ISSUED ON BEHALF OF FLORA GROWTH CORP.

Following Strong Strategic Moves and Robust Market Positioning, with Wall Street Analysts at Roth MKM Touting Flora Growth Corp. Flora Growth Corp. (NASDAQ:FLGC) as a BUY Rating, with a Price Target of $6 (Recently at $0.94, as of Sept. 12, 2024). Don’t Miss the Chance to Discover this Emerging Small-Cap Leader in the Cannabis Industry.

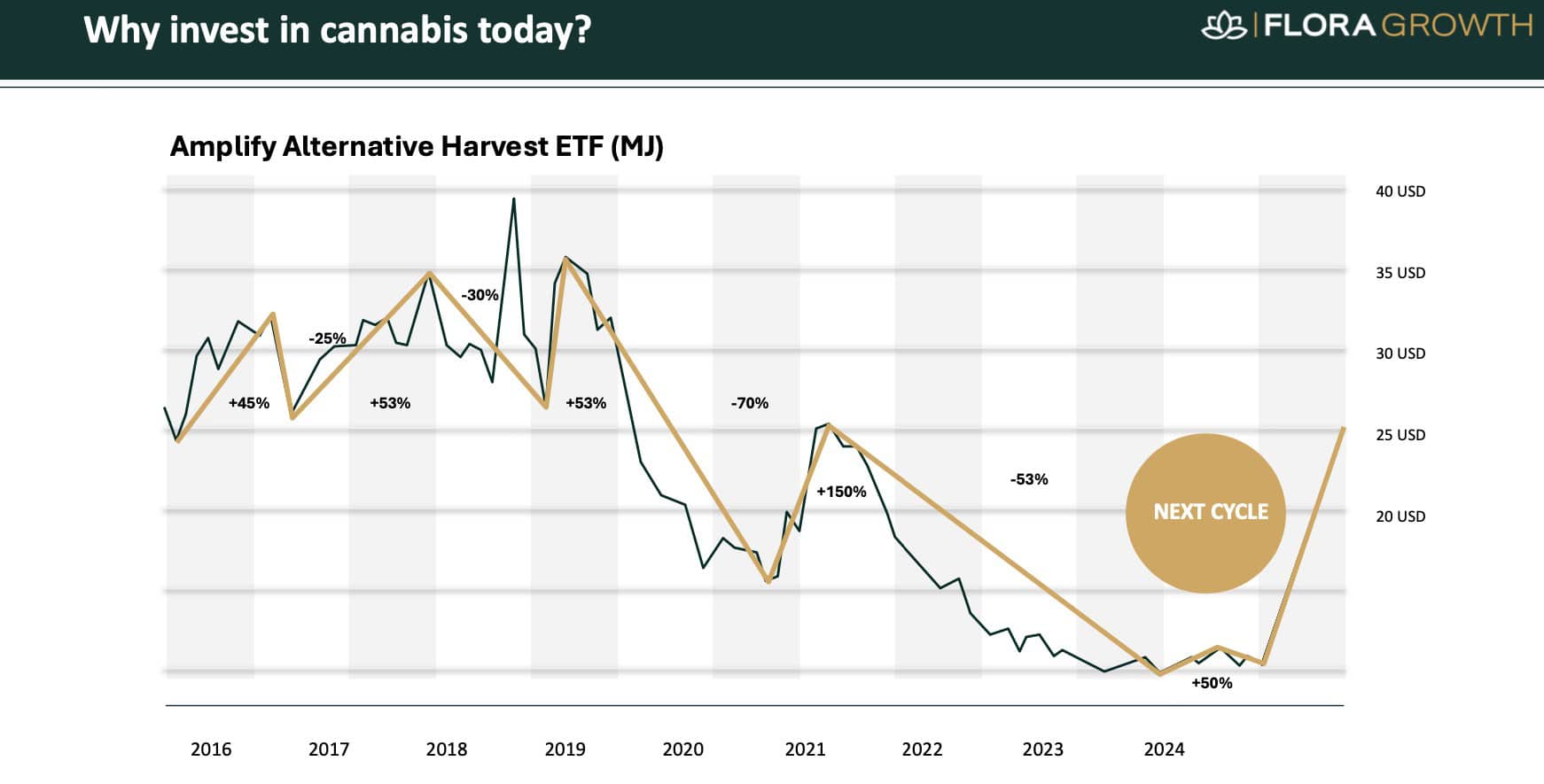

The cannabis industry has weathered storms, making investors wary. Yet, a quiet resurgence is brewing—one that demands attention.

Amidst challenges like regulatory hurdles and price drops, global legalization is accelerating, consumer demand is rebounding, and consolidation is paving the way for a market comeback.

