Bitcoin Set for Blast-off — It’s Time to Buy, Says Kiyosaki

Robert Kiyosaki, author of Rich Dad Poor Dad, has once again voiced strong opinions on financial markets, predicting both dramatic downturns and potential investment opportunities for those prepared. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

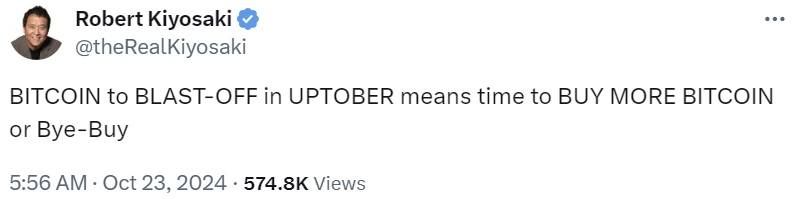

Kiyosaki advised his 2.6 million followers on the social media platform X Wednesday to consider investing in bitcoin, predicting a “blast-off” in prices during what he termed “Uptober” and suggesting it may be an ideal time to buy.

The day before, he emphasized the potential in silver, encouraging investment “before it hits $50.00.” His longtime advocacy of precious metals and bitcoin reflects his broader belief in hard assets as defenses against economic instability.

The famous author has warned of an impending market catastrophe, calling it “The Everything Bubble,” which he argues could soon give way to “The Everything Crash.” He believes this impending collapse will encompass major assets, including gold, silver, and bitcoin, with a subsequent global depression. He expects “the prepared” will be able to capitalize on the aftermath, stating: “I plan on being one of the prepared … I plan on becoming even richer… and I want you to become richer too.”

Kiyosaki also recently reiterated his long-term forecast for bitcoin, suggesting it might dip to $5,000 during a crash but ultimately skyrocket, potentially reaching $100,000 to $250,000 per coin, and even up to $1 million by 2030. Citing Jim Rickards’ upcoming book, Money GPT, Kiyosaki noted Rickards’ warnings about artificial intelligence (AI) exacerbating financial instability, suggesting that bitcoin could benefit as people increasingly turn to alternative assets. Despite the risks, Kiyosaki’s message encourages proactive financial planning, advising followers to study, join investment groups, and look for future growth opportunities.