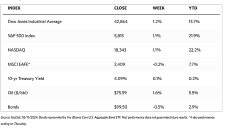

Stock Markets

The bull market continues as major indices rose through this week. The 30-stock Dow Jones Industrial Average (DJIA) added 1.21% while the Total Stock Market Index gained 1.17%. The broad S&P 500 likewise climbed by 1.11% and the technology-heavy Nasdaq Stock Market Composite rose by 1.13%. The NYSE Composite inched up by 0.88% and the Russell 1000, 2000, and 3,000 all ended higher for the week. The CBOE Volatility Index, the indicator of investor risk perception, rose by 6.51%.

This past week marks the two-year anniversary of the present bull market during which time stocks gained around 60%. Historically, returns tend to moderate as bull markets make it to the end of the third year. This may likewise happen with this bull market since fundamental conditions remain strong but are tending to slow down. The Federal Reserve is expected to continue with its easing campaign even though September inflation came in slightly hotter than expected. It is more likely that quarter-point rate cuts will be decided on at each meeting until the Fed policy approaches 3% 5o 3.5%. However, earnings will have to push any future market gains since valuation have limited room to increase further. Signs of earnings broadening are expected to become evident as the third quarter season kicks off.

U.S. Economy

There has been several disappointing economic news over the weekend. The Labor Department reported on Thursday some modest some upside movements in headline and core (excluding food and energy) inflation which rose in September by 0.2% and 0.3% respectively, both slightly above expectations. Core prices rose by 3.3% year-over-year in September compared to 3.2% in August, the first increase since March 2023. Medical care (up 0.7%) and transportation (up 1.4%) services registered sharp increases in their seasonally-adjusted prices, which offset a 1.9% drop in energy prices.

The Labor Department also reported on Thursday a surprise jump in weekly jobless claims to its highest level in 14 months at 258,000. Partly to blame were disruptions by Hurricane Helene, however, Michigan also recorded substantial job losses. Continuing claims also rose to 1.86 million, their highest level since late July. This may have influenced the University of Michigan’s preliminary gauge of consumer sentiment in October which declined unexpectedly as respondents to the survey expressed greater caution about their personal finances.

The surprise increase in consumer inflation led to a significant change in expectations about the Fed’s next policy meeting in November. The futures market ended the week pricing in a respectable 14.1% likelihood that the Fed will hold rates steady. Minutes from the Fed’s October meeting, which were released on Wednesday, likewise revealed that some members favored on a 25-basis-point rate cut, compared to a 50-basis-point cut.

Metals and Mining

Gold’s price action continues to remain bullish despite being mostly ignored by generalist investors. Shallow corrections are consistently bought resulting in the yellow metal continuing to defy the odds. According to analysts, gold investors are justified in taking profits as expectations around the monetary policy actions of the Federal Reserve continue to vacillate. Last Friday, the market’s expectation of a 50-basis-point cut next month was dramatically doused by a stellar jobs report. This week, it was reported that consumer inflation rose more than expected as the core Consumer Price Index increased by 3.2% year-on-year, causing monetary policy doves to take another hit. Despite the hawkish news, analysts have noted that the gold market is delinking from single monetary policy decisions and growing much bigger. While a 50-basis-point but remains out of the question, it is evident the Fed will continue to ease interest rates even if the inflation rate remains high.

The spot prices of precious metals ended mixed week-on-week. Gold rose by 0.11% from last week’s close at $2,653.60 to this week’s close at $2,656.59 per troy ounce. Silver ended 2.05% lower from its last traded price of $32.20 one week ago to its last traded price this week at $31.54 per troy ounce. Platinum lost 0.48% from its close last week at $992.55 to its close this week at $987.76 per troy ounce. Palladium surged by 5.73% from its ending price last week at $1,013.11 to its ending price this week at $1,071.21. The three-month LME prices of base metals have mostly come down. Copper, which closed last week at $9,866.00, ended this week at $9,723.00 per metric ton for a loss of 1.45%. Aluminum, which ended at $2,629.00 the prior week, ended this week at $2,586.00 per metric ton for a decline of 1.64%. Zinc settled this week at $3,086.50 per metric ton, 1.20% lower than last week’s closing price of $3,124.00. Tin closed this week at $32,817.00 per metric ton, 2.65% below last week’s close at $33,709.00.

Energy and Oil

Brent futures were nudged lower by some of the disappointment that an Israeli retaliatory strike on Iran, which the market anticipated all week, failed to materialize. Brent futures settled this week just below the $79-per-barrel mark. The oil-related impacts of Hurricane Milton were relatively minor despite the devastation the storm wreaked on Florida. Macroeconomics played a more robust role in influencing prices this week, particularly on the back of U.S. inflation dipping to an annual rate of 2.4%. In other parts of the world, A UK oil major signaled a $500 million decline in refining margins and a weak performance from oil trading into its third-quarter earnings. Its rival company Shell quantified the decline in refining margins at 30% quarter-on-quarter, down to $5.5 per barrel compared to $7.7 per barrel in the second quarter.