A Global Green Wave

The Overton Window on cannabis is shifting faster than ever:

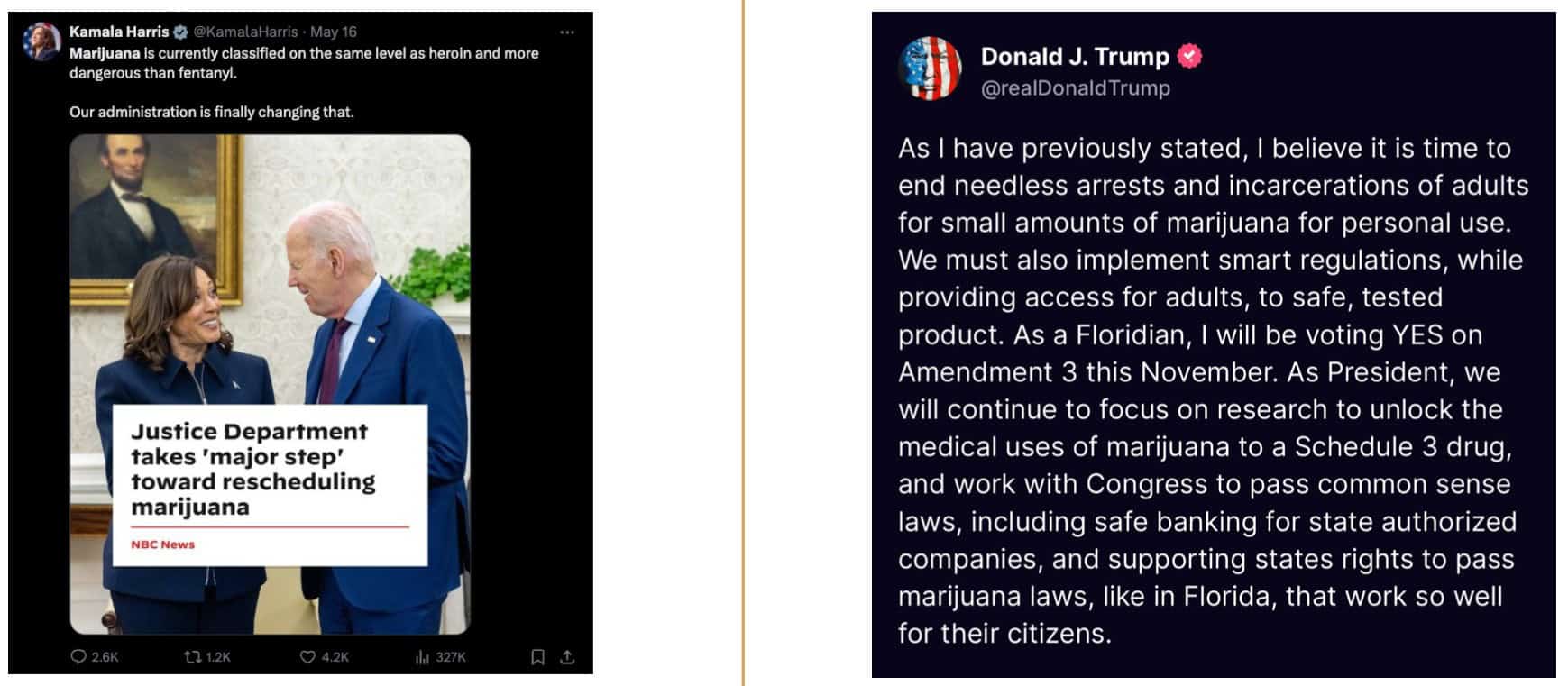

- S. Reforms: The U.S. government is edging closer to reclassifying cannabis[1], with both candidates (Harris and Trump) showing support ahead of the upcoming elect,[2],[3] and signalling an end to the partisan divide on the marijuana issue.[4]

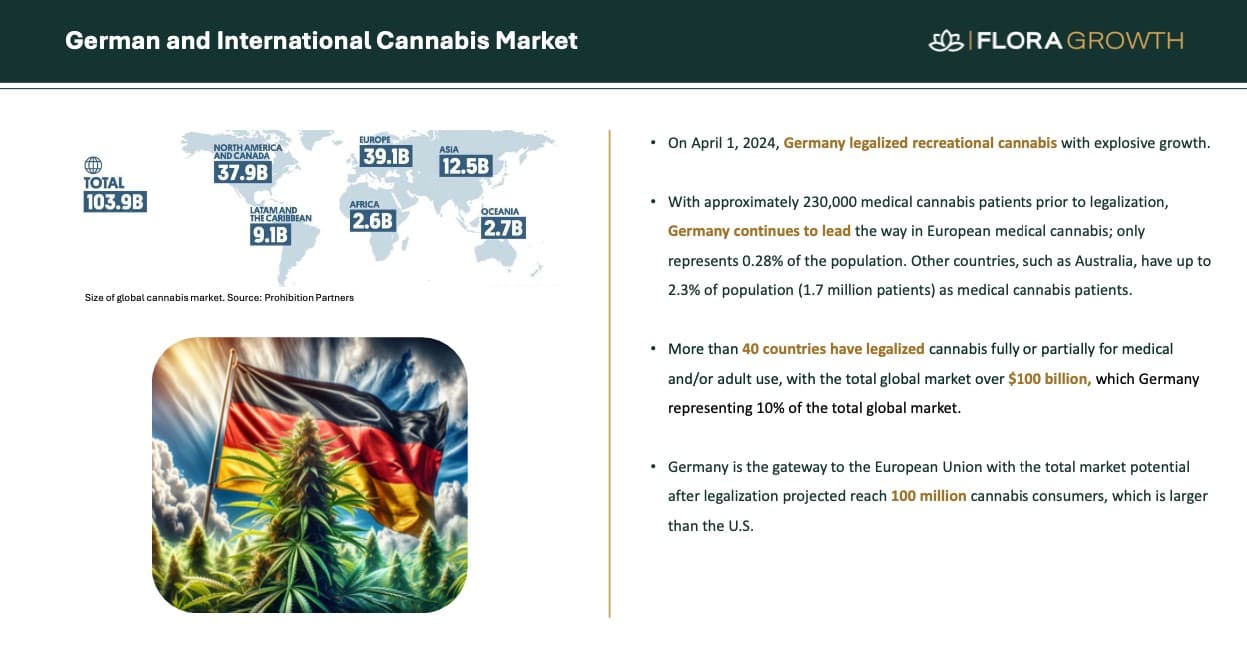

- Germany Leads Europe: Germany, Europe’s economic powerhouse, has fully legalized recreational cannabis[5], setting the tone for the rest of the EU[6].

