ISSUED ON BEHALF OF YUKON METALS CORP.

Poised to help unlock the Yukon’s untapped mineral wealth, Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) is advancing its copper, silver, and gold projects in one of the world’s most promising and underexplored mining regions.

Untapped potential—it’s the phrase that investors dream about. And when it comes to the Yukon, it’s more than just a catchphrase.

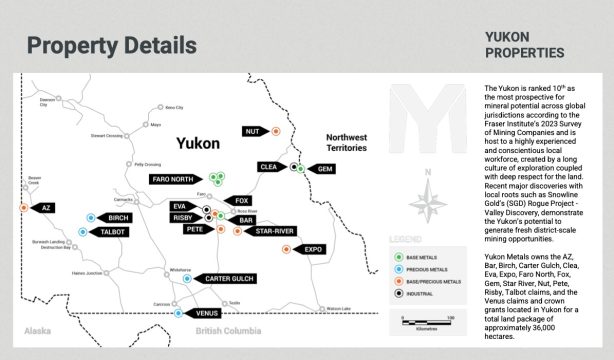

Sitting on one of the world’s most mineral-rich regions, the Yukon boasts over 2,700 known mineral occurrences and more than 80 deposits with established reserves.[1]

This vast, untapped wealth includes copper, silver, and gold—three metals essential for everything from being an economic safe haven[2] to clean energy[3],[4] electronics[5],[6] and global infrastructure[7],[8].

Gold, Silver, and Copper

The mining world is watching closely. Why? Because despite its geological riches, only about 3.6% of Yukon’s land is under mining claims[9]. There’s a lot of ground left to explore.

And with the Yukon Grid Connect project underway, providing the critical infrastructure for new discoveries to come online, the region is primed for a breakthrough.[10],[11]

Investors are flocking to this opportunity. Big players in the mining space know that when you mix a highly prospective region with growing global demand for copper, silver, and gold, you get a recipe for success.

Gold prices are breaking records[12], and silver is showing strength, hitting a 10-year high above $32.50[13]. This has led to speculation that mergers and acquisitions (M&A) in the mining industry are about to ramp up[14].

The Yukon’s untapped mining potential, combined with the increasing demand for these three metals, positions it as a hotbed for future mining opportunities.

But the real question is, who will lead the charge in unlocking this untapped potential?

Meet Yukon Metals Corp. (CSE:YMC) (OTCQB: YMMCF): Positioned to capitalize on the demand for gold, silver, and copper with a portfolio of high-potential projects in the Yukon.

This is where Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) comes in. Positioned at the heart of this mineral-rich territory, YMC is set to capitalize on the growing demand with its diverse portfolio of copper, gold, and silver assets.

With multiple high-potential projects across the Yukon, YMC’s portfolio is like a treasure map waiting to be fully uncovered.

The Star River project, known for its bonanza-grade gold and silver, sits at the center of their exploration efforts. Meanwhile, the Birch Property offers rich copper and gold zones that could become crucial as the world moves deeper into electrification. And that’s not all—AZ, Expo, and Fairway round out YMC’s impressive collection of mineral-rich properties, each offering unique opportunities to tap into the Yukon’s untapped wealth.

But what makes YMC truly exciting is that they’re not just sitting on potential—they’re actively unlocking it. With exploration underway and promising results already coming in, the groundwork for success is being laid.

Curious about these assets? Keep reading to discover why Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) is positioned to be a key exploration player in helping the Yukon move into the next phase of its mining boom—and why investors who get in now could see significant upside as the story unfolds.

Top 7 Highlights Showing

Why Yukon Metals (CSE: YMC) (OTCQB: YMMCF) is Positioned for Success

- Positioned in a Premier Mining Jurisdiction: Yukon Metals operates in the Yukon, one of the world’s top-ranked mining regions, known for its rich mineral potential and supportive mining culture. This location provides YMC with significant exploration upside for copper, silver, and gold.

- Diverse Portfolio of High-Grade Copper, Silver, and Gold Projects: YMC’s portfolio includes the Star River and Birch projects, both offering high-grade copper, silver, and gold mineralization. Recent exploration results include up to 101 g/t gold and 10,936 g/t silver (or 319 oz/t)[15], and 0.98 g/t gold and over 0.2% copper across 1,400 meters[16], reinforcing the incredible untapped mineralization and growth potential across multiple metals.

