As Walmart and Amazon leverage their paid membership programs to drive loyalty, the former is seeing millennials prove to be the most eager to subscribe.

By the Numbers

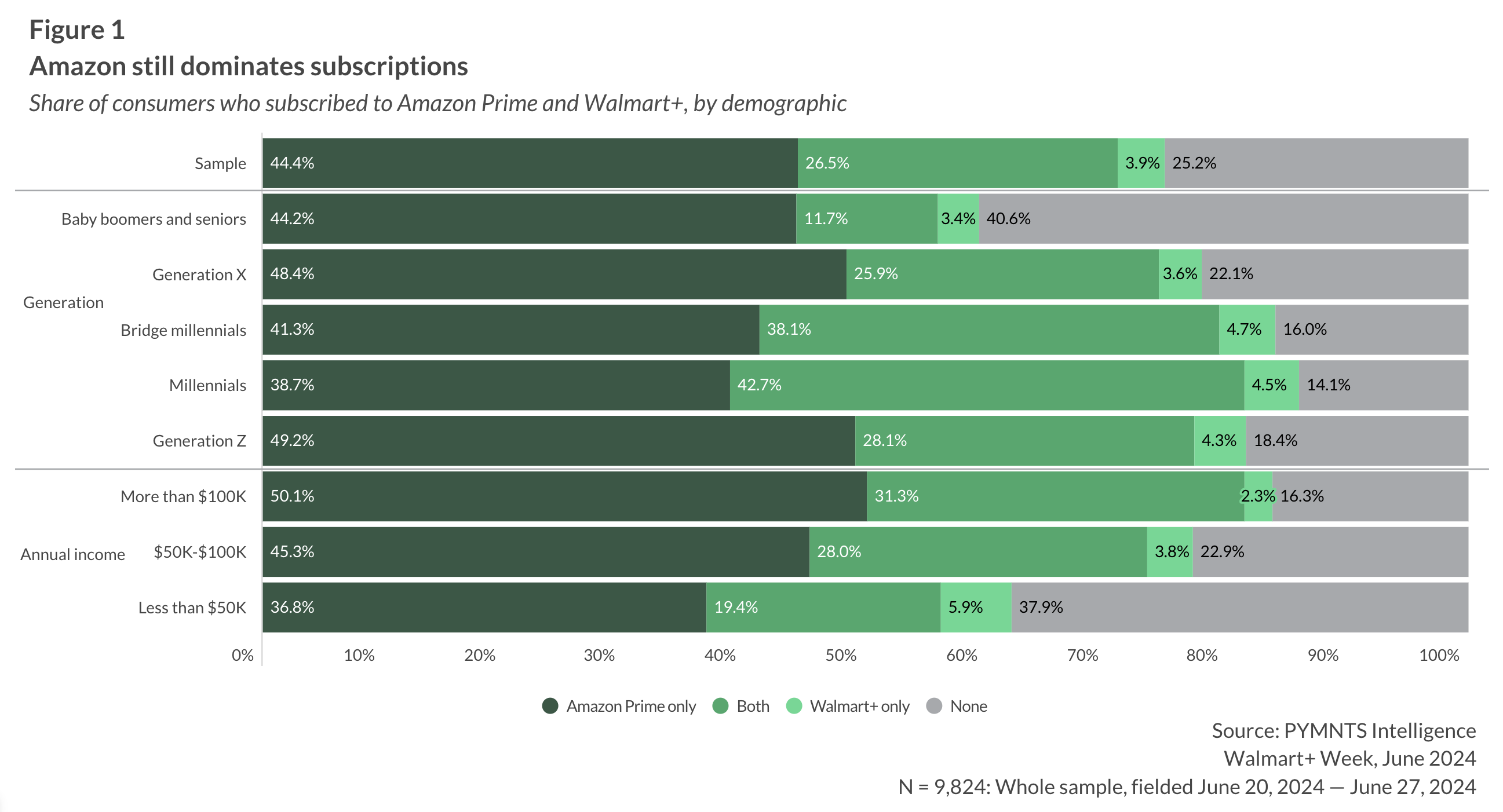

“Walmart+ Week 2024,” a new PYMNTS Intelligence report, digs into consumer trends regarding subscriptions and purchases during Walmart+ Week, drawing on a survey of more that 7,700 respondents in late June.

The study revealed that, overall, roughly 30% of consumers subscribe to or have access to a Walmart+ account, and among those subscribers, the vast majority — 87% — also have an Amazon Prime account.

That share rises by more than 50% when looking specifically at millennials, of whom 47% hold or have access to a Walmart+ account, and 90% of those also have access to a Prime Membership.

In contrast, baby boomers and seniors are the least likely to hold paid Walmart+ subscriptions, with only 15% of those in this age bracket doing so. Yet that is not to say that these older consumers are strangers to retail subscriptions. The majority — six in 10 — of them hold at least one Amazon Prime or Walmart+ subscription.

The Data in Context

“Walmart+ continued to grow double digits as members engage with us more frequently and spend more than other customers,” Walmart CFO John David Rainey told analysts on the retail giant’s most recent earnings call in May.

CEO of Walmart U.S. John Furner added that the program “is an important part of what we do,” and improving fulfillment has been key to growing the program.

Amazon, meanwhile, is seeing its Prime membership prove a key priority internationally, a make-or-break factor for success as it continues its global expansion.

“We’ve launched 10 new countries in the last seven years. Each of those has its own particular trajectory on profitability. The first thing we see there is having a good customer experience, having people sign up for Prime,” CFO Brian Olsavsky told analysts in April. “ … Then work on our cost structure as we get scale, ad advertising and other things. And eventually, what we see is a break-even countries breakeven, and then they make … [a] positive contribution to the international segment.”