- Global Acceptance: Even in traditionally conservative regions, cannabis is gaining ground—Thailand has legalized medical marijuana[7], South Africa legalized cannabis use[8], and both Brazil, Mexico and the Philippines are on the brink of following suit[9],[10],[11].

These developments are more than just policy changes—they’re game-changers, potentially unlocking vast new opportunities for growth.

The Consumer Is King

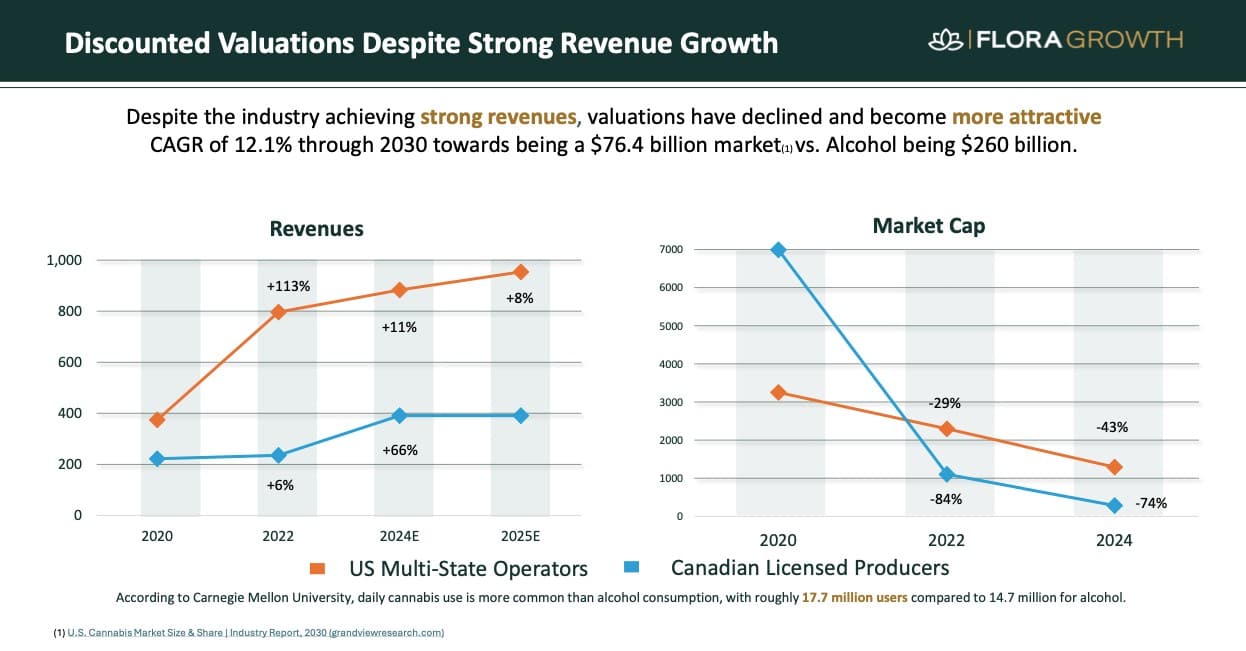

Demand for cannabis isn’t just holding steady—it’s growing, with Grand View Research projecting the US market alone to grow at a CAGR of 12.10% through 2030 towards being a US$76.4 billion market.[12]

Key Drivers:

- Global regulatory shifts converging[13]

- Rebounding consumer demand[14],[15]

- National polling by Gallup in 2023 showed a record 70% support for legalizing marijuana[16]

- Industry leaders are talking about potential consolidation paving the way for a mature, resilient market[17],[18], however obstacles remain in the short term[19].

A New Era of Global Legalization

The wave of global legalization, particularly in major markets like the U.S. and Germany, is driving potentials for growth. These regulatory milestones unlock new consumer bases and revenue streams for companies that can execute on opportunities.

Resilient Consumer Demand

Consumer demand for cannabis—both medical and recreational—remains robust, with Grand View Research projecting a CAGR of 12.1% through 2030 in the US market alone to potentially surpass $76 billion.[20] As the industry matures, companies that innovate and diversify their product lines will be best positioned to weather market fluctuations and deliver consistent growth.

Meet Flora Growth Corp. (NASDAQ:FLGC)

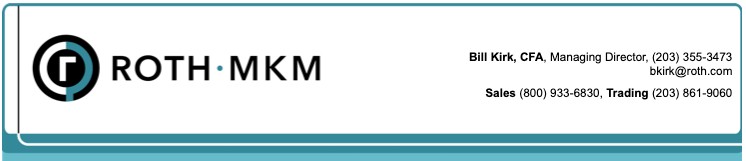

Flora Growth Corp. (NASDAQ:FLGC) is inspired to become a standout small-cap cannabis issuer on Nasdaq. With a clean balance sheet, strategic M&A, and strong liquidity, Flora is well positioned for growth.