- Important Metals for Global Electrification and Green Energy: Copper is essential for electric vehicles, power grids, and renewable energy infrastructure, while silver is vital for solar panels and electronics. As demand for these metals continues to rise, YMC is well-positioned to meet the needs of the green energy transition.

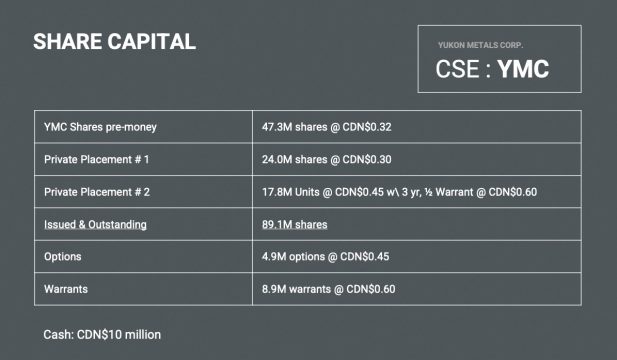

- Strong Financial Position to Support Growth: With C$10 million in cash and a disciplined share structure of 89.1 million shares issued and outstanding, YMC has the financial strength to fund its ongoing exploration programs without excessive dilution. The company’s solid financials ensure a runway for continued project development and expansion.

- Proven Leadership with Extensive Industry Experience: YMC is led by a seasoned team with deep expertise in both mining and finance. President and CEO Rory Quinn has overseen major acquisitions valued at over US$6 billion, while Chairman Patrick Burke brings over 25 years of capital markets experience. The leadership team is further strengthened by Dr. Darryl Clark and Helena Kuikka, who have extensive experience in global exploration and project development.

- Established Relationships and Local Support: YMC has built strong relationships within the Yukon mining community and maintains a commitment to sustainable exploration practices. By working closely with local stakeholders, the company ensures that its projects benefit both the local economy and its shareholders.

- Significant Upside Potential with Ongoing Exploration: The company’s aggressive exploration programs, combined with the proven mineral potential of its assets, offer significant upside potential. YMC is actively advancing its projects to define larger resource bases, with plans for continued drilling and expansion.

Why Gold, Silver, and Copper?

In today’s rapidly changing global economy, gold, silver, and copper are more important than ever.

Here now are some of the top reasons these metals are emerging as top metals for a changing global economy.

Why Gold?

Gold continues to play a role as a safe-haven investment and in technology:

- Safe-Haven Investment: Central banks increased gold reserves by 183 metric tons in Q2 2024 alone, driven by global market volatility.[17],[18] Experts including Goldman Sachs predict gold could reach $2,900 per ounce by early 2025.[19]

- Technological Uses: Gold demand for AI-related tech and electronics rose 11% year-over-year.[20]

- Global Economic Impact: Countries like China, Turkey, and Poland have boosted their gold reserves against economic instability.[21]

Why Silver?

Silver is a key player in green energy and industrial demand:

- Green Economy: 64% of global silver demand now comes from industrial uses, marking a 19% increase from the previous year[22], with solar panels, EVs, and PV systems consuming 100 million ounces annually[23].

- Undervalued Potential: Silver’s gold-silver ratio (currently around 84:1) [24] suggests room for growth, with projections that it could hit $50 per ounce in the near future[25],[26].

- Supply Deficit: For the fourth consecutive year, silver has faced a supply deficit of nearly 185 million ounces[27].

Why Copper?

Copper is crucial for the electrification of the global economy:

- Electrification: Copper demand is expected to increase by 115% in the next 20 years due to its role in EVs, solar panels, and power grids.[28],[29]

- Supply Shortages: Global copper demand is set to rise 72% by 2050[30], with prices likely to surpass $10,000 per ton by 2025. [31],[32]

- AI Boom: Copper demand from AI infrastructure is projected to add 3.4 million tonnes annually by 2050, highlighting copper’s growing scarcity.[33]

YMC’s Copper-Gold-Silver Assets

Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) is actively expanding and developing its portfolio of copper-gold-silver properties throughout the Yukon region, with a strong focus on the Star River, Birch, AZ, and other key projects. The company has made significant advancements in geological mapping, sampling, and reconnaissance work, positioning itself as a leader in Yukon’s mining industry.

