False declines, which cause friction in the payment process, have a detrimental effect on transaction success rates and discourage customers from returning.

According to findings detailed in “Fraud Management, False Declines and Improved Profitability,” false declines put a staggering $157 billion at risk in the United States alone in 2023, with an estimated $81 billion ultimately lost.

The study, a PYMNTS Intelligence and Nuvei collaboration, examines the failed payments landscape in the eCommerce space, drawing on insights from a survey of 300 executives representing eCommerce firms with annual revenues of more than $100 million.

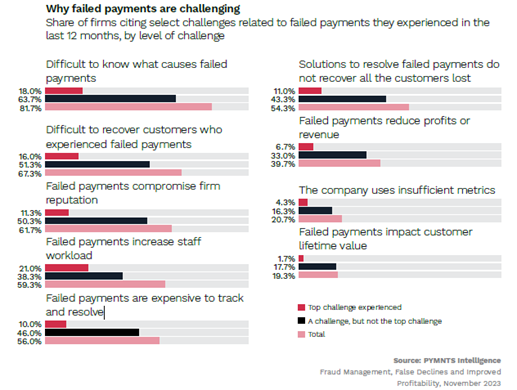

According to the study, 11% of transactions processed by the average eCommerce firm failed in the past year, yet few merchants have a clear understanding of the underlying causes. In fact, over 80% cite difficulty in pinpointing the causes of failed payments as a major challenge, with nearly 64% ranking it as their top challenge.

Other challenges include difficulty in recovering customers affected by failed payments and concerns about compromised reputation, noted by 67% and 63% of firms, respectively. Furthermore, nearly 60% report an increased staff workload due to failed payments, while 56% find them expensive to track and resolve.

Overall, more than 1 in every 10 online transactions processed by the average eCommerce firm failed in the last 12 months, per the study’s findings.

The research offers several actionable insights for eCommerce firms to address the issue of failed payments. First, increasing collaboration with payments service providers (PSPs) and leveraging their expertise and technology is crucial for boosting profits and enhancing transaction success rates.

Moreover, working with PSPs to accurately identify the causes of failed payments can improve customer retention and maintain brand reputation. By understanding the specific reasons behind transaction failures, eCommerce firms can take targeted actions to rectify the issues and ensure a positive customer experience.

Optimizing fraud screening mechanisms is also essential to better identify the root causes of failed payments. By implementing advanced fraud detection systems and continuously refining their screening processes, eCommerce firms can gain valuable insights into the factors contributing to transaction failures, providing a seamless and secure payment experience for customers.

The report further highlights the need for eCommerce firms to outsource some or all of their failed payment recovery solutions. Currently, 94% of these firms rely on outsourcing, with a combination of in-house and third-party approaches being the most common.

This outsourcing strategy allows online retailers to leverage the expertise of specialized service providers, ensuring efficient and effective recovery processes.

In sum, tackling failed payments requires a multi-approach strategy, which eCommerce firms will have to implement to stay relevant and protect their existing customer base. Moreover, with 1 in 5 firms saying failed payments impact customer lifetime value, implementing these strategies is not only essential but key to sustaining long-term growth.