Top 7 Reasons Flora Growth Corp. (NASDAQ:FLGC) is a Name to Watch in the Legal Pot Sector

1 Premiere Small-Cap Opportunity on Nasdaq: Flora Growth isn’t just another small-cap cannabis stock; it’s a growing international cannabis company on Nasdaq. With a global footprint and a diverse product portfolio, Flora offers a potent blend of growth and stability in the cannabis market.

2 Healthy Financials: Flora Growth’s clean balance sheet provides strong liquidity and manageable debt, and positions the company to capitalize on market opportunities.[21]

3 Aggressive M&A and Strategic Expansion: Flora Growth’s bold M&A strategy is a game-changer, pushing its reach into lucrative markets like Germany, and the United States. These strategic acquisitions diversify revenue streams and position Flora to excel within regions with rapidly evolving cannabis regulations.

4 Favourable Political Timing: With a solid footprint in Germany that is the largest legal cannabis market in the West, Flora Growth’s also positioned in the USA which has shifted from 31% support for legalization in 2001[22] to a record 70% in 2023, legalization may be on the horizon with both major political parties signalling support for reclassification in the upcoming election.[23]

5 Diverse Product Portfolio: Flora Growth isn’t putting all its eggs in one basket. From wellness essentials like JustCBD to premium cannabis accessories under the Vessel brand, Flora’s broad product range minimizes risk and appeals to a wide, growing consumer base.

6 Global Reach and Market Penetration: Flora Growth has carved out an international presence in key cannabis markets, from the U.S. to Europe and Latin America. With Germany’s recent full legalization of recreational cannabis and the U.S.’s shifting regulations, Flora is strategically positioned for opportunities in the global cannabis industry.

7 Leadership with Proven Success: Flora Growth’s leadership have a strong vision for the business, with plenty of skin in the game having taken multiple opportunities to increase their insider ownership[24],[25]. This team of seasoned executives has experience in cannabis, finance, and global markets that helps shape the company’s strategic plan.

Trust the Pros: Flora Growth Rated as a ‘Buy’

The buzz around Flora Growth Corp. (NASDAQ:FLGC) is getting louder, and for good reason. Analyst Bill Kirk at Roth/MKM is signaling a clear BUY rating with a price target of $6.[26]

With the stock currently sitting at about $0.94 (as of Sept. 12, 2024), hitting that target would represent a leap to nearly five times its value—a potential +500% gain!

What insights do these sharp analysts have that the broader market might be missing?

Market Trends and Tailwinds: The Perfect Storm for Growth

The global cannabis market is primed for even more growth, led by Germany, Europe’s largest economy. With full legalization, Germany is expected to push the EU cannabis market to €123 billion by 2028[27]. At a population of 84.5 million[28], and GDP of US$4.46 trillion[29], Germany is now the largest federally regulated recreational cannabis market in the world[30].

Consumer demand is surging. The global cannabis market, valued at $26.86 billion in 2022, is projected to skyrocket to nearly $200 billion by 2032, growing at a CAGR of 22.2%[31], driven by innovative products that meet the growing appetite for wellness and lifestyle solutions.

Flora Growth Corp. (NASDAQ:FLGC) is not only well positioned in Germany, but also strategically embedded in the United States.

The winds are shifting are shifting in the USA. Both leading candidates (Harris and Trump) have hinted that their position on the topic have shifted in recent years[32],[33], with each party’s ticket showing what looks like support for legalization[34],[35].

The Market Challenges That Remain

Amid industry challenges, some companies have strategically positioned themselves for the next wave, especially if federal legalization is potentially on the horizon. Through acquisitions and global expansion, some have built up portfolios ready for growth.

However, until federal legalization occurs, the challenges remain, especially when it comes to banking[36],[37]. Cannabis M&A deals don’t allow for part of the purchase price to be placed in escrow, while insurance companies, nervous about federal penalties, don’t offer the same coverage.[38]

Despite the overwhelming majority of states allowing for the use of cannabis at some level, the federal legalization structure is lacking[39]. Currently, the federal-state law conflict is particularly evident in the financial services sector, where limitations are imposed on cannabis companies.

