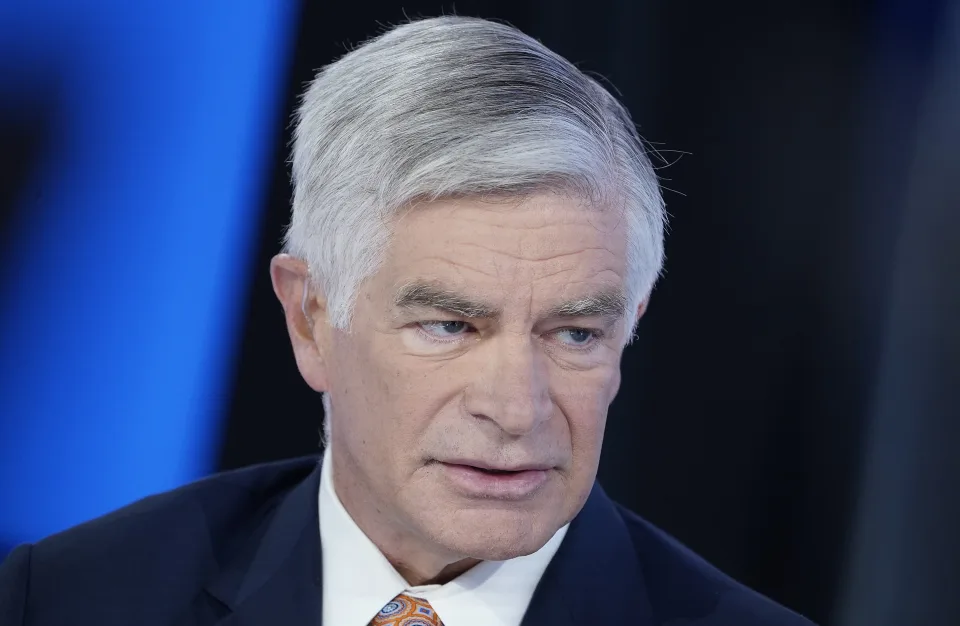

Philadelphia Fed president Patrick Harker said he expects the central bank to start with a 25 basis point cut as it begins to ease monetary policy and he would be open to a larger cut if the labor market deteriorates suddenly.

“Starting at 25 makes a lot of sense to me,” Harker told Yahoo Finance Friday during an interview at the Kansas City Fed’s annual economic symposium in Jackson Hole, Wyo.

While he is open to the idea of a larger cut if it becomes clear the labor market is in trouble, “right now that is not in our forecast.”

The new comments from the regional Fed president came just hours after Fed Chair Jerome Powell said in a speech at Jackson Hole that “the time has come for policy to adjust,” giving markets the all-clear sign that lower rates are coming.

Powell’s speech comes just over three weeks out from the Fed’s Sept. 17-18 meeting, which should see the central bank announce its first interest rate cut since 2020.

But Powell was silent on whether a first cut would be 25 basis points or 50 and whether September was, in fact, the starting point, saying “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

However, market bets that a larger move will come in September moved up Friday morning. Markets are pricing in a 34.5% chance the Fed cuts by 50 basis points by the end of its September meeting, up from a roughly 24% chance seen the day prior, per the CME’s FedWatch Tool.

Former Cleveland Fed president Loretta Mester — who stepped down from the central bank’s rate-setting committee less than two months ago — told Yahoo Finance in an interview that she wouldn’t want to start with 50 basis points because “that is really signaling the Fed is behind the curve and I don’t believe the Fed is.”

“I think a reasonable baseline would be doing 25,” she added.

Former Fed vice chair Alan Blinder, on the other hand, would have preferred to see the Fed cut at its last meeting in July.

“I think they are a little behind the curve,” he told Yahoo Finance, but added: “not drastically.”

Harker said the Fed will let the data dictate whether a cut is 25 or 50 basis points and that the “process is more important” than the actual number.

“The right direction is clearly down,” and “I don’t think we are behind the curve at all.”

Mester said she can see the Fed pulling the trigger on three 25 basis point cuts at its last three meetings of 2024.

The real challenge for the central bank, she said, is to get inflation all the way down to its 2% target while keeping labor markets healthy.

It has a “good shot” at achieving that sort of soft landing, she added.

Harker agreed.

“Right now things look pretty good,” he said.