Swedish fintech giant Klarna is rolling out two new products on Thursday that could make its buy now, pay later offerings more enticing to use.

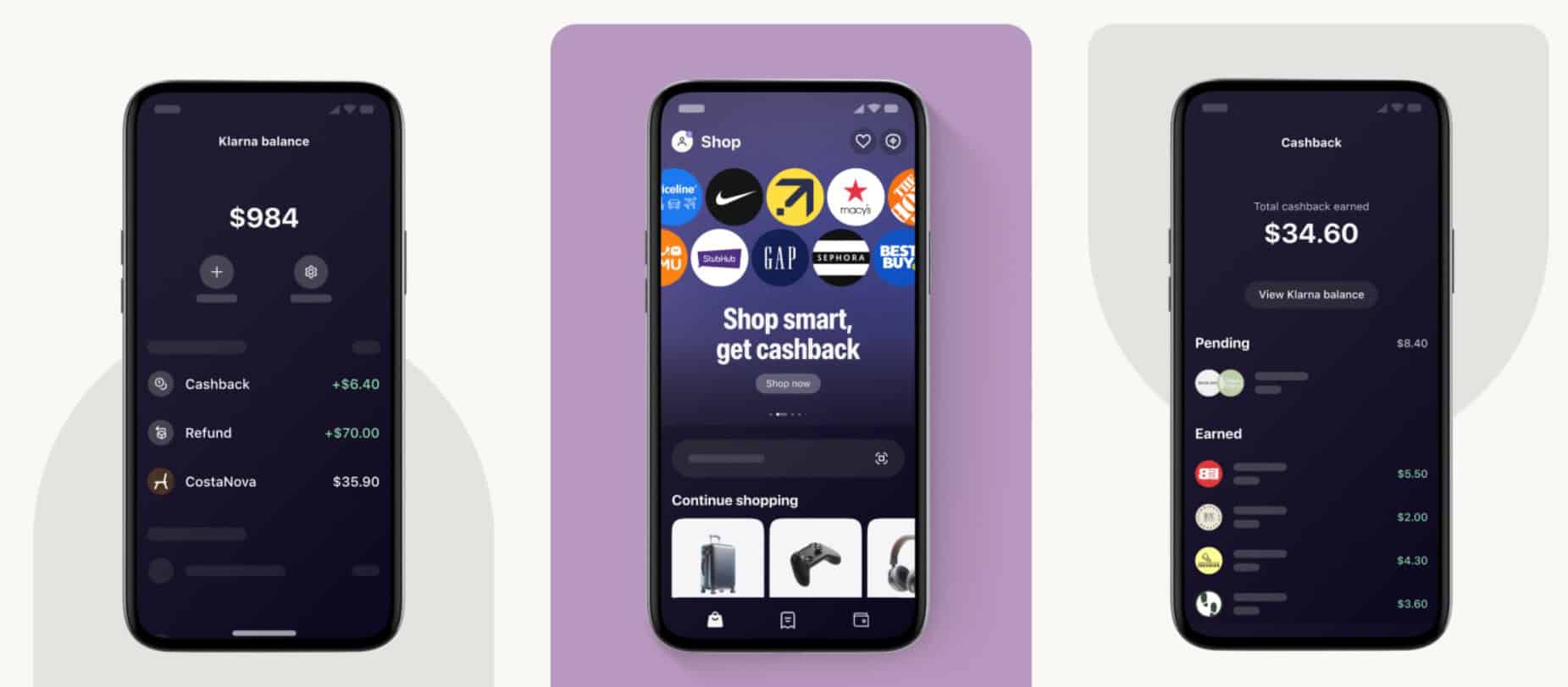

The company is offering consumers in the U.S. and 11 European countries the ability to store money in a Klarna “balance” account, where they can deposit money directly from their bank account. They can use the money to pay for purchases in full or to pay for their installments when they use Klarna’s BNPL service.

Klarna’s marketing slogan for this is “save now, pay later,” the company said. Klarna isn’t offering shoppers interest on that cash account like a typical savings account in the United States yet but “the plan is to get there,” according to a company spokesperson. It does pay interest of up to 3.58% in Europe, she added.

The company is also offering consumers the ability to get cash back on shopping without using a Klarna-issued credit card. Consumers making purchases through the Klarna app will now be able to earn a percentage of those buys at participating retailers. That money will be stored in their Klarna balance account. The cash-back percentage varies by retailer but can be as high as 10%. It is funded by the merchants, not Klarna.

The company also said these cash-storing accounts may give consumers other benefits in the future, though didn’t hint at what those may be.

“Klarna Balance is focused on being a place where consumers can receive their cash-back payments and get refunds more quickly,” the spokesperson said. “However, they have big plans to build the product features out over time.”

It’s an interesting twist for 19-year-old Klarna, which started out as a buy now, pay later company and has gradually evolved its model over the years. It moved toward offering more traditional banking products several years ago when it unveiled the Klarna card first in Sweden in mid-2019 and then in Germany in 2021 and the United Kingdom in 2022. The card was released to a waitlist in the United States in April, marking the first time consumers in the U.S. could apply for one. It is now available to consumers in the U.S.

In announcing that card, Klarna said users would earn up to 10% cash back on selected merchants when using the card in its app. But as mentioned, with these new offerings, they don’t necessarily have to use the card to earn cash back. The card put Klarna in competition with the likes of Apple and, more recently, Robinhood, as well as rival BNPL player Affirm in offering a credit card in the United States. Robinhood offers a savings account, with the ability to earn 5% interest if you’re a Gold member.

It’s not likely that Klarna will be competing directly with the likes of digital bank Revolut, one of Europe’s most valuable companies, anytime soon. But with products like these, it sure seems like that’s the direction in which it hopes to be heading.