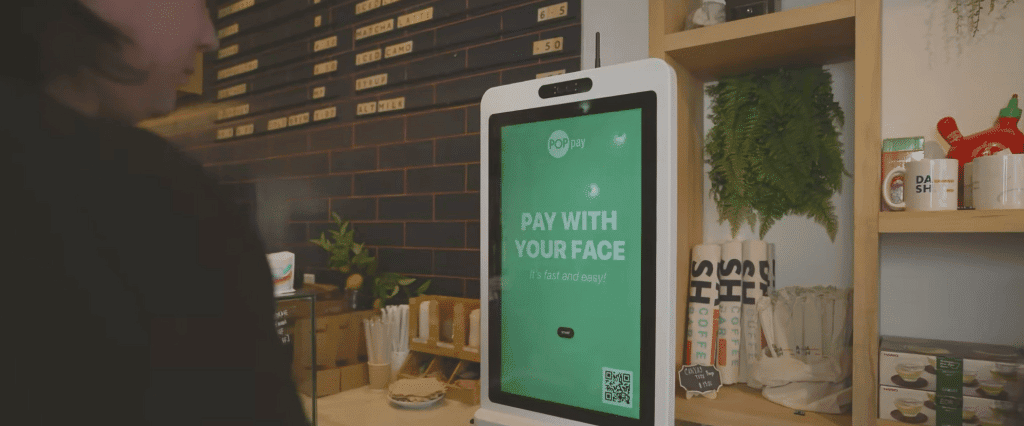

JP Morgan Payments is to deploy in-store biometric payment technology among select pilot merchants in the US, through its newly expanded partnership with California-based facial recognition solutions provider PopID.

The checkout solution enables shoppers to authenticate payments using the unique features of their face, without the need to present a physical card or digital wallet.

The process is powered by PopID, a majority-owned subsidiary of Cali Group which handles enrolment for the solution, while JP Morgan Payments manages payment processing.

The pair first debuted the solution in March last year among brick-and-mortar retailers in the US, with South Florida Motorsports – the organiser of the Formula 1 Crypto.com Miami Grand Prix – being one of the first notable takers.

JP Morgan Payments claims that a proof of concept completed with the retailer that year produced a 100% transaction authentication rate, with processing reduced to “under a second”.

One of the latest confirmed recipients of the solution is US restaurant chain Whataburger, which already uses PopID to accept biometric payments but will now extend this capability with payments processing powered by JP Morgan Payments.

Jean-Marc Thienpont, MD of omnichannel and biometric solutions at JP Morgan Payments, describes the solution’s latest development as “a giant step forward in helping our clients reimagine the entire retail experience”.

“We offer something that is hard to match – the stability, scale and trust of a world-class bank combined with the technology and agility of a fintech,” he claims.

Elsewhere, the payments division is also currently applying the person match and identity document verification technology of software provider Trulioo to power its personal and business identity verification services.