Natural Gas

For the report week from Wednesday, October 2, to Wednesday, October 9, 2024, the Henry Hub spot price fell by $0.34, from $2.76 per million British thermal units (MMBtu) to $2.42/MMBtu. Regarding Henry Hub futures, the price of the November 2024 NYMEX contract decreased by $0.23, from $2.886/MMBtu at the start of the report week to $2.660/MMBtu by the week’s end. The price of the 12-month strip averaging November 2024 through October 2025 futures contracts declined by $0.12 to $3.130/MMBtu.

Concerning regional markets, natural gas spot price changes were mixed this report week. Prices rose in the Northeast but fell in most other major pricing locations. Price changes ranged from a decrease of $2.64 at the Wahu Hub to an increase of $0.48 at Algonquin Citygate.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.06 to a weekly average of $13.10/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands increased by $0.20 to a weekly average of $12.78/MMBtu. In the week last year that corresponds to this report week (from October 4 to October 11, 2023) the prices were $14.18/MMBtu in East Asia and $13.28/MMBtu at the TTF.

World Markets

European equities were up, albeit modestly, for the week as the pan-European STOXX Europe 600 Index closed 0/66%. The market continued to hope that the European Central Bank (ECB) would proceed more quickly to cut interest rates and that China is set to enhance its economic stimulus, The major continental stock indexes were elevated as Italy’s FTSE MIB added 2.13%, Germany’s DAX rose by 1.32%, and France’s CAC 40 Index gained by 0.48%. However, the UK’s FTSE 100 Index lost by 0.33%. More ECB officials foresee that inflation may slow closer to the 2% target by the end of 2024, as indicated in the minutes from the September meeting. If incoming inflation data points align with the ECB’s projections, the central bank noted that a gradual reduction of borrowing costs would be appropriate. Nevertheless, policymakers refuse to commit to a particular rate path, although based on recent comments from ECB officials, they appeared to align with the market’s view that the pace of policy easing could quicken if inflation slows and the economy weakens.

Japanese stock indexes climbed over the week. The Nikkei 225 rose by 2.45% while the broader TOPIX Index gained by 0.45%, largely due to the weakness in the yen that provided a favorable profit outlook for Japanese exporters. The exchange rate floated close to its lowest level since August at about the high JPY 148 level against the US dollar. Earlier this month, the new prime minister, Shigeru Ishiba, brought the yen came under pressure when he cautioned that the environment is not ready for another interest rate hike. The 10-year Japanese government bond (JGB) yields rose in tandem with U.S. Treasury yields. Investors’ expectations around the likelihood of another aggressive (50-basis-point) rate cut by the Federal Reserve in November moderated. From 0.87% at the end of the prior week, the yield on the 10-year JGB rose to 0.94%. Regarding its economy, Japan’s real wages (wages adjusted for inflation) fell by 0.6% year-on-year in August. The first decline in three months was brought about partly due to the diminishing impact of higher bonuses paid in the preceding two months. However, since the positive cycle wherein rising wages boost consumer spending has not yet come about, the sluggishness in the pay trend could lend some support to the view that the Bank of Japan (BoJ) may avoid raising interest rates again anytime soon. While the August household spending declined by 1.9% year-on-year, the drop was less than the consensus forecast of 2.6%.

During the holiday-shortened week, Chinese equities fell as optimism about the most recent stimulus measure faded. The Shanghai Composite Index lost by 3.56% and the blue-chip CSI 300 shed 3.25%. The Hong Kong benchmark Hang Seng Index gave up 6.53%. The markets in the mainland were closed on Monday for the National Day holiday that started on Tuesday, October 1. At a press conference on Tuesday, the country’s economic planning agency, the National Development and Reform Commission, announced that China would speed up countercyclical measures to support growth. The announcement reiterated for the most part plans to boost investment and increase direct support to low-income groups and fresh graduates. Towards this end, the central government will continue ultra-long special bonds in 2025 for the purpose of funding major projects. Officials stated that Beijing will invest RMB 100 billion in strategic areas. In the meantime, over the long holiday that ended on Monday, spending by Chinese consumers failed to rise to pre-pandemic levels. Spending increased by 6.3% year-on-year while passenger traffic rose by 5.9%. Box office sales amounted to RMB 2.1 billion, lower than the RMB 2.7 billion reported last year. However, the average spending per trip was roughly RMB 131, which was higher than the RMB 113 recorded during the five-day Labor Day in May.

The Week Ahead

The CPI inflation data, import price index data, and an analysis of consumer sentiment are among the important economic releases this coming week.

Key Topics to Watch

- Columbus Day holiday. Bond market closed. (October 14)

- Federal Reserve Governor Christopher Waller speaks (October 14)

- Empire State manufacturing survey for Oct.

- Fed Governor Adriana Kugler speaks (October 15)

- Import price index for Sept.

- Import price index minus fuel for Sept.

- Initial jobless claims for Oct. 12

- S. retail sales for Sept.

- Retail sales minus autos for Sept.

- Industrial production for Sept.

- Capacity utilization for Sept.

- Business inventories for Aug.

- Home builder confidence index for Oct.

- Housing starts for Sept.

- Building permits for Sept.

- Federal Reserve Governor Christopher Waller speaks (October 18)

Markets Index Wrap-Up