Stock Markets

The Dow Jones Industrial Average (DJIA), which consists of 30 stocks, inched up by 0.54% for the week, while the Dow Jones Total Stock Market Index jumped by 1.33%. The broad S&P 500 Index is up by 1.54% while the technology-heavy Nasdaq Stock Market Composite added 2.77% and outperformed all the other major indexes. The NYSE Composite is up by 0.50%, mirroring the DJIA. Investor risk perception as reflected by the CBOE Volatility Index (VIX) went up by 1.96% for the week.

The S&P 500 continued to break into new highs despite the notably narrow market advance. Growth shares outperformed value stocks by 415 basis points, as measured by the Russell 1000 indexes, while the small- and mid-cap benchmarks registered losses. The Nasdaq Composite, which tracks technology (growth) stocks, closed this week 73.71% off its lows since the market turned and reversed its downtrend in mid- to late-2022, while the more value-oriented and narrowly focused DJIA had achieved half that increase, 32.79%. A major factor for investors to favor growth stocks was the expectation for lower interest rates, fed by weakening growth and easing inflation pressures. This combination places a lower implied discount on future earnings. Volume was light this week partly due to the Independence Day Holiday when the markets were closed.

U.S. Economy

On Monday, the Institute for Supply Management (ISM) posted its lowest reading of manufacturing activity since February at 48,5, a level in contraction territory. A surprise contraction in construction activity was also signaled by a separate reading. More surprising is a report released on Wednesday showing a sharp downturn in the ISM’s gauge of current services sector activity. This metric plunged from 53.8 in May to 48.8 in June, a full five points into contraction territory. It is also the index’s lowest level since soon after the start of the pandemic lockdowns in early 2020. According to the survey respondents, the high gas prices and worries over elevated restaurant menu prices were weighing on consumers. The survey’s chief researcher and other observers hope, however, that the drop will eventually prove to be an anomaly. By comparison, S&P’s Global rival survey rose from 55.1 to 55.3, indicating continued expansion and even a slight acceleration.

The week’s important jobs data was similarly mixed on the health of the economy. The Labor Department’s JOLTS report revealed on Tuesday that job openings slightly increased to 8.14 million in May but the same statistic was downwardly revised to 7.9 million in April, the lowest level in more than three years. Likewise, the tally of private sector job growth by payroll processor ADP was released on Wednesday. The job tally fell more than expected, from 160,000 in May to 150,000 in June. Chief US Economist Blerina Uruçi noted that the JOLTS data showed both quits and hiring back to pre-pandemic levels, indicating sustained loosening in the labor market. Labor market cooling does not, however, signify weakness.

Metals and Mining

The precious metals market was up for the week. Gold, which ended at $2,326.75 last week, closed this week at $2,392.16 per troy ounce for an appreciation of 2.81%. Silver ended at $31.22 per troy ounce, higher by 7.14% over last week’s close at $29.14. Platinum came from $996.26 last week to end at $1,030.09 per troy ounce this week, an increase of 3.40%. Palladium was worth $977.10 last week but gained by 5.37% to settle at the closing price of $1,029.57 per troy ounce. The three-month LME prices of base metals are also up during this week’s trading. Copper closed at $9,944.00 per metric ton, 4.50% higher than its close last week at $9,515.50. Aluminum ended the week at $2,535.50 per metric ton, 1.73% above last week’s closing price of $2,492.50. Zinc settled this week at $3,001.00 per metric ton, higher than the previous week’s close at $2,929.50 by 2.44%. Tin, which traded last week at $32,208.00, closed this week at $33,874.00 per metric ton, higher by 5.17%.

Energy and Oil

US markets were closed for the Independence Day Holiday thus market activity was relatively light. Hopes were instilled among investors that summer demand would not be that bad after all, as indicated by the triple combination of lower US crude, gasoline, and diesel inventories. Crude is set for another weekly gain with ICE Brend ending the week above $87 per barrel The bullish sentiment is driving the market amid increasing optimism for US interest rate cuts in September. In the meantime, in defiance of the White House snapback of sanctions, Venezuela increased its oil production last month to 922,000 barrels per day (b/d), up from 912,00 b/d in May, due to increasing activity in new drilling and well workovers.

