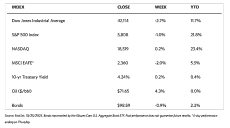

Stock Markets

The major indexes ended lower this past week as rising bond yields attracted investors’ attention. The 30-stock Dow Jones Industrial Average (DJIA) lost 2.68% while the Total Stock Market Index fell by 1.15%. The broad S&P 500 Index lost 0.96% while the NYSE Composite Index gave up 2.16%. The only major index that managed to end in positive territory was the technology-heavy Nasdaq Stock Market Composite which advanced by 0.16% for the week. Investor risk perception, as indicated by the CBOE Volatility Index (VIX), was elevated by 12.76%.

After posting gains in each of the six previous weeks, the S&P 500 corrected this week. The stock market appeared to take cues from the U.S. Treasury market, where the futures market pricing currently reflects a shallower Fed rate-cutting cycle. Growth stocks outperformed value stocks as evidenced by the slight gain in the technology-heavy Nasdaq Composite Index. Tesla was the best performer in the S&P 500, posting unexpectedly strong quarterly earnings and projecting 20% to 30% vehicle sales growth in 2025. The electric vehicle manufacturer experienced its best gain (22%) in more than 11 years, driven by good quarterly results and a bright outlook.

U.S. Economy

The Fed’s Beige Book, which is released eight times a year and provides a summary of economic conditions in each Fed region, was issued in a relatively light week of economic news. This latest release reported little economic growth across most of the U.S., tepidly stating that the demand for workers “eased somewhat” while “inflation continued to moderate.” The Book’s assessment of the economic developments did not have a noticeable effect in stopping the increase in longer-term Treasury yields that began in late September. The market’s expectations for Fed rate cuts have steadily declined, now reaching a total of 125 basis points of easing in the next 12 months on Friday.

Metals and Mining

The spot prices of precious metals ended positive for the week. Gold closed at $2,747.56 per troy ounce, up by 0.96% from its close last week at $2,721.46. Silver ended at $33.72 per troy ounce, unchanged from its close last week. Platinum last traded this week at $1,025.29 per troy ounce, 0.98% higher than last week’s closing price of $1,015.31. Palladium closed this week at $1,196.50 per troy ounce, 10.37% more than its close one week ago at $1,084.09. The three-month LME prices of industrial minerals were mixed. Copper closed this week at $9,602.50 per metric ton, 0.24% below its previous weekly close of $9,625.50. Aluminum’s last trade was at $2,677.50 per metric ton, 2.51% higher than its last traded price one week ago at $2,612.00. Zinc ended this week at $3,102.00, 0.40% higher than its prior week’s close at $3,089.50. Tin ended this week at $31,325.00 per metric ton, 0.04% higher than its last weekly close at $31,313.00.

Energy and Oil

The Israel-Iran conflict just advanced into its next phase with the retaliatory missile attack overnight that Israel launched into Iranian territory. Its impact on the main oil market narrative for October is still to be seen. Added to that is the speculation regarding the results of the U.S. presidential election, which is just slightly more than a week away, and how it would impact future escalation scenarios. In the meantime, Brent and WTI are expected to post only minor week-over-week increases as they trend around $75 and $71 per barrel respectively. The upside is limited by a stronger dollar and a larger-than-expected U.S. inventory spike. In other industry news, the top executives of Enterprise Products and Plains All American announced that they would not be building any new crude oil pipeline out of the Permian shale play. They believe that the next step for crude evacuation capacity would be optimization,

Natural Gas

For the report week from Wednesday, October 16 to Wednesday, October 23, 2024, the Henry Hub spot price declined by $0.30 from $2.21 per million British thermal units (MMBtu) to $1.91/MMBtu. Regarding Henry Hub futures, the price of the November 2024 NYMEX contract decreased by $0.03, from $2.367/MMBtu at the start of the report week to $2.342/MMBtu at the week’s end. The price of the 12-month strip averaging November 2024 through October 2025 futures contracts rose by $0.03 to $2.971/MMBtu. Regional natural gas spot prices fell at most major pricing locations this report week. Price changes ranged from a decrease of $1.17 at PG&E Citygate to an increase of $0.11 at the Houston Ship Channel.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.28 to a weekly average of $13.45/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, Europe’s most liquid natural gas market, decreased by $0.04 to a weekly average of $12.75/MMBtu. In the week last year that corresponds to this report week (beginning October 18 and ending October 25, 2023), the prices were $18.21/MMBtu in East Asia and $15.65/MMBtu at the TTF.