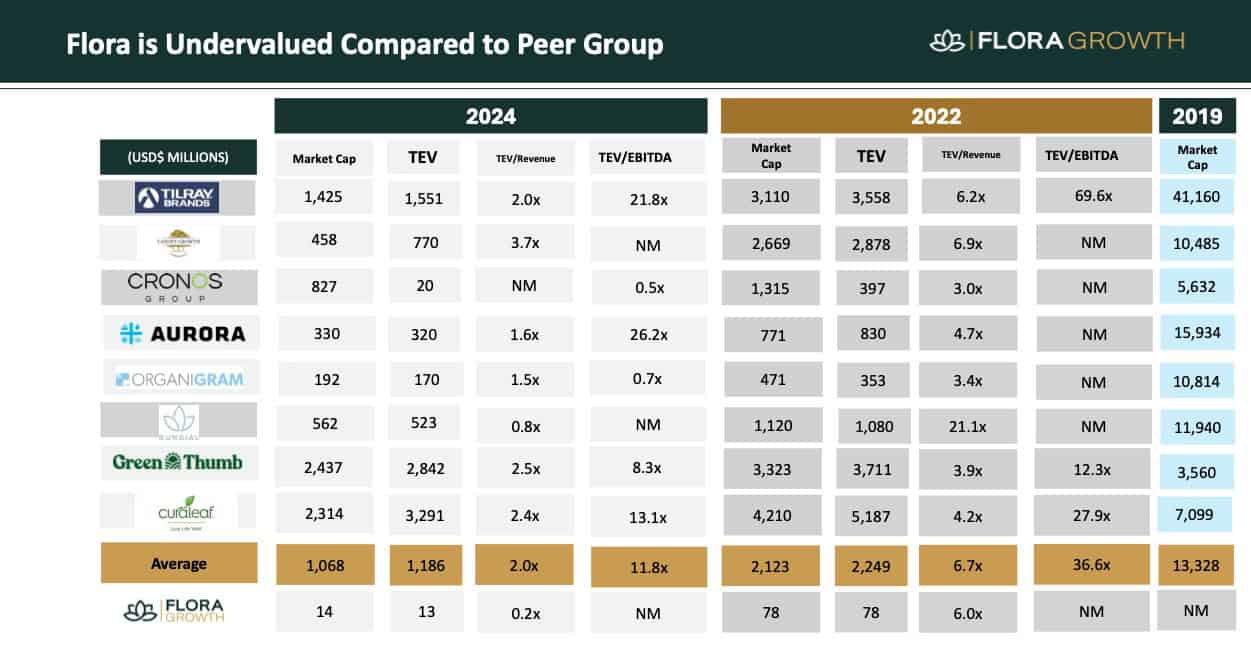

FLGC Among Its Peers

As Flora Growth Corp. (NASDAQ:FLGC) continues to solidify its position, it’s essential to see how it stacks up against its peers in the cannabis sector.

Comparing Flora Growth’s strategic advantages—such as its global market reach, financial health, and product diversity—with those of other industry players highlights why this company is poised to lead in the coming years.

It’s clear that in the world of legal cannabis, Flora Growth Corp. (NASDAQ:FLGC) stands out in this resurging field.

Below is a chart setting out comparable numbers for other cannabis issuers. Flora Growth’s TEV/Revenue and TEV/EBITDA ratios stand out compared to peers.

Strategic Initiatives: Flora Growth’s Blueprint for Success

Flora Growth Corp. (NASDAQ:FLGC) isn’t just participating in the cannabis market—it’s strategically shaping its future with calculated, high-impact initiatives that differentiate it from the competition.

Global Expansion & Strategic Acquisitions: Flora Growth’s strategic acquisitions, including Franchise Global Health[40] in 2022 and TruHC Pharma GmbH[41] in 2024, have solidified its presence in Europe’s growing cannabis market. With EU-GMP certified facilities and a vast distribution network, Flora is positioned to lead. Its international reach provides a differentiation over competitors still focused primarily on domestic markets.

Innovation That Drives Growth: Flora is not just meeting industry standards—it’s setting them. Its brands, like JustCBD and Vessel, develop products to meet consumer demand. The company’s commitment to research and development ensures that new, innovative products continue to serve the cannabis and wellness industries. Additionally, new ventures, such as the Melo beverage line and Peak USA JV partnership with Althea Group, reinforce Flora’s ability to stay ahead of market trends.

Sustainability as a Core Value: In an industry often criticized for its environmental footprint[42], Flora is leading by example. The company incorporates sustainability throughout its supply chain, from eco-friendly cultivation practices to sustainable packaging[43], aligning with the values of today’s conscious consumers.

The Path Forward: By leveraging its global expansion, product innovation, and commitment to sustainability, Flora Growth Corp. (NASDAQ:FLGC) is positioning itself towards long-term success in the evolving cannabis industry. Its healthy financials, coupled with strategic foresight, position Flora Growth to capitalize on opportunities as they arise.