Below is a breakdown of YMC’s current assets and ongoing exploration activities:

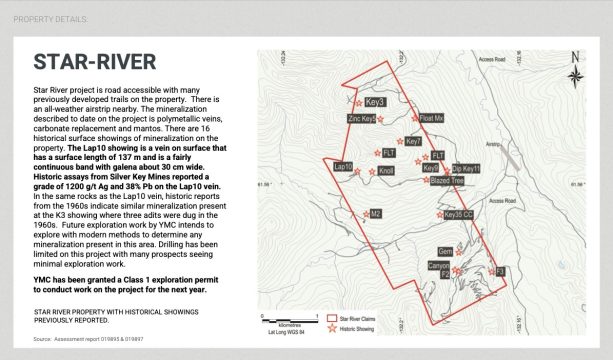

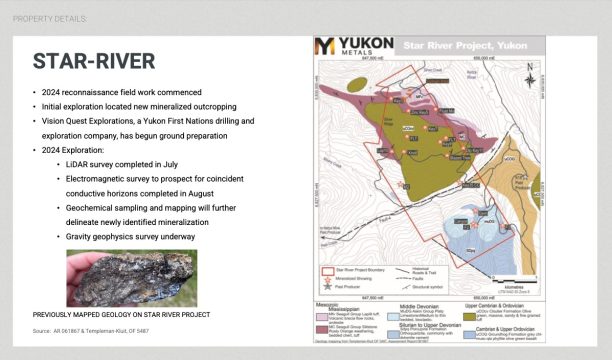

Star River Project

Star River stands as one of YMC’s flagship projects, located south of Ross River, Yukon. So far, the 2024 exploration program yielded bonanza-grade discoveries[34], including up to 101 g/t gold and 10,936 g/t silver (or 319 oz/t)[35].

These results are some of the highest-grade samples found in recent exploration, showcasing the significant upside potential for further exploration. There are also 16 historical surface showings of mineralization on the property. One vein, for example, boasts a historical grade of 1,200 g/t Ag and 38% Pb over 137 meters[36], while another zone has yielded silver and lead with assays up to 6,930 g/t Ag[37],[38].

YMC’s exploration is supported by Vision Quest Explorations, a Yukon First Nations-owned company, which has set up a 10-person camp on the site[39]. With modern exploration techniques being applied, the Star River Project is shaping up as a flagship asset with substantial potential.

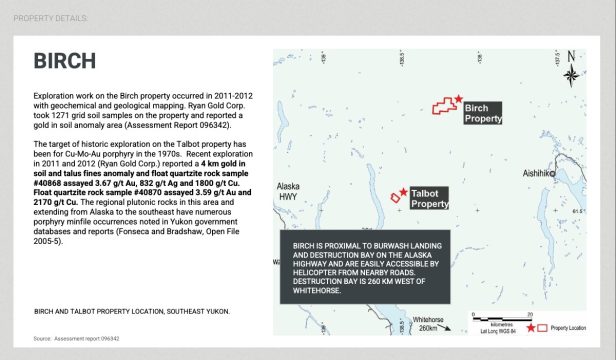

Birch Property (and Talbot Arm)

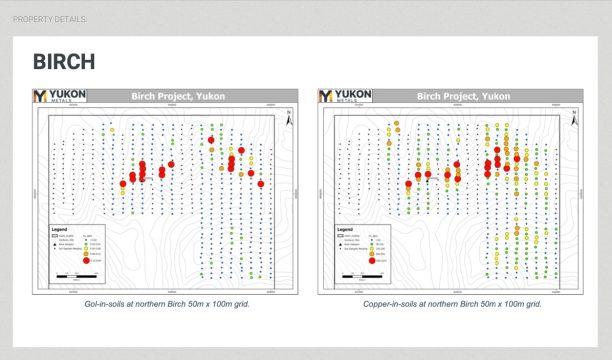

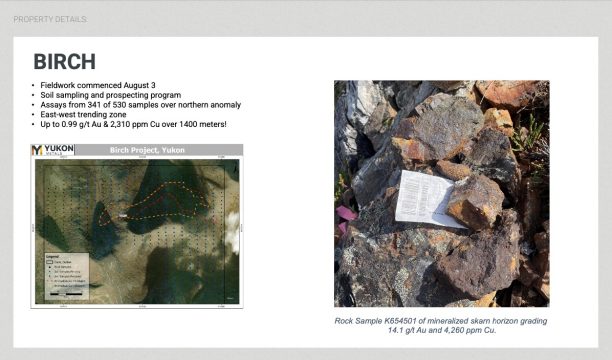

The Birch Property is another cornerstone of YMC’s Yukon portfolio, offering strong copper and gold potential. Previous work in 2011 and 2012 identified a significant gold-in-soil anomaly extending 4km and quartzite float samples grading up to 3.67 g/t Au, 832 g/t Ag, and 1,800 ppm Cu[40].