Natural Gas

For the report week from Wednesday, June 19 to Wednesday, June 26, 2024, the Henry Hub spot price rose by $0.06 from $2.39 per million British thermal units (MMBtu) to $2.45/MMBtu. Regarding Henry Hub futures, the July 2024 NYMEX contract expired at the end of the report week at $2.628/MMBtu, down by $0.11.3 from the start of the week. The August 2024 NYMEX contract price decreased to $2.745/MMBtu, down by $10.9 from the start to the end of the report week. The price of the 12-month strip averaging August 2024 through July 2025 futures contracts declined by $0.085 to $3.268/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.25 to a weekly average of $12.61/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.27 to a weekly average of $10.75/MMBtu. In the week last year corresponding to this report week (beginning June 21 and ending June 28, 2023), the prices were $11,96/MMBtu in East Asia and $10.72/MMBtu at the TTF.

World Markets

European stocks ended higher this week. The pan-European STOXX Europe 600 Index closed the week 1.01% higher in local currency terms. The favorable turn is attributable to the easing of political jitters as the far right in France failed to win an outright majority in the first round of legislative elections on June 30. In the UK, the Labour Party won the general elections on July 4 with a large majority. Major stock indexes in the region climbed. France’s CAC 40 surged by 2.62%, Italy’s FTSE MIB advanced by 2.51%, and Germany’s DAX added 1.32%. The UK’s FTSE 100 Index gained by 0.49%. In the last European Central Bank’s (ECB’s) annual retreat in Portugal, Christine Lagarde, ECB President, struck a more hawkish tone. According to Lagarde, Europe is “still facing several uncertainties regarding future inflation, especially in terms of how the nexus of profits, wages, and productivity will evolve and whether the economy will be hit by new supply-side shocks… It will take time for us to gather sufficient data to be certain that the risks of above-target inflation have passed.” The year-over-year change in consumer prices ticked lower in June to 2.5%, as a final estimate of eurozone inflation confirmed. A crucial services component, however, remains stubbornly high and reinforces the ECB’s cautious approach.

Japan’s stocks generally ended the week higher, and both its major stock indexes hit all-time highs during the week. The Nikkei 225 Index climbed 3.36% while the broader TOPIX Index gained 2.56% in local currency terms. The stellar performance of equities was in part propelled by the weakness in the yen, typically a tailwind for export-focused industries. Later in the week, the yen slightly recovered. Members of Japan’s biggest union group achieved an average wage increase of 5.1%, the largest increase in 33 years, based on data from the union group. The final wage increase statistic, which included more small businesses, came in at a 5.28% wage hike, highlighting the strong upward wage momentum. In May, household spending declined by 1.8% year-over-year, short of the consensus estimate of a 1% increase. Consumer spending slid by 0.3% compared with the consensus estimate for an increase of 0.5% month-over-month. The weak spending appeared to be dependent upon the weak yen, particularly for the demand for overseas package tours. A 3.1% decline in outlays for food year-on-year appeared to have been driven by rising prices.

Chinese stocks fell due to the lackluster manufacturing data that heightened concerns about China’s slowing economy. Both the Shanghai Composite Index and the blue-chip CSI 300 recorded modest losses for the week. The Hong Kong benchmark Hang Seng Index rose by 0.46% during the holiday-shortened week. Markets in Hong Kong were closed on Mondy in commemoration of the Special Administrative Region Establishment Day. Government data showed that China’s manufacturing sector shrank in June for the second consecutive month. As new orders and exports declined, the official manufacturing purchasing managers’ index (PMI) reached 49.5 in June, unchanged from May. Since the figure still missed the 50-mark threshold, the index remained in contraction. The nonmanufacturing PMI, which measures construction and services activity, registered 50.5 which, while expansionary, is below consensus estimates and down from 51.1 in May. On the other hand, the value of new home sales by China’s top 100 developers fell by 17% in June from last year, slowing down from a 34% decline in May. This data released by the China Real Estate Information Corp. raises hopes that the Chinese housing market, now on a downturn for its fourth consecutive year, may begin to gain traction after the government’s sweeping rescue package in May.

The Week Ahead

The CPI and PPI inflation data for June as well as a read on the preliminary consumer sentiment for July are among the important economic releases in the coming week.

Key Topics to Watch

- Consumer credit for May

- NFIB optimism index for June

- Fed Chairman Powell testimony to Senate (July 9)

- Wholesale inventories for May

- Fed Chairman Powell testimony to House (July 10)

- Initial jobless claims for July 6

- Consumer price index for June

- CPI year over year

- Core CPI for June

- Core CPI year over year

- Louis Fed President Alberto Musalem speaks (July 11)

- Monthly U.S. federal budget by June

- Producer price index for June

- PPI year over year

- Core PPI by June

- Core PPI year over year

- Consumer sentiment (prelim) July

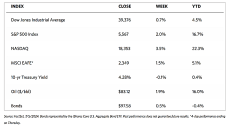

Markets Index Wrap-Up