Products and Brands: The Core of Flora Growth

Flora USA

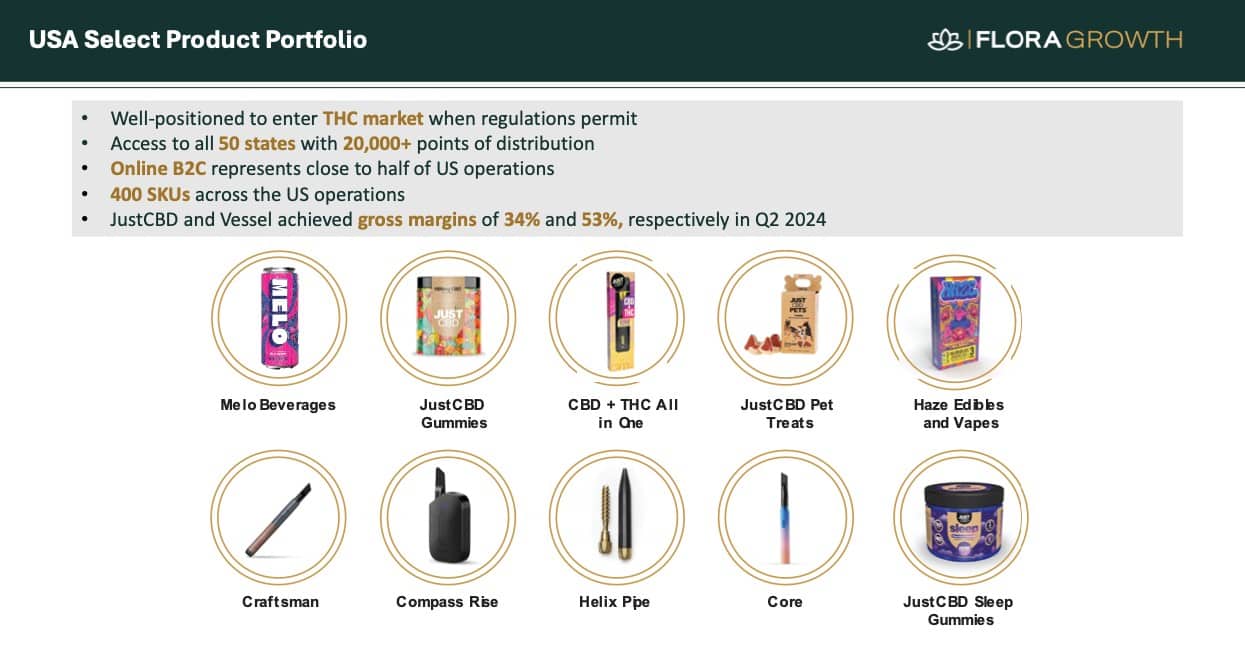

Flora Growth’s U.S.-based brands and product lines are designed to capture the rapidly growing wellness and cannabis markets across all 50 states, with a strong focus on high-quality products that consumers trust.

JustCBD: is a market leader in the U.S. wellness space, offering a wide range of CBD-infused products from gummies to topicals. With over 350,000 customers, JustCBD is synonymous with transparency and quality, positioning itself as a go-to for consumers seeking reliable, lab-tested CBD products. One of the best-selling CBD gummy brands in the world, JustCBD’s appeal continues to grow among health-conscious consumers.

Vessel: Vessel redefines the cannabis consumption experience with its premium accessories. Known for their sleek, modern design and cutting-edge technology, Vessel products appeal to discerning consumers who value both form and function. Whether it’s the elegant Compass vaporizer or their high-end accessories, Vessel elevates the cannabis lifestyle experience.

Flora International

Flora Growth’s global footprint is rapidly expanding, with strategic partnerships and acquisitions in Europe, solidifying the company’s presence in high-growth international markets.

In addition to selling JustBrands and Vessel products in the United Kingdom, Flora has established a significant footprint in Germany with the following products:

Phatebo: Phatebo is Flora’s key player in the international pharmaceutical cannabis market. With an EU-GMP certified facility and distribution network that spans 28 countries, Phatebo provides branded pharmaceutical products from some of the world’s leading companies, including Merck, Gilead, Novartis, AstraZeneca, and Janssen. This strategic footprint allows Flora to tap into the medical cannabis sector, particularly in Germany, which is Europe’s largest and fastest-growing market.

TruHC: Flora’s acquisition of TruHC Pharma GmbH[44] gave the company a significant foothold in Germany’s cannabis market. TruHC’s EU-GMP certified facilities and licenses provide Flora with the capacity to control its cannabis production process, from cultivation to distribution. This acquisition positions Flora to take full advantage of Germany’s recent legalization of recreational cannabis and further European expansion.

These brands are more than just part of Flora Growth’s portfolio—they are the backbone driving the company’s growth and expanding its market share across key sectors. With each brand tailored to meet specific consumer demands, Flora Growth is seeking to grow its business in key markets.

Flora Growth’s Financial Health: A Solid Foundation for Expansion

Flora Growth Corp. (NASDAQ:FLGC) Q2 2024 financial results showcased a business with a sharp focus on operational efficiency and strategic expansion, providing support for executing on emerging market opportunities.

Revenue Recovery: Flora Growth reported a net loss of $2.7 million for Q2 2024, a dramatic improvement from the $44.6 million loss in the same quarter last year—a remarkable 94% quarter-over-quarter recovery. This turnaround is a testament to Flora’s ability to adapt and thrive in challenging market conditions.

Operational Efficiency at its Core: Flora has significantly optimized its operations, reducing cash used in operating activities by 91%—down to $0.3 million from $3.5 million in the previous year’s comparable quarter. This efficiency isn’t just about cutting costs; it’s about freeing up resources to reinvest in high-growth opportunities.

Strategic Expansion: Flora’s recent acquisitions of TruHC in Germany and Australian Vaporizers are not just about expanding its footprint; they’re about securing strategic positions in key markets. These moves allow Flora to integrate its operations vertically and horizontally, ensuring that it can capitalize on the rapidly growing global cannabis and CBD landscape.

Liquidity for Potential Future Growth: Flora ended Q2 2024 with $6.1 million in cash, providing the company with some of the liquidity needed to potentially act on new opportunities. As well, Flora has another $2M of available capacity through German lines of credit that the company still has the option to draw upon.

Flora Growth’s financial position, paired with its strategic investments, positions it well in the global cannabis industry.

Leadership and Management: The Strategic Minds Driving Flora Growth’s Success

Flora Growth Corp. (NASDAQ:FLGC) is not just built on innovative products and strategic market positioning—it’s driven by a leadership team with deep expertise and a clear vision for the future of the cannabis industry.

