Stock Markets

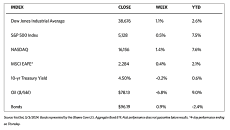

Major indexes have all registered gains for the week as they continue their uptrend after a brief period of consolidation. The 30-stock Dow Jones Industrial Average (DJIA) added 1.14% while its Total Stock Market Index rose by 0.63%. The broad S&P 500 Index climbed by 0.55% with Midcap 400, Small Cap 600, and Super Composite 1500 chalking gains of 1.17%, 1.36%, and 0.60% respectively. The technology-heavy Nasdaq Stock Market Composite advanced by 1.43%, while the Russell 1000, 2000, and 3000 indexes all ended higher for the week, indicating that gains were broad among equities. The CBOE Volatility Index (VIX), an indicator of risk perception among investors, was down by 10.25% signifying growing optimism.

While the indexes ended generally higher, the trading week was volatile and featured a raft of economic and earnings data. The week was busy with first-quarter earnings reports, although a rebound in overall sentiment on the last trading day appeared to have been driven by a spillover positive reception to Apple’s earnings release after trading closed on Thursday. The company beat consensus revenue estimations, however, investors were further energized by Apple’s announcement that it would buy back USD 110 billion of its shares, the largest such repurchase in history.

U.S. Economy

Last week, the Federal Reserve held interest rates steady since inflation readings for 2024 reveal that growing inflation has not yet been solved. The Fed noted that conditions are not improving at a pace that supports a policy change anytime soon. Analysts feel that while the next Fed action will be to cut rates, it may occur much later in the year, or possibly in the next year. Another defining factor last week was news of developments in the labor market. Early in the week, labor cost data sparked concerns that inflation may prevail for a longer period. The Labor Department reported that employment costs rose by 1.2% in the first quarter, or at an annualized rate of nearly 5%, which was the fastest pace in a year and well above expectations. A separate report revealed that home prices rose in February at their fastest pace in eight months. Both reports contributed to a sharp fall in stock prices on Tuesday.

However, later in the week, the jobs report came in cooler than expected and allayed inflation worries while signaling employment conditions that remain supportive for consumers. The main driver of the end-of-week rally appears to be the nonfarm payrolls report released on Friday morning. It showed that employers added 175,000 jobs in April, which is the lowest number since November and less than consensus estimates. The lower figure may buoy optimism as it may be a sign that economic activity is cooling down and lowering inflation may soon follow. The report also indicated a surprise slowdown in monthly wage increases, from 0.3% in March to 0.2% in April. The year-over-year gain in wages slid to 3.9%, the slowest pace in almost two years. The unemployment rate climbed slightly to 3.9% while the average weekly hours worked also slowed modestly.

Metals and Mining

In what may be signs of a possibly fatigued market, traders took advantage of the recent rally to realize some profits and wait for further consolidation. The gold market manages to hold support above $2,300 per ounce, however, it closes this week with a slight loss. There is every indication that gold continues to consolidate after its massive $400 rally as sentiment normalizes. Focus once more shifts towards actions the Federal Reserve may take in its monetary policy and interest rates. Before the disappointing employment figures released last Friday, the Fed already signaled that it will not be reversing interest rates soon; this will limit the upside to the gold market in the short term. The consolidation period is not, however, entirely disadvantageous. It allows investors the chance to establish tactical positions at lower prices and avoid chasing the market when the rally resumes. Some major banks see the gold challenging new ceilings within the year. Goldman Sachs, for instance, sees prices rallying to $2,700 before the year ends.

The spot prices of precious metals ended the week mixed. Gold closed the week at $2,301.74 per troy ounce, down by 1.55% from its close last week at $2,337.96. Silver ended the week at $26.56 per troy ounce, lower from its close last week at $27.21 by 2.39%. Platinum ended the week 4.41% higher than last week’s close at $917.04 to close this week at $957.44 per troy ounce. Palladium came down by 1.43% from its closing price of $958.15 last week to end at $944.49 per troy ounce this week. Also closing mixed for the week were the three-month LME prices for industrial metals. Copper ended this week at $9,910.00 per metric ton, down by 0.56% from last week’s closing price of $9,965.50. Aluminum closed this week at $2,551.50 per metric ton, lower than last week’s closing price of $2,569.50 by 0.70%. Zinc ended the week at $2,903.00 per metric ton, which is higher than last week’s close at $2,844.00 by 2.07%. Tin, which closed last week at $32,411.00, last traded this week at $31,983.00 per metric ton, lower by 1.32%.

Energy and Oil

A notable drop in oil prices has been triggered by the disappointing money markets with more hotter-than-expected U.S. inflation data. The prognosis is aggravated by higher crude inventories and slackening geopolitical risk. For instance, on the heels of U.S. sanctions, demand for Venezuela’s heavy barrels cut this country’s oil exports by a whopping 38% month-over-month to a mere $545,000 barrels per day, prompting at least six VLCCs to leave Venezuela empty in recent weeks. Despite these factors, both WTI and Brent prices fell by more than $5 per barrel since last week. Neither was the sentiment boosted by falling middle distillate and gasoline cracks. It seems that only a high-impact supply distribution would be capable of breaking the bearish streak currently prevailing in the oil market.

Natural Gas

For the report week from Wednesday, April 24, to Wednesday, May 1, 2024, the Henry Hub spot price rose by $0.04 from $1.59 per million British thermal units (MMBtu) to $1.63/MMBtu. Regarding Henry Hub futures, the May 2024 NYMEX contract expired on Friday at $1.614/MMBtu, down by $0.04 from the beginning of the report week. The June 2024 NYMEX contract price descended to $1.932/MMBtu, down by $0.05 from the beginning to the end of the report week. The price of the 12-month strip averaging June 2024 through May 2025 futures contracts declined by $0.05 to $2.880/MMBtu.

International natural gas futures prices declined for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.21 to a weekly average of $10.31/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.30 to a weekly average of $9.07/MMBtu. By comparison, in the week last year corresponding to this week (the week from April 26 to May 3, 2023), the prices were $11.54/MMBtu in East Asia and $12.32/MMBtu at the TTF.

World Markets

In Europe, equities slightly lost some ground in the week just ended. The pan-European STOXX Europe 600 Index lost 0.48% in local currency terms. Amid mixed corporate earnings and uncertainty about the interest rate outlook after June, investors seem to exhibit greater caution in taking market positions. Major European stock indexes ended mixed. Losing ground were Italy’s FTSE MIB which declined by 1.81%, France’s CAC 40 Index which slid by 1.62%, and Germany’s DAX which fell by 0.88%. On the other hand, advancing by 0.90% was the UK’s FTSE 100 Index as it surged to a new high due to strength in the mining and energy stocks. There was a general decline in European government bond yields this week even as policymakers downplayed the growing concerns regarding future possible interest rate increases by major central banks. The yield on the German 10-year government bond dropped to 2.5%; likewise, the yield on the 10-year UK government bonds also eased. The first-quarter gross domestic product (GDP) report indicated that the economy grew faster than expected by expanding by 0.3% after it shrank 0.1% in the last quarter of 2023. The contraction for the last three months of 2023 was the result of a downward revision from 0.0%, which means that the Eurozone’s economy was in a technical recession during the second semester of 2023. Annual consumer price growth was steady in April at 2.4%. However, core inflation (excluding volatile components, namely energy and food prices) slowed from 2.9% to 2.7%.

Japanese stocks returned gains on the back of perceptions that the Japanese authorities had intervened in the foreign exchange markets twice during the week to prop up the yen. The Nikkei 225 Index rose by 0.8% while the broader TOPIX Index climbed by 1.6%. The likelihood that such interventions had taken place was suggested by changes in the Bank of Japan’s (BoJ’s) accounts. Authorities, however, avoided confirming having intervened to halt the historic slump of the currency. The yen strengthened to approximately JPY 153 versus the U.S. dollar, from about JPY 158 at the end of the week before. The yield on the 10-year Japanese government bond finished the week unchanged at 0.9%, near a six-month high, despite increased intraweek volatility. The markets are reacting to strong U.S. wage data that raised concerns that the Federal Reserve will maintain interest rates higher for longer. The BoJ lifted interest rates from negative territory in March for the first time in seven years. Many are thus anticipating two further rate hikes that are expected to occur within the coming year. Japan’s monetary policy remains among the most liberal in the world, and for the time being, financial conditions are expected to remain accommodative.

Markets in mainland China were closed from Wednesday for the Labor Day Holiday, and Chinese stocks rose during the shortened trading week on hopes that the government will ramp up support for the economy. The Shanghai Composite Index rose by 0.52% while the blue-chip CSI 300 inched up by 0.56%. In Hong Kong, its stock market benchmark Hang Seng Index ascended by 4.67%. The Hong Kong markets were also closed on Wednesday but reopened on Thursday. The mainland stock markets are scheduled to open on Monday, May 6. At its April meeting held on Tuesday, China’s 24-member Politburo, which is its top decision-making body, pledged to implement prudent monetary and fiscal support to shore up demand. According to government officials, China intends to make flexible use of monetary policy tools to restore growth. These tools include possible cuts to interest rates and the reserve requirement ratio, which sets the amount of cash that banks must set aside in reserve. In the economy, the official manufacturing Purchasing Managers’ Index (PMI) was better than expected (50.4 in April down from 50.8 in March) and marked a second consecutive monthly expansion. The nonmanufacturing PMI was 51.2 which was below consensus expectations, easing from 53 in March but remaining expansionary.

The Week Ahead

Outstanding consumer credit data, the Michigan Consumer Sentiment Survey, and wholesale inventories are among the important economic releases in the coming week.

Key Topics to Watch

- Richmond Fed President Tom Barkin speaks (May 6)

- New York Fed President Williams speaks (May 6)

- Minneapolis Fed President Kashkari speaks (May 7)

- Consumer credit for March

- Wholesale inventories for March

- Fed Vice Chair Philip Jefferson speaks (May 8)

- Boston Fed President Susan Collins speaks (May 8)

- Fed Gov. Cook speaks (May 8)

- Initial jobless claims for May 4

- San Francisco Fed President Mary Daly speaks (May 9)

- Fed Governor Michelle Bowman speaks (Mau 10)

- Consumer sentiment (prelim) for May

- Chicago Fed President Austan Goolsbee speaks (May 10)

- Fed Vice Chair for Supervision Michael Barr speaks (May 10)

- Monthly U.S. federal budget for April

Markets Index Wrap-Up