Careem Pay has rolled out a new service enabling UAE-based Lebanese residents to send money back home, following a partnership with Lebanon’s Purpl digital wallet.

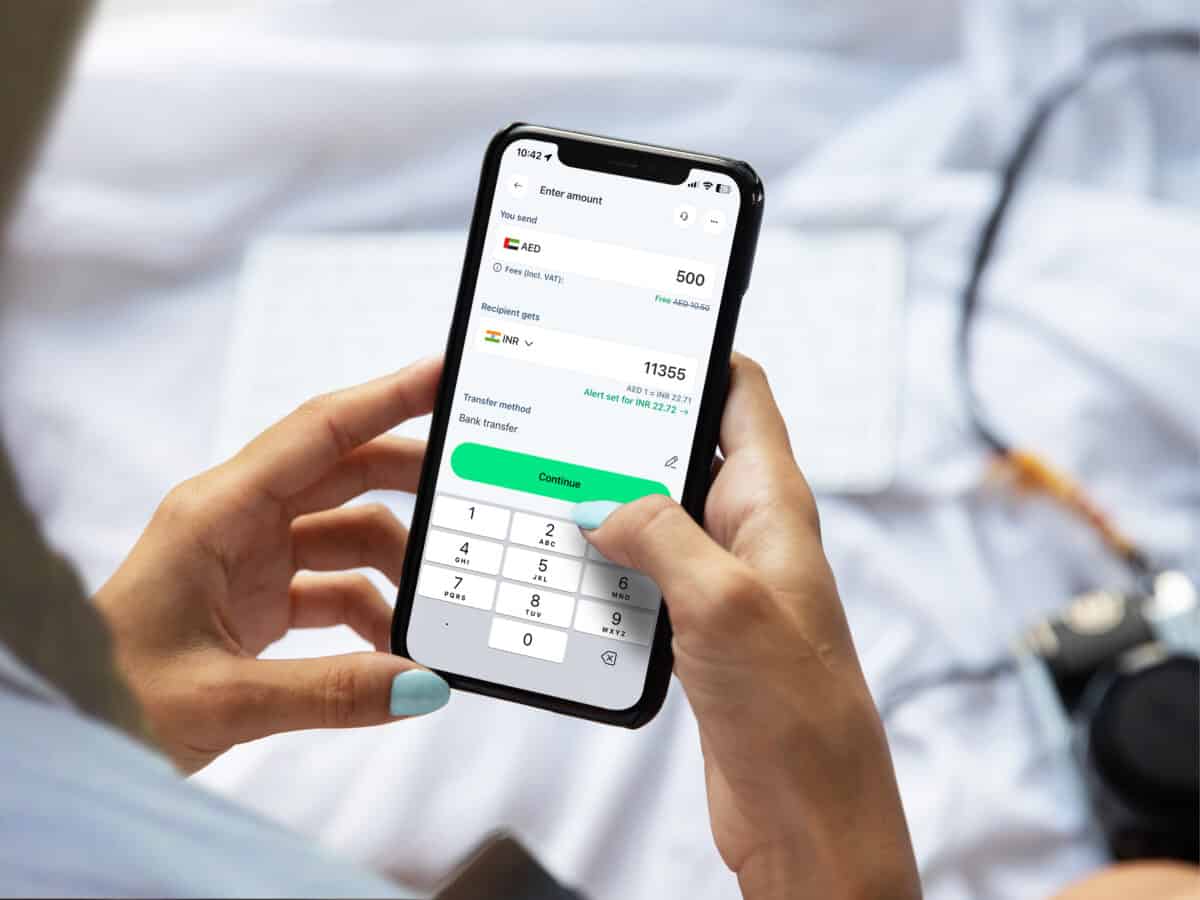

The remittance solution enables users to send transfers from AED into USD directly to mobile numbers connected to a Purpl wallet, circumventing the need for a traditional bank account.

The service features sending fees of up to 1.5 per cent. Recipients can access their funds through Banque Libano-Francaise (BLF) ATMs without any withdrawal fees, or at OMT (online money transfer) stores with a minimal fee of 0.5 per cent. The companies claim that the transfers typically complete in about 15 minutes.

“We’re pleased to help make it easier for the Lebanese community in the UAE to transfer money to loved ones during such a challenging year,” said Mo Elsaadi, VP of Careem Pay. “Our partnership with Purpl enables us to provide a fast, reliable, and inclusive solution for sending money home when it’s needed most.”

Wissam Ghorra, co-founder and CEO at Purpl, also added: “After all the challenges Lebanon faced in 2024, once again, the lebanese diaspora showed tremendous support to Lebanon and showed how important these resources are for the country.

“We at Purpl want to put all our capabilities to facilitate these transactions to Lebanon, and we are deeply convinced that this partnership with Careem will help us reach that.”

Careem Pay launched its remittance service in 2023 and now offers instant transfers to India, Pakistan, the Philippines, the UK as well as Europe. Its referral programme for remittance users enables new customers who send money abroad through a referral link to receive up to AED 2,000 credited to their Careem Pay wallet.