Arm Holdings Plc climbed as much as 42% in late trading after the chip designer gave a surprisingly bullish forecast, showing that its push beyond smartphones is helping fuel growth and profitability.

Revenue in the three months ending in March will be $850 million to $900 million, Arm said in a statement Wednesday. That compares with an average analyst estimate of $778 million. Earnings will be roughly 30 cents, excluding some items, well ahead of the 21-cent projection.

The upbeat outlook reflects an expansion by Chief Executive Officer Rene Haas into fresh areas, including server chips. Executives said that the smartphone industry now accounts for about a third of the company’s sales, underlining how successful he’s been at spreading its bets. And phones now contain more Arm technology per device, helping lift royalty payments.

“We are involved in just about every single end market,” Haas said on a conference call with analysts. “And just about every single market is putting more compute into their devices.”

Haas and Chief Financial Officer Jason Child explained that the company’s customers are shifting to new version of its technology called V9, which carries twice the royalty rate of its predecessors. They’re also using more Arm computing cores per device — more than 100 in Microsoft Corp.’s new server chips, for example — which amplifies royalties. Arm is also gaining market share from rival technology in the data-center and automotive markets, they said.

Arm’s joint venture in China was a “nice positive surprise” as well, according to Child. It contributed 25% of total revenue.

The news sent Arm shares on a startling rally, with the stock rising as high as $109.48 in extended trading. If the surge holds up in regular trading, it would easily vault Arm into record territory. The shares closed earlier at $77.01, up 2.5% this year.

Arm now expects sales of $3.16 billion to $3.21 billion in fiscal 2024, which runs through March. That’s up from a previous range that topped out at $3.08 billion.

Revenue grew 14% to $824 million in the fiscal third quarter. Excluding some items, profit was 29 cents a share. Wall Street had predicted revenue of $760 million and earnings of 25 cents a share.

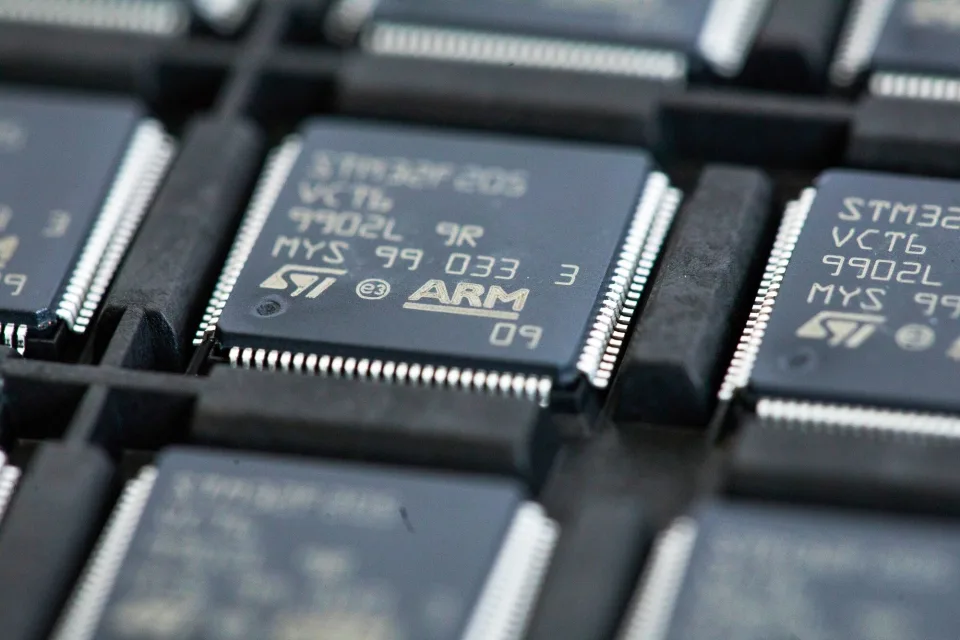

Arm has an unusual role in the