Clifford Starke, CEO and Chairman: At the helm of Flora Growth is Clifford Starke, a seasoned executive with a strong track record in the medical cannabis sector. His extensive experience in investing and public markets, particularly within the cannabis industry, has been pivotal in building and scaling successful companies. Before Flora Growth, Starke led Franchise Global Health Inc., where he played a crucial role in expanding the company’s footprint across Europe. Under his leadership, Flora Growth has executed strategic acquisitions and forged key partnerships that have positioned the company for international success. His hands-on approach and strategic foresight are critical assets in navigating the complexities of the global cannabis market.

Dany Vaiman, CFO: Dany Vaiman, Flora Growth’s CFO, brings a wealth of financial expertise to the table. With a robust background in finance, including senior roles such as CFO at Franchise Global Health Inc. and Corporate Controller at Torex Gold Resources, his financial acumen ensures Flora Growth’s solid financial foundation. His experience with Ernst & Young’s Toronto Audit Group provided him with a deep understanding of financial strategies for publicly traded companies, which he now applies to Flora’s operations. Vaiman has been instrumental in optimizing Flora’s financial operations, securing the liquidity needed for expansion, and ensuring that the company remains on solid financial footing as it scales globally.

Harold Wolkin, Director: Harold Wolkin brings over 30 years of experience in the finance and investment banking sectors, with a career marked by leadership roles at BMO Capital Markets and Dundee Capital Markets. His expertise in corporate finance, governance, and strategic investments has made him a key figure in multiple industries. Currently, he serves as the Audit Committee Chair and Vice Chair of the Board at Baylin Technologies, Lead Independent Director and Audit Committee Chair at Cipher Pharmaceuticals, and Director at BYND Cannasoft Enterprises. With his Chartered Financial Analyst (CFA) designation and a Master of Arts in Economics and Finance from the University of Toronto, Wolkin’s financial expertise is instrumental in guiding Flora Growth’s strategic financial initiatives as the company continues its global expansion.

Edward Woo, Director: Edward Woo brings over two decades of extensive experience in the consumer-packaged goods industry, with a particular focus on the tobacco sector. His career includes senior leadership roles at global giants like Rothmans Benson & Hedges Inc. and Philip Morris International, where he served in critical positions such as Head of Regulatory & External Affairs at the Global Headquarters in Lausanne, Switzerland, and Regional Communications Director for Latin America and Canada. Woo’s deep understanding of regulatory environments and market dynamics in heavily regulated industries is invaluable to Flora Growth as it navigates the complexities of the global cannabis market. His strategic insights and experience in government affairs and business strategy are instrumental in guiding Flora’s expansion and regulatory compliance efforts across multiple markets.

Brendan Cahill, Director: Brendan Cahill is a seasoned corporate executive with a strong track record in capital markets and corporate development. He served as the President and CEO of Excellon Resources Inc. from 2012 to 2022, where he successfully led the company through a period of significant growth and strategic development. His background also includes key roles in the mining sector, such as Vice President of Corporate Development at Pelangio Mines and Pelangio Exploration, where he was instrumental in advancing corporate strategy and securing crucial investments. His extensive experience in governance, mergers and acquisitions, and strategic planning make him a vital asset to Flora Growth’s board, where his insights help steer the company’s growth strategy and long-term value creation efforts.

A Track Record of Success

Flora Growth’s leadership team brings a wealth of experience and proven success in the cannabis and financial sectors. Clifford Starke’s strategic vision, Dany Vaiman’s financial acumen, and Harold Wolkin’s extensive leadership background are complemented by Edward Woo’s regulatory expertise and Brendan Cahill’s capital markets insight. Together, they form a powerhouse driving Flora’s rapid expansion and market leadership, ensuring the company remains agile, financially robust, and strategically positioned for long-term success.

RECAP: 7 Things to Remember About Flora Growth Corp. (NASDAQ:FLGC).

1. Premiere Small-Cap Cannabis Opportunity on Nasdaq

2. Clean Balance Sheet

3. Strategic M&A

4. Optimal Political Timing

5. Diversified Portfolio

6. Global Market Penetration

7. Experienced Leadership

Flora Growth’s Time is Now

Flora Growth Corp. (NASDAQ:FLGC) is not just another player in the global cannabis market; it’s establishing its place with strategic acquisitions, a diverse product lineup, and a visionary leadership team. With solid financial health and a clear path to growth, Flora is positioned to dominate in this dynamic industry.

DON’T FORGET… noted Roth/MKM analyst BILL KIRK is already backing Flora Growth with a Buy rating and a $6 price target. With the company currently trading under $1, a potential early-mover-advantage is underway.

Whether you’re keen to stay informed, explore investment options, or dive deeper into Flora Growth’s strategies, don’t miss out on what comes next, so visit their official website and sign-up to keep up to date on WHAT COMES NEXT.

Learn More About Flora Growth | Sign Up for Updates | Explore Investment Opportunities

USA News Group

Editorial Staff

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Flora Growth Corp. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Flora Growth Corp., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Flora Growth Corp. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Flora Growth Corp. at any time without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by MIQ has been approved by the above mentioned company; this is a paid advertisement, we currently own shares of Flora Growth Corp. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles.

While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.

