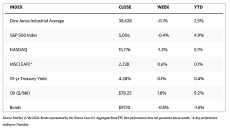

Stock Markets

The major stock indexes went south this week, albeit modestly. The Dow Jones Industrial Average (DJIA) dipped by 0.11% while the DJ Total Stock Market Index fell slightly further, by 0.26%. The broad-based S&P 500 Index slipped by 0.42% while the technology-heavy Nasdaq Stock Market Composite fell a bit more, by 1.34%. The NYSE Composite bucked the trend and gained 0.77%. The CBOE Volatility Index (VIX), the metric for investor risk perception, rose by 10.13%. Some earnings reports that surprised on the upside provided some buying incentive, causing the equally weighted version of the S&P 500 Index to reach a record high on Thursday. The investors’ sell-out was due to negative developments in the macroeconomic news of the week. The declines were concentrated in large-cap growth stocks, since the small-cap Russell 2000 Index rebounded to register gains by the week’s end.

The slump in stocks can be attributed to the inflation report that came out this week. January’s Consumer Price Index (CPI) and Producer Price Index (PPI) inflation reports that were released this week were higher than expected. Stocks dropped sharply when the inflation reports were released on Tuesday but recovered before trading ended to close only marginally lower. Although the reports were disappointing, it is too soon to conclude that the trend of descending inflation has reversed and it will soon trend higher. But grounds are likely eroding for expectations that the Federal Reserve interest rate cuts will be coming sooner than later. A trend towards rising inflation is just not justifiably sustainable at present.

U.S. Economy

The higher inflation readings are the results of certain components in the CPI basket. Consumer prices rose 0.3% in January, higher than the consensus expectation of 0.2%. More worrisome is the rise in core consumer prices which hit 0.4%. This kept the year-over-year inflation at 3.9%, almost double the Federal Reserve’s target of 2%. Producer prices, which are usually more volatile than consumer prices, increased by 0.3% in January, the most in five months and higher than December’s reading of 0.1%. The main contributor was a 2.2% increase in the cost of hospital outpatient care.

Inflation was more moderate in energy and energy services, commodities, and used car and truck pricing. Nevertheless, food and food away from home (such as in restaurants) climbed higher, together with motor vehicle insurance. The most critical components that moved up were shelter and rent, which account for almost one-third of the CPI basket. These components were higher than expected, registering an increase of 6% annually. However, they often lag behind current developments in the housing and rental markets nationwide. Over the past year, real-time data suggests that these components are likely to cool in the coming months. CPI is expected to fall to approximately 2.5% over the coming year. If this materializes, it is good news because not only does it tend to provide support for consumers, but it also gives the Fed a reason to at last consider cutting interest rates.

The week also brought news of slowing economic growth, which, while concerning, nevertheless eased fears of a resurging inflation rate. The Commerce Department on Thursday reported that retail sales fell in January by 0.8%. Some economists cited seasonal factors and harsher weather conditions in January, but other weather-sensitive sales at restaurants and bars surprisingly increased by 0.7%. Continuing claims were slightly above expectations although initial jobless claims were slightly below consensus. Housing starts that came out on Friday were lower than expected, but a gauge of homebuilder confidence trended surprisingly higher.

Metals and Mining

Due to the sentiment that the Fed is still a long distance from its inflation target of 2%, gold and silver prices fell to their lowest in months, and now are testing their supports at $2,000 and $22 per ounce respectively. Investors are selling off from the gold market, due to higher-for-longer interest rates supporting higher bond yields and a stronger U.S. dollar. Investors continue to push equities to record highs rather than remain in the gold market. So far this year, more than $3 billion has exited the global gold-backed exchange traded products, while the newly approved Bitcoin ETFs have experienced total inflows of $4.115 billion. Nevertheless, there is underlying strength in the precious metals market, as they have so far held at their critical support levels despite strong selling pressure.

This week, the spot market for precious metals was mixed. Gold lost by 0.53% from its close last week at $2,024.26 to its close this week at $2,013.59 per troy ounce. Silver gained by 3.58% from its closing price last week of $22.61 to its closing price this week of $23.42 per troy ounce. Platinum, which ended this week at $909.63 per troy ounce, climbed by 3.72% from last week’s close at $877.04. Palladium, closing this week at $951.37 per troy ounce, appreciated by 10.39% from its closing price last week at $861.86. The three-month LME prices of industrial metals generally rose this week. Copper, the price of which was $8,193.50 last week, climbed by 1.47% to settle this week at $8,314.00 per metric ton. Zinc gained 1.16% for the week, beginning at last week’s closing price of $2,327.50 to end at $2,354.50 per metric ton this week. Aluminum, which was priced at $2,221.50 last week, climbed by 0.14% to end this week at $2,224.50 per metric ton. Tin ended at $27,293.00 per metric ton this week, up by 5.40% from last week’s close at $25,895.00.