Recent exploration has uncovered copper grades up to 4,260 ppm Cu, along with promising gold values of up to 14.1 g/t Au. Within those results, YMC saw encouraging results of 2,310 ppm Cu and 0.99 g/t Au over impressive 1,400-meter trend[41].

YMC plans to continue exploration here, targeting the large cohesive copper-gold-silver system through geophysical and geochemical surveys[42].

Moreover, the Talbot arm of the Birch Property, which shares the same geological setting, continues to show excellent potential for copper-molybdenum-gold porphyry mineralization.

In 2024, YMC’s exploration work has been focused on expanding the mineralized footprint (doubling its position in mid-June)[43], with ongoing fieldwork expected to deliver more positive results.

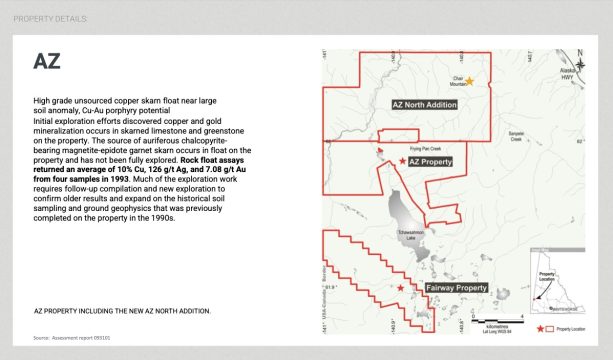

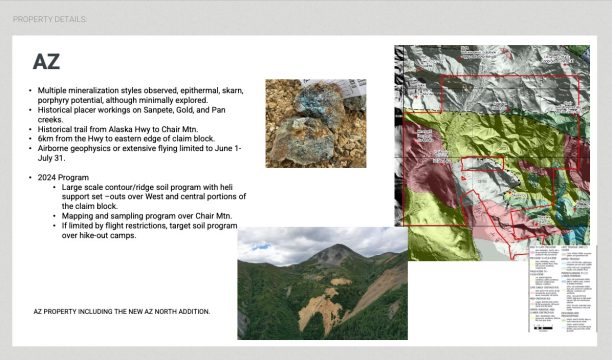

AZ Property

The AZ Property offers another exciting target in YMC’s Yukon portfolio, known for its historical copper, silver and gold showings. Assays from previous exploration returned notable grades, including rock float samples from 1993 averaging 10% copper, 126 g/t silver, and 7.08 g/t gold[44].

These findings indicate the presence of significant mineralization that YMC aims to explore further, having doubled the AZ property land position through staking in mid-June[45], much like the Birch Talbot arm.

Optimally located near the Alaska Highway, AZ benefits from excellent access and proximity to historical placer mining areas, further enhancing its exploration potential. YMC’s 2024 program at AZ is focused on expanding and confirming the historical data, with a large-scale soil sampling program already underway. Additionally, airborne geophysics completed in July is providing valuable insights for identifying new targets across the claim.[46]

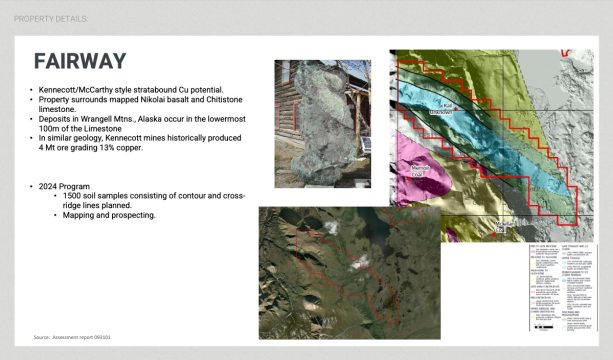

Fairway Property

Situated near the AZ property, the Fairway Property offers great potential for high-grade copper (and gold). The geology here is similar to other areas that have produced a lot of copper, which makes Fairway an exciting target for future exploration.