SOURCES CITED:

[1] https://www.pbs.org/newshour/health/what-reclassifying-marijuana-means-for-americans

[2] https://www.usatoday.com/story/news/nation/2024/07/22/kamala-harris-marijuana-stance-policy/74495543007/

[3] https://apnews.com/article/marijuana-trump-kamala-harris-dea-election-bdf75d4cd71fda5975fd3dcf29638499

[4] https://abcnews.go.com/US/wireStory/americas-divide-marijuana-coming-end-113611790

[5] https://apnews.com/article/cannabis-marijuana-legalization-decriminalization-germany-26e6a5ec254cfa69d063ec352036dfd8

[6] https://businessofcannabis.com/cannabis-europa-2024-day-1-europes-tipping-point/

[7] https://www.reuters.com/world/asia-pacific/thailand-legislate-marijuana-medical-use-deputy-pm-says-2024-07-23/

[8] https://www.aljazeera.com/news/2024/6/10/south-africa-legalises-cannabis-use-will-the-rest-of-africa-follow

[9] https://www.nytimes.com/2024/06/26/world/americas/brazil-marijuana-decriminalize-weed.html

[10] https://www.benzinga.com/markets/cannabis/24/06/39140974/mexicos-first-female-president-supports-cannabis-will-claudia-sheinbaum-legalize-marihuana

[11] https://www.bangkokpost.com/world/2839002/philippines-tries-again-to-approve-medical-cannabis

[12] https://www.grandviewresearch.com/industry-analysis/us-cannabis-market#:~:text=The%20demand%20for%20marijuana%20in,consumer%20behavior%20toward%20recreational%20marijuana.

[13] https://www.newsweek.com/global-cannabis-outlook-worldwide-developments-2024-1874461

[14] https://www.globenewswire.com/news-release/2024/08/28/2936814/0/en/Cannabis-Cultivation-Market-Global-Food-Additives-Oils-Tinctures-Cannabis-Indica-Cannabis-Sativa-Forecast-2024-2030.html

[15] https://finance.yahoo.com/news/cannabis-market-growth-trends-report-133000159.html

[16] https://news.gallup.com/poll/514007/grassroots-support-legalizing-marijuana-hits-record.aspx

[17] https://mjbizdaily.com/curaleaf-boris-jordan-on-marijuana-consolidation-global-expansion/

[18] https://www.mercurynews.com/2024/05/21/big-weed-consolidation-is-changing-the-face-of-california-cannabis/

[19] https://www.gesmer.com/publications/the-unique-challenges-of-cannabis-ma-deals/

[20] https://www.grandviewresearch.com/industry-analysis/us-cannabis-market#:~:text=The%20demand%20for%20marijuana%20in,consumer%20behavior%20toward%20recreational%20marijuana.

[21] https://www.floragrowth.com/flora-growth-corp-reports-second-quarter-2024-financial-results/

[22] https://www.abajournal.com/web/article/cannabis-reclassified

[23] https://apnews.com/article/marijuana-trump-kamala-harris-dea-election-bdf75d4cd71fda5975fd3dcf29638499

[24] https://www.investing.com/news/company-news/flora-growth-director-harold-wolkin-purchases-24255-in-stock-93CH-3612390

[25] https://www.newsfilecorp.com/release/204788

[26] https://www.sahmcapital.com/news/content/roth-mkm-reiterates-buy-on-flora-growth-lowers-price-target-to-6-2024-05-16

[27] https://prohibitionpartners.com/reports/the-germany-cannabis-report/

[28] https://www.worldometers.info/world-population/germany-population/

[29] https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=DE

[30] https://mjbizdaily.com/german-cannabis-imports-rise-to-34-tons/

[31] https://www.sphericalinsights.com/press-release/cannabis-market#:~:text=According%20to%20a%20research%20report,22.2%25%20during%20the%20projected%20period.

[32] https://apnews.com/article/harris-positions-flipflop-trump-marijuana-death-penalty-f35dbacc2137e6aebc214befd4503ff8

[33] https://x.com/KamalaHarris/status/1791208525412114926

[34] https://www.forbes.com/sites/emilyearlenbaugh/2024/08/07/harris-walz-is-first-major-ticket-to-support-cannabis-legalization/

[35] https://www.theguardian.com/us-news/article/2024/aug/31/donald-trump-recreational-marijuana-florida

[36] https://www.findlaw.com/cannabis-law/starting-a-cannabis-business/can-marijuana-dispensaries-use-traditional-banks-.html

[37] https://www.merkley.senate.gov/the-big-problem-for-marijuana-companies-what-to-do-with-all-that-cash/

[38] https://www.abajournal.com/web/article/cannabis-reclassified

[39] https://www.americanbar.org/groups/business_law/resources/business-law-today/2022-april/a-cannabis-conflict-of-law-federal-vs-state-law/

[40] https://www.floragrowth.com/flora-growth-closes-acquisition-of-franchise-global-health-cementing-foothold-in-germany-and-the-european-union/

[41] https://www.floragrowth.com/new-leader-in-german-cannabis-created-with-acquisition-of-truhc-leading-eu-gmp-medical-cannabis-producing-facility-on-historic-day-germany-legalizes-recreational-cannabis/

[42] https://thebreakthrough.org/issues/energy/a-very-green-carbon-footprint#:~:text=As%20it%20turns%20out%2C%20the,an%208%2Dounce%20sirloin%20steak.

[43] https://www.floragrowth.com/about-us#our-approach

[44] https://www.floragrowth.com/investors/news-events/2024/flora-growth-corp-enters-into-definitive-agreement-to-acquire-truhc