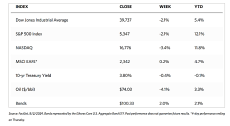

Stock Markets

The weekly performances of major stock indexes plummeted across the board. The 30-stock Dow Jones Industrial Average (DJIA) fell by 2.10%, mirroring the Total Stock Market Index which dropped by 2.51%. The broad-based S&P 500 Index slumped by 2.06% with small, mid, and large-cap components down. The technology-heavy Nasdaq Stock Market Composite lost 3.35%, and the NYSE Composite Index gave up 2.17%. The investor risk perception indicator, the CBOE Volatility Index (VIX) shot up by 42.71%, suggesting that the market expects significant volatility in the coming days.

Investors reacted to the busiest week of the quarterly earnings reporting season which is arguably also the most important week of the monthly economic data. During the week, companies representing almost 40% of the S&P 500’s market capitalization reported second-quarter earnings. Among them are four of the so-called Magnificent Seven – Microsoft, Meta Platforms (parent of Facebook) Apple, and Amazon.com. Results varied relative to consensus expectations. However, expectations for heavy capital spending to build out artificial intelligence (AI) capabilities appeared to be a common theme.

U.S. Economy

The closely watched nonfarm payrolls report was released on Friday, and it was the main driver of sentiment for the week. The data indicated more rapid cooling in the labor market than was originally thought. According to the Labor Department, the economy added only 114,000 jobs in July which is well short of expectations and the lowest number in three months. Only 97,000 jobs originated from the private sector, the lowest in 15 months. Surprising on the high side is the jump in the unemployment rate from 4.1% to 4.3%, its highest level since October 2021. The Labor Department reported earlier that the number of Americans leaving jobs voluntarily dropped to 3.82 million in June, the lowest number since November 2020. The quits rate is considered by many observers to be a more accurate metric of labor market conditions than the number of job openings. Job openings fell slightly to 8.18 million but remain above 7.92 million, its April low.

Another event that shook the confidence of investors in the strength of the economy seems to be the release on Thursday of the gauge of July manufacturing activity by the Institute for Supply Management (ISM). This surprised on the low side, falling unexpectedly to 46.6 its lowest level since November. Ratings below 50.0 are indicative of contraction. This week’s reading marks nearly two years of almost continuous contraction in the sector. Manufacturing jobs remained roughly steady in July, however, while the tech sector shed 20,000 jobs. In the aftermath of both the ISM manufacturing report and the jobs data, longer-term interest rates plummeted, sending the yield on the benchmark 10-year Treasury note to its lowest intraday level of 3.79% since late December.

Metals and Mining

Since mid-2022, the gold market has been pricing in a pivot from the Federal Reserve. Investors were not disappointed this week when they got the signal they were waiting for after two years of lackluster trading. The Fed signaled to the market that it expects to cut interest rates in September. After the central bank left interest unchanged in its last meeting, Fed Chair Jerome Powell declared in a press conference that the body was amenable to considering a rate cut “as soon as the next meeting.” He also mentioned that “We think the time is approaching.” The dovish stance hinted at by the Fed propelled gold price to a new record high of $2,500 an ounce. Although the Fed is finally open to cutting rates, it might be too late as fears of an impending recession are intensifying. On Friday morning, following significantly disappointing employment numbers, gold demand heightened as a solid safe-haven asset in the face of heightened risk.

The spot prices for precious metals generally rebounded from their recent weekly corrections. Gold shot up by 2.35% from its close last week at $2,387.19 to end this week at $2,443.24 per troy ounce. Silver began at its previous weekly close of $27.93 and climbed by 2.26% to end this week at $28.56 per troy ounce. Platinum, which was priced at $940.30 at the end of trading last week, closed this week at $959.95 per troy ounce for a weekly gain of 2.09%. Palladium closed this week at 895.22 per troy ounce, a loss of 1.09% from last week’s close at $905.09. The three-month LME prices of industrial metals were mixed. Copper, which previously closed at $9,122.00, ended this week at $9,055.50 per metric ton for a loss of 0.73%. Aluminum closed this week at $2,263.50 per metric ton, down by 0.31% from its previous weekly close of $2,270.50. Zinc gave up 1.04% from its close last week at $2,681.00 to end this week at $2,653.00 per metric ton. Tin, which closed last week at $29,416.00, ended this week at $30,188.00 per metric ton for a weekly gain of 2.62%.

Energy and Oil

This week saw a sudden escalation of geopolitical tensions brought about by Israel’s strike in Lebanon and the assassination of Hamas leader Ismail Haniyeh in Iran. These events should have sent oil prices skyrocketing. Iran’s failure to mount a swift retaliation is one factor that dampened sentiments for a possible rally. Furthermore, the OPEC+ meeting failed to surprise the markets this week, and there remain lingering demand concerns, which contributed to dragging oil prices back down. The August 1 online meeting of OPEC+ ministers left the oil group’s current policy unchanged, with participating members reiterating their intent to start unwinding the third layer of voluntary production cuts beginning October 2024.

