The digital payments market in Israel is on the verge of a significant transformation, with major changes expected to take effect in the coming year. New and refreshing payment options will allow consumers to pay quickly and easily, saving both time and money. V-Check, a leading Israeli fintech company headed by CEO Kobi Ram, is at the forefront of this innovation, offering advanced solutions for businesses and consumers alike.

One of the most notable upcoming changes is the ability to store funds directly in payment apps, similar to a digital wallet. Additionally, users will soon be able to transfer funds between different payment apps, simplifying financial management and fostering competition among various payment methods. V-Check, which already offers digital checks as an alternative to traditional paper checks, is expected to expand its services to include these new features.

Another exciting development is the ability to pay directly from a bank account via mobile phone, without the need for a credit card. Israel’s “instant payments” technology, developed by the Bank of Israel, will enable immediate and secure payments to businesses, eliminating the credit card processing fees. V-Check will also offer this service, providing its customers with a fast and efficient payment experience.

Kobi Ram, CEO of V-Check, notes that these changes stem from regulatory efforts to open the banking and payments market to competition. “Today, consumers are looking for flexibility and choice, alongside competition, innovation, and cost reduction,” Ram says. “The upcoming changes will allow businesses to offer more payment options to their customers, save on costs, and create healthy market competition.”

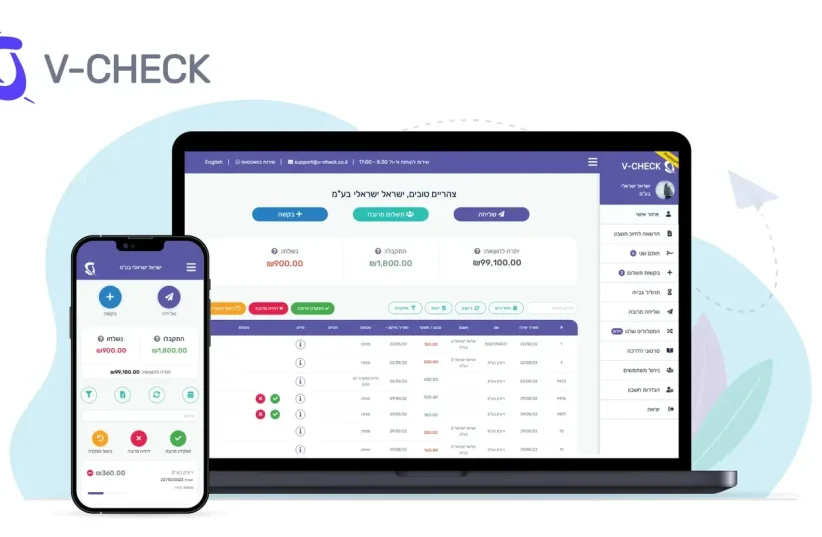

With over 30,000 business and private customers, V-Check is leading the digital revolution in the payments market. The company offers a user-friendly platform that allows small and medium-sized businesses to enjoy the benefits of digital payments without unnecessary complications. “We are witnessing a significant shift in the market’s willingness to adopt digital payment methods,” Ram says. “Digital tools offer a personalized payment experience, make it easier for consumers, and help businesses operate more efficiently.”