World Markets

European stocks modestly declined on expectations that the Federal Reserve may ease monetary policy more gradually than expected. The pan-European STOXX Europe 600 Index ended 1.18% lower in local currency terms. The major European stock indexes also lost ground. France’s CAC 40 Index lost by 1.52%, Italy’s FTSE MIB slid by 1.22%, and Germany’s DAX dipped by 0.99%. The UK’s FTSE 100 Index gave back 1.31%. Business activity continued to contract in the euro area in October as new orders continued to dwindle, according to S&P Global. The composite Purchasing Managers’ Index (PMI), which combines activity in the manufacturing and services sectors, is estimated to register 49.7 in October compared to its September estimate of 49.6. While it is a slight improvement, the PMI readings below 50 indicate contraction, and failure of the PMI reading to break above 50 signals a failure to attain expansion. The main sources of weakness were France and Germany, the two largest economies. Several European Central Bank (ECB) policymakers, including those formerly in favor of aggressive policies, broached the likelihood of more policy easing this year, although there is some disagreement regarding the pace at which rate cuts should be applied.

Japanese equities lost traction over the week amid uncertainty over the outcome of the country’s general election on Sunday, October 27. The Nikkei 225 Index gave up 2.74% while the broader TOPIX Index fell by 2.63%. The yen weakened to the high end of the JPY 151 range against the greenback, from JPY 149.5 at the end of the preceding week, mainly due to the heightened investor caution ahead of the elections. The yen also succumbed to some pressure from a strengthening dollar as investors discounted the prospect that the Federal Reserve was less likely to aggressively reduce interest rates. The Tokyo-area core consumer price index (CPI) rose by 1.8% year-on-year in October. This CPI is a leading indicator of nationwide inflation, and it rose slightly more than expected but slowing from the September 2.0% level. The slowdown was attributed to the reinstatement of electricity and gas subsidies. Bank of Japan (BoJ) Governor Kazuo Ueda urged the need to proceed cautiously due to the huge uncertainty and to avoid entertaining expectations that interest rates are going to stay low for a very long time.

Chinese stocks rose for the week as the central bank implemented more stimulus measures to support the economy. The Shanghai Composite Index gained by 1.17% while the blue-chip CSI 300 advanced by 0.79%. The Hong Kong benchmark Hang Seng Index fell by 1.03%. In line with a broad stimulus package unveiled by the People’s Bank of China (PBOC) in late September aimed at reviving China’s economy, Chinese banks lowered their one- and five-year loan prime rates by 25 basis points to 3.1% and 3.6% respectively to make it cheaper for consumers to take out mortgages and other loans. The PBOC also signaled additional easing measures in the short term. Depending on liquidity conditions, it made possible that another potential rate cut to the reserve requirement ratio may be taken. The central bank last cut the reserve requirement ratio by 50 basis points on September 27. The Chinese youth unemployment rate, for 16- to 24-year-olds, excluding students, eased to 17.6% in September from a record high of 18.8% in August. The August unemployment rate marked the highest level of youth unemployment since the statistics bureau stopped including students in the metric in December 2023.

The Week Ahead

Included among the economic releases scheduled for this week are the PCE inflation data, the third quarter GDP, and the nonfarm payrolls report for October.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities) for Sep.

- Consumer confidence for Oct.

- Job openings for Sept.

- ADP employment for Oct.

- GDP for Q3

- Advanced U.S. trade balance in goods for Sept.

- Advanced retail inventories for Sept.

- Advanced wholesale inventories for Sept.

- Pending home sales for Sept.

- Personal income for Oct.

- Personal spending for Oct.

- PCE index for Oct.

- PCE (year-over-year)

- Core PCE index for Oct.

- Core PCE (year-over-year)

- Initial jobless claims for Oct. 26

- U.S. employment cost index for Q3

- Chicago PMI for Oct.

- U.S. employment report for Oct.

- U.S. unemployment rate for Oct.

- U.S. hourly wages for Oct.

- Hourly wages year over year

- S&P final U.S. manufacturing PMI for Oct.

- Construction spending for Sept.

- ISM manufacturing for Oct.

- Auto sales for Oct.

Markets Index Wrap-Up