has prevailed over the past two years.” The report stated that while the consumer assessments of both the present situation and expectations contributed to the overall decline, the expectations component of the index sustained the sharpest drop, falling by 12.6 points to 81.1. The expectations component measures consumers’ short-term outlook for income, business, and labor market conditions. A reading below 80 could signify an upcoming recession.

Also on Monday, a reading for durable goods orders for the month of November came in below consensus. In the past six months, this is the fourth time that new orders for durable goods declined, falling by 1.1% compared to consensus expectations for a rise of 0.2%. The November decline resulted from fewer orders for commercial aircraft and lower-than-expected defense spending. Also coming in slightly below consensus expectations are new home sales in November. The Census Bureau reported a seasonally adjusted annual pace of 664,000, as against expectations for 670,000. The November figure, however, was a notable improvement over the previous month which was negatively impacted by hurricanes in southeast US.

On Thursday, the Labor Department reported that applications for unemployment benefits fell slightly to 219,000 for the week ended December 21, its lowest level since mid-November, although continuing claims rose to 1.91 million for the prior week, the highest since late 2021. This is a signal that out-of-work individuals are taking longer to find new jobs.

Metals and Mining

The spot prices of precious metals hardly moved during the Christmas holiday week. Gold slid a hairline 0.06% down from its close last week at $2,622.91 to end this week at $2,621.40 per troy ounce. Silver ticked down by 0.44% from last week’s close at $29.52 to settle this week at $29.39 per troy ounce. Platinum edged 0.24% down from its closing price last week of $927.80 to close this week at $925.54 per troy ounce. Palladium slipped by 0.34% from its previous weekly close of $919.54 to its new weekly close of $916.38 per troy ounce. The three-month LME prices of base metals took modest steps up for the week. Copper came from its close last week of $8,883.00 and rose by 1.11% to settle this week at $8,982.00 per metric ton. Aluminum climbed by 2.03% from its previous weekly close of $2,507.00 to end this week at $2,558.00 per metric ton. Zinc added 2.17% to its previous closing price of $2,967.00 to end this week at $3,031.50 per metric ton. Tin settled 1.45% higher than last week’s closing price of $28,399.00 to end this week at $28,810.00 per metric ton.

Energy and Oil

Oil prices climbed this week on falling U.S. inventories and China’s stimulus outlook. Toward the end of the week, oil prices were gaining ground with WTI bouncing back above $70 and Brent trading at $73.72. After Beijing agreed to issue special treasury bonds worth roughly $411 billion, optimism surrounding China’s economic growth helped to spark bullish sentiment in markets this week. Expectations of a crude draw in the U.S. prompted prices to rise even further, with the EIA set to report at 13:00 EST due to a Christmas holiday delay.

Natural Gas

For the report week beginning Wednesday, December 11, and ending Wednesday, December 18, 2024, the Henry Hub spot price fell by $0.09 from $3.11 per million British thermal units (MMBtu) to $3.02/MMBtu. Concerning Henry Hub futures, the price of the January 2025 NYMEX contract was largely unchanged from $3.378/MMBtu to $3.374/MMBtu. The price of the 12-month strip averaging January 2025 through December 2025 futures contracts declined by $0.05 to $3.232/MMBtu. Natural gas spot prices fell at most locations this report week. Price changes ranged from a decrease of $6.88 at the Algonquin Citygate to an increase of $0.07 at the Waha Hub.

International natural gas futures prices decreased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $1.26/MMBtu to a weekly average of $13.78/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands decreased by $1.38/MMBtu to a weekly average of $12.73/MMBtu. In the week last year corresponding to this report week (beginning December 13 to December 20, 2023), the prices were $13.30/MMBtu in East Asia and $10.89/MMBtu at the TTF.

World Markets

Over the truncated holiday trading week, stocks in Europe moved higher with the STOXX 600 Index annexing 0.99% in local currency terms. Major regional indexes also realized gains, with France’s CAC 40 Index adding 1.11% and Germany’s DAX climbing by 0.50%. The only noteworthy economic news released this week was that of the UK’s Office for National Statistics. On Monday, the ONS announced that it was lowering its final estimate for third-quarter economic growth to 0.0% from 0.1%. Its revised estimate of second-quarter growth from 0.5% to 0.4%. The unexpected downward revisions added to investor concerns that the economy may have stalled even prior to the planned tax increases by the Labor government to meet budgetary requirements. On the same day as the ONS release, US President-elect Donald Trump announced on social media that the European Union (EU) should “make up their tremendous deficit with the US by the large-scale purchase of our oil and gas.” Failure to do so would result in tariffs imposed by the US on EU exports entering the country. Analysts believe that as the EU proceeds to wean itself off Russian supplies, it is likely to increase its purchases of U.S. energy exports.

Japan’s stock markets climbed this week with the Nikkei 225 Index ascending by 4.08% and the broader TOPIX Index gaining by 3.69%. The yen’s weakness lent support to the profit outlooks for Japan’s export-oriented industries, which remain near five-month lows due to cautions by the Bank of Japan (BoJ). From about JPY 156 to the USD at the end of the week prior, the yen lost some ground to about JPY 157 against the US dollar. The yield on the 10-year Japanese government bond increased to its highest level in five weeks 1.1%. If economic conditions continue to improve as expected, the central bank will need to hike interest rates again as stated by BoJ Governor Kazuo Ueda. In December, the Tokyo-are consumer price index (CPI) rose to an above-expected 3% year-on-year up from 2% in November. The core CPI (excluding volatile food and energy prices) increased by 2.4% from one year ago in December. This is slightly higher than the 2.2% increase of the prior month. Tokyo prices, which have been hovering around the BoJ’s 2% inflation target, are viewed as a leading indicator of trends nationwide. Japan’s November activity data painted a mixed picture of the economy. Industrial production dipped by 2.3%, lower than October’s 2.8% but higher than estimates of a 3.5% decline. However, retail sales were optimistic, rising by a better-than-expected 1.8% in November and speeding up from October’s 0.1% increase. The 2.5% unemployment rate remained unchanged, as forecasted.

Amid hopes that the government will announce further stimulus measures to support economic growth, the Chinese stock markets climbed this week. The Shanghai Composite Index gained by 0.95% and the blue-chip CSI 300 added 1.36%. The Hong Kong benchmark Hang Seng Index ascended by 1.87% this holiday-shortened week. Markets were closed for Christmas and Boxing Day, which fell on Wednesday and Thursday respectively. The lending rate was unchanged at 2% as the People’s Bank of China injected RMB 300 billion into the banking system via its medium-term lending facility. RMB 1.45 trillion in loans are due to expire in December. Thus, the operation will result in a net withdrawal of RMB 1.15 trillion from the banking system. This will be the largest liquidity drain via the one-year lending facility since 2014. With respect to manufacturing, profits at industrial firms fell by 7.3% in November according to reports by the National Bureau of Statistics. The November decrease is the fourth consecutive monthly decline, although it is slower than the 10% year-on-year October drop. Although the slower decline follows Beijing’s extensive stimulus measures, it shows that the policies have yet to stop the decline in corporate earnings, which are under pressure from deflation in China over the last year.

The Week Ahead

The ISM manufacturing PMI and housing price data are among the important economic releases in the coming week.

Key Topics to Watch

- Chicago Business Barometer (PMI) for Dec.

- Pending home sales for Nov.

- S&P Case-Shiller home price index (20 cities) for Nov.

- Initial jobless claims for Dec. 28

- Construction spending for Nov.

- ISM manufacturing for Dec.

Markets Index Wrap-Up