Natural Gas

For the report week from Wednesday, July 24 to Wednesday, July 31, 2024, the Henry Hub spot price fell by $0.10 from $2.03 per million British thermal units (MMBtu) to $1.93/MMBtu. Regarding the Henry Hub Futures, the August 2024 NYMEX contract expired Monday at $1.907/MMBtu, down by $0.21 from the start of the report week. This settlement price for the August 2024 contract is the lowest since trading of this contract began 12 years ago. The September 2024 NYMEX contract price decreased to $2.036/MMBtu, down by $0.12 from the start to the end of the report week. The price of the 12-month strip averaging September 2024 through August 2025 futures contracts declined by $0.08 to $2.905/MMBtu.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for LNG cargoes in East Asia increased by $0.21 to a weekly average of $12.35/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.43 to a weekly average of $10.70/MMBtu. In the week last year corresponding to this report week (beginning July 26 and ending August 2, 2023) the prices were $10.91/MMBtu in East Asia and $8.92/MMBtu at the TTF.

World Markets

European stocks ended lower this week on the back of weak U.S. economic data that triggered concerns about a likely global recession ahead. The pan-European 600 Index closed the week 2.92% lower than last week in local currency terms. Major continental stock indexes also declined significantly. Italy’s FTSE MIB plummeted by 5.30%, Germany’s DAX plunged by 4.11%, and France’s CAC 40 Index tumbled by 3.54%. The UK’s FTSE 100 Index dropped by 1.34%. The market also priced in the possibility of more rate cuts from the European Central Bank later this year, bringing UK gilt yields and German bund yields lower. The Bank of England (BoE) lowered borrowing costs for the first time in four years. The BoE cut its key interest rate by a quarter point to 5.00%, its first reduction in borrowing costs since the coronavirus pandemic began in March 2020. The move to reduce rates was a split decision, however, as the Monetary Policy Committee voted 5-4 in favor of the cut. Governor Andrew Bailey cautioned against embarking on a rapid succession of rate cuts, emphasizing that “We need to make sure that inflation stays low and be careful not to cut interest rates too quickly or by too much.” The eurozone economy in the second quarter grew by a faster-than-expected 0.3% sequentially, translating to 0.6% year-over-year. The economies of France, Italy, and Spain expanded, but counter to expectations, Germany’s economy contracted.

Japan’s stock markets suffered heavy losses this week as the Bank of Japan (BoJ) took a hawkish turn. The Nikkei 225 Index fell by 4.7% and the broader TOPIX Index came down by 6.0%. Disappointing U.S. macroeconomic data which dropped on the last trading day of the week dampened investor risk appetite. The drop in the Nikkei was comparable to its one-day plunges in March 2020 when the coronavirus pandemic hit, which were among the biggest in the index’s history. It was also comparable to the “Black Monday” global stock market crash in October 1987. Meanwhile, the earnings outlooks for Japan’s export-oriented companies were hampered by a rebounding yen. Japan’s currency strengthened to around JPY 148.9 against the U.S. dollar from about JPY 153.7 at the end of the previous week. Regarding fixed-income investments, the yield on the 10-year Japanese government bond (JGB) fell from the prior week’s 1.06% to this week’s 0.98%. In a quarterly outlook, the BoJ lowered its core inflation outlook for fiscal year 2024 from 2.8% forecast in April to 2.5%. The bank also slightly cut its growth outlook from 0.8% to 0.6%.

After weak manufacturing data tempered investor sentiment, Chinese equities ended mixed. The Shanghai Composite Index rose by 0.5% while the blue-chip CSI 300 declined by 0.73%. The Hong Kong stock market benchmark Hang Seng Index fell by 0.45%. On the economic front, the official manufacturing Purchasing Managers’ Index (PMI) dipped to 49.4 in July compared to 49.5 in June which is contractionary since it falls below the borderline of 50.0. The non-manufacturing PMI slipped to 50.2 from 50.5 in June, in line with expectations. The non-manufacturing PMI measures construction and services activity. Officials declared in a statement following the release that the declines are attributed to seasonal factors and extreme weather events in some Chinese cities. At industrial firms, profits rose by 3.6% in June compared to one year ago. It is up from a 0.7% gain in May, as shown by official data. Amid stronger industrial production growth and slower producer price declines, a steady recovery in topline revenue drove June’s rise. However, speculation that Beijing will continue to roll out measures to shore up the economy has been raised by persistent weakness in domestic demand, as recent stimulus measures have done little to boost consumption.

The Week Ahead

Among the important economic releases scheduled this week are the ISM Services PMI for July, the U.S. trade deficit for June, and consumer credit data.

Key Topics to Watch

- S&P final U.S. services PMI for July

- ISM services for July

- The U.S. trade deficit for June

- Consumer credit for June

- Initial jobless claims for Aug. 3

- Wholesale inventories for June

- Richmond Fed President Tom Barkin speaks (August 8)

Markets Index Wrap-Up