YMC plans to dig deeper into Fairway’s potential, with exploration efforts aimed at uncovering high-grade copper deposits that could add to the company’s future success.

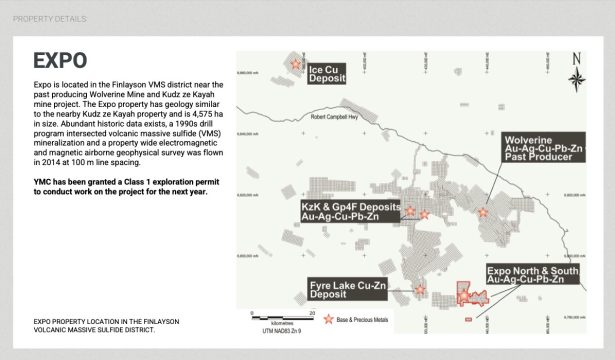

Expo Property

YMC’s Expo Property is located in the well-known Finlayson VMS district, adjacent to some of the Yukon’s significant past-producing mines.

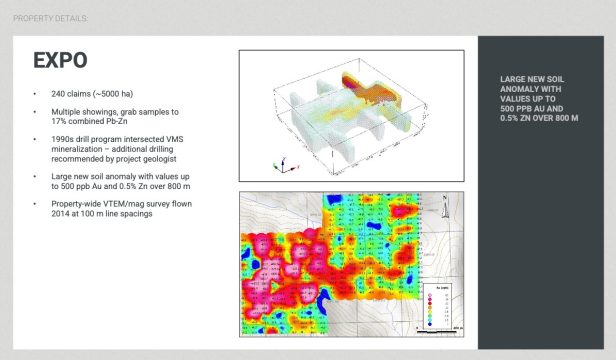

This 4,575-hectare property is geologically similar to the nearby Kudz ze Kayah and Wolverine deposits, which have yielded high-value base metals in the past. Historical exploration efforts in the 1990s intersected VMS (volcanogenic massive sulfide) mineralization, with samples returning values up to 17% combined lead-zinc (Pb-Zn).

More recent geophysical surveys, including a property-wide VTEM/magnetic survey flown in 2014, revealed large soil anomalies with values of up to 500 ppb gold (Au) and 0.5% zinc (Zn) over an 800-meter span.

In 2024, YMC plans to capitalize on these promising indicators, focusing on further exploration through mapping and additional sampling programs. The company has already secured a Class 1 exploration permit, allowing them to expand their work on this highly prospective property.

The Family Behind the Vision: YMC’s Asset Acquisition and Local Support

At the heart of Yukon Metals Corp.’s (CSE: YMC) (OTCQB: YMMCF) portfolio is its visionary approach to asset acquisition, driven by a deep understanding of the region’s mining potential. The company’s portfolio of copper, silver, and gold projects didn’t come together by chance—it’s the result of decades of experience, strategic planning, and local partnerships.

The Berdahl Family Legacy

The journey began with the Berdahl family, renowned prospectors who have spent over 30 years identifying and exploring mineral-rich territories in the Yukon. Known for their expertise, the Berdahls were the same team behind the highly successful Snowline Gold portfolio (valued at US$660M as of Oct 1, 2024). Their eye for promising ground led to the discovery of several key assets now held by Yukon Metals.

Recognizing the immense potential of these discoveries, Yukon Metals seized the opportunity to acquire its flagship projects, including Star River and Birch, directly from the Berdahls. This acquisition gave YMC immediate access to some of the most promising polymetallic systems in the Yukon, already known for their rich copper, silver, and gold potential.

Local Partnerships and Community Support

YMC’s commitment to working with local communities has been a cornerstone of its strategy from day one. By partnering with local prospectors and community leaders, the company has ensured that its projects not only generate value for investors but also foster sustainable development in the region.

This inclusive approach has allowed Yukon Metals to build strong relationships with local stakeholders, ensuring that exploration and development efforts align with community needs and environmental stewardship. Whether it’s creating jobs or contributing to infrastructure, Yukon Metals is committed to ensuring that the Yukon remains a thriving hub for mining activity.

Strong Financial Position and Proven Leadership

Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) is primed to capitalize on the growing demand for copper, gold and silver in the changing global economy, with a robust financial position and an experienced leadership team. The company’s strategic approach to financing, combined with a talented management team, is paving the way for exciting developments across its portfolio.

A Strong Balance Sheet

Yukon Metals is well-funded, with CDN$10 million in cash, offering a solid foundation to drive exploration and project advancement. The company’s 89.1 million shares issued and outstanding provide a disciplined share structure, ensuring the company can push forward with its aggressive exploration goals without unnecessary dilution. Two successful private placements, including the most recent at CDN$0.45 with three-year warrants, reflect strong investor confidence in YMC’s growth potential.

This financial strength equips Yukon Metals to expand its efforts on the ground while continuing to create long-term value for shareholders.

Led by Proven Mining and Finance Veterans

At the core of Yukon Metals’ success is a leadership team that brings decades of experience in mining, capital markets, and corporate development. Rory Quinn, YMC’s President and CEO, has over 20 years of expertise in the mining sector, including time at Wheaton Precious Metals, where he contributed to major acquisitions valued at over US$6 billion. Quinn’s strategic insight and focus on unlocking value across YMC’s assets make him a driving force behind the company’s growth.

Supporting this vision is Patrick Burke, YMC’s Chairman, who brings a wealth of experience from his time as Global Head of Equity at Canaccord Genuity and Scotiabank, giving YMC an edge in capital markets strategy. His extensive relationships in the investment banking world strengthen the company’s financial prospects.

Dr. Darryl Clark, a Director at YMC, adds a wealth of technical expertise with decades of experience in global exploration, particularly in precious metals. His track record of successful greenfield discoveries further bolsters the company’s exploration ambitions.

Jim Coates, YMC’s Director and Executive VP, brings over two decades of experience in mineral exploration across Canada and the Yukon. His commitment to low-impact exploration methods aligns perfectly with the company’s sustainable development goals.

Daniel Vickerman, Director, contributes 25 years of expertise in corporate finance and resource development. As the Senior VP of Corporate Development at Blackrock Silver, Vickerman has successfully raised capital for mining ventures and brings valuable insight into navigating public and private equity markets.

Adding to the company’s technical expertise is Helena Kuikka, VP of Exploration, a Professional Geologist with over 15 years of experience leading both grassroots and late-stage development programs. Kuikka’s career has included work on projects ranging from high-grade gold to tungsten skarns. Her deep understanding of the Yukon’s mineral potential makes her a key figure in advancing YMC’s exploration efforts.

With a leadership team that combines financial expertise, operational know-how, and strategic vision, Yukon Metals is well-positioned to execute its ambitious plans and continue delivering value to its investors.

BEFORE YOU GO…

Yukon Metals Corp. (CSE: YMC) (OTCQB: YMMCF) is leading the charge in Yukon’s mineral-rich landscape with a portfolio of copper, gold, and silver projects ready for exploration breakthroughs. With a seasoned leadership team and strong financials, YMC is primed for rapid growth in one of the world’s top mining jurisdictions.

As demand for these metals soars, YMC’s projects—Star River, Birch, AZ, Expo, and Fairway—are already delivering promising results.

With exploration programs underway and key updates expected soon, the window to capitalize on YMC’s momentum is now.

Don’t miss out. Stay tuned for major news as YMC continues to unlock value for its shareholders..

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Yukon Metals Corp. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Yukon Metals Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Yukon Metals Corp. which were purchased through a private placement, and reserve the right to buy and sell, and will buy and sell shares Yukon Metals Corp. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Yukon Metals Corp. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://emrlibrary.gov.yk.ca/ygs/brochures/discover-yukon/discover_yukon.pdf

[2] https://www.jpost.com/business-and-innovation/precious-metals/article-821935

[3] https://sprott.com/insights/silver-s-critical-role-in-the-clean-energy-transition/

[4] https://carboncredits.com/copper-and-the-need-to-meet-the-worlds-rewiring-demand-for-energy-transition/

[5] https://www.fmiblog.com/2024/09/27/rising-copper-demand-in-construction-and-electronics-sectors-to-boost-usa-and-canada-market-to-usd-32773-0-million-by-2032/

[6] https://www.mining.com/silver-looks-ready-to-rip/

[7] https://carboncredits.com/copper-price-breakout-and-big-role-in-carbon-emission-reduction-and-net-zero/

[8] https://www.wsj.com/articles/the-global-solar-power-boom-is-driving-a-surge-in-silver-demand-4ac20435

[9] https://emrlibrary.gov.yk.ca/ygs/brochures/discover-yukon/discover_yukon.pdf

[10] https://www.miningnewsnorth.com/story/2024/09/27/news/ottawa-invests-60m-in-northern-bc-yukon/8720.html

[11] https://www.miningnewsnorth.com/story/2024/09/27/news/yukon-grid-project-may-spark-mining-growth/8722.html

[12] https://fortune.com/2024/09/25/gold-prices-investing/

[13] https://www.jpost.com/business-and-innovation/precious-metals/article-821913

[14] https://www.jpost.com/business-and-innovation/precious-metals/article-821915

[15] https://yukonmetals.com/news/yukon-metals-samples-bonanza-grade-gold-up-to-3-o-9550/

[16] https://yukonmetals.com/news/yukon-metals-announces-positive-results-of-up-to-1-9478/

[17] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2024

[18] https://www.schiffsovereign.com/trends/and-right-on-cue-gold-hits-another-all-time-high-151422/

[19] https://www.kitco.com/news/article/2024-10-01/goldman-sachs-raises-gold-price-target-s2900oz-early-2025-sovereign-buying

[20] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q2-2024

[21] https://www.investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx

[22] https://www.dailygazette.com/life_and_arts/stacker/can-silver-help-reduce-carbon-emissions-how-this-precious-metal-plays-a-role-in-a/collection_f179db35-9e41-55c8-8b71-3301bafd20b6.html?=/&subcategory=659%7CFestival#1

[23] https://www.mining.com/silver-looks-ready-to-rip/

[24] https://www.jpost.com/business-and-innovation/precious-metals/article-821913

[25] https://www.fxempire.com/forecasts/article/silver-to-maintain-an-upward-trend-with-strong-technical-support-1455953

[26] https://www.mining.com/silver-looks-ready-to-rip/

[27] https://www.mining.com/silver-looks-ready-to-rip/

[28] https://miningdigital.com/sustainability/copper-shortage-will-thwart-global-2050-ev-plans

[29] https://evmagazine.com/sustainability/copper-shortage-could-derail-global-2050-ev-goals

[30] https://www.mining.com/bhp-warns-ai-boom-would-worsen-copper-shortage/

[31] https://www.mining.com/bank-of-america-sees-copper-price-surging-above-10000-iron-ore-slipping-below-80-by-2025/

[32] https://www.usatoday.com/money/blueprint/investing/copper-today-09-16-2024/

[33] https://www.mining.com/bhp-warns-ai-boom-would-worsen-copper-shortage/

[34] https://yukonmetals.com/news/yukon-metals-samples-bonanza-grade-gold-up-to-3-o-9550/

[35] https://yukonmetals.com/news/yukon-metals-samples-over-10000-g-t-silver-multi-9493/

[36] https://webfiles.thecse.com/24-06-03_NR_YMC_Closing.pdf?Ap_O2780W57sfFooJPPs57auOCGhjj68

[37] https://yukonmetals.com/news/yukon-metals-samples-over-10000-g-t-silver-multi-9493/

[38] https://webfiles.thecse.com/24-06-03_NR_YMC_Closing.pdf?Ap_O2780W57sfFooJPPs57auOCGhjj68

[39] https://yukonmetals.com/news/yukon-metals-samples-over-10000-g-t-silver-multi-9493/

[40] https://webfiles.thecse.com/24-06-03_NR_YMC_Closing.pdf?Ap_O2780W57sfFooJPPs57auOCGhjj68

[41] https://yukonmetals.com/news/yukon-metals-announces-positive-results-of-up-to-1-9478/

[42] https://wp-yukonmetals-2024.s3.ca-central-1.amazonaws.com/media/2024/08/24-09-05-YMC-Beaver-Creek-Deck.pdf

[43] https://yukonmetals.com/news/yukon-metals-doubles-land-position-9140/

[44] https://wp-yukonmetals-2024.s3.ca-central-1.amazonaws.com/media/2024/08/24-09-05-YMC-Beaver-Creek-Deck.pdf

[45] https://yukonmetals.com/news/yukon-metals-doubles-land-position-9140/

[46] https://wp-yukonmetals-2024.s3.ca-central-1.amazonaws.com/media/2024/08/24-09-05-YMC-Beaver-Creek-Deck.pdf