Energy and Oil

This week oil prices continued its sideways trek of the past weeks. Some bullish activity from weak U.S. retail sales was rapidly curtailed by a fresh escalation of the Middle East political unrest as Israel attacked Rafah, potentially prompting a Houthi retaliation soon. Speculation is growing that production cuts by OPEC+ in 2024 appear to be ignored by the members of the oil group. If there is any truth to this narrative, the impact has still to become evident in Brent’s price which currently remains at $82 per barrel. In any case, the Iraqi oil ministry confirmed that over the next four months, it would compensate for its January increase in crude production. OPEC’s secondary sources estimate Iraq’s output at 4.19 million barrels per day (b/d), which is about 190,000 b/d above target

Natural Gas

For the report week covering Wednesday, February 7, to Wednesday, February 14, 2024, the Henry Hub spot price fell by $0.46 from $1.97 per million British thermal units (MMBtu) to $1.51/MMBtu throughout the week. The Henry Hub spot price averaged $1.88/MMBtu so far this month, the lowest inflation-adjusted monthly average since at least January 2000, according to data from Natural Gas Intelligence. Regarding the Henry Hub futures, the price of the March 2024 NYMEX contract decreased by $0.358, from $1.967/MMBtu at the start of the report week to $1.609/MMBtu at the end of the week. The price of the 12-month strip averaging March 2024 through February 2025 futures contracts declined by $0.224 to $2.417/MMBtu.

International natural gas futures prices decreased during this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia declined by $0.04 to a weekly average of $9.42/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, also declined, by $0.81 to a weekly average of $8.26/MMBtu. In the week last year that corresponds to this report week (week from February 8 to February 15, 2023), the prices were $17.91/MMBtu and $16.68/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks advanced for the week as the pan-European STOXX Europe 600 Index gained 1.39% in local currency terms. The improved investor sentiment is due to signs of cooling inflation and optimism regarding the possibility of interest rate cuts. Italy’s FTSE MIB outshined, rising by 1.85%, while France’s CAC 40 Index hit new highs during the week and closed on Friday higher by 1.58% week-over-week. Germany’s DAX also impressed, gaining by 1.13% for the week. The UK’s FTSE 100 rose by 1.84% for the week. Core eurozone government bond yields recorded modest gains in response to reports that the U.S. announced higher-than-expected inflation readings. European Central Bank (ECB) officials cautioned against “making a hasty decision,” in the words of ECB President Christine Lagarde, in hastily crafting policy decisions just in case inflation reverses course and heads up again. In the meantime, official UK economic data places the country in recession territory in the final three months of 2023, and that inflation held steady in January, furthering market expectations that the Bank of England (BoE) may cut interest rates by June.

Japan’s equities markets climbed during the week. The Nikkei 225 Index gained by 4.3% while the broader TOPIX Index rose by 2.6%. The Nikkei continued its strong performance in the year-to-date period and the year 2023, now holding around its highest level in 34 years. Positive corporate earnings releases and the continued weakness in the yen provided support to the rally. Regarding economic performance, Japan’s weak fourth-quarter growth data fostered some uncertainty regarding the future direction of the Bank of Japan’s monetary policy, which the BoE anchored on sustainability in achieving its 2% inflation target. The yield on the 10-year Japanese government bond closed the week mostly unchanged at 0.73%. Investors factored in the most recent U.S. economic data, including its inflation reports, and the possible impacts they may have on the timing of future Federal Reserve rate cuts. The yen weakened to the low JPY 150 range from the low JPY 149 range at the end of the previous week. The weak yen has redounded to a competitive advantage for Japanese exporters because it increases the domestic value of their overseas revenues.

China’s financial markets were closed for the week in observance of the weeklong Lunar New Year holiday that commenced on Saturday, February 10. There was a pickup in consumer spending over the Lunar New Year, China’s most important holiday, as indicated by early data. During the first six days of the national holiday, more than 61 million rail trips were made. This is a 61% jump over comparative figures last year, according to official media reports. State media reported that hotel sales on China’s e-commerce platforms increased by more than 60% while travel by road and airplane likewise improved. Analysts were quick to caution, however, that the year-over-year consumption figures may be misleading, given that China was in the throes of a coronavirus outbreak in early 2023 which caused Beijing to roll back pandemic restrictions in December 2022.

The Week Ahead

The January FOMC minutes and the S&P Global PMI data are among the important economic data scheduled for release in the coming week.

Key Topics to Watch

- U.S. leading economic indicators

- Atlanta Fed President Raphael Bostic delivers welcome remarks

- Fed Gov. Michelle Bowman speaks

- Minutes of Fed’s January FOMC meeting

- Initial jobless claims for Feb. 17

- S&P flash U.S. services PMI for February

- S&P flash U.S. manufacturing PMI for February

- Existing home sales for January

- Fed Vice Chair Philip Jefferson speaks

- Philadelphia Fed President Patrick Harker speaks

- Fed Gov. Lisa Cook speaks

- Minneapolis Fed President Neel Kashkari speaks

- Fed Gov. Christopher Waller speaks

Markets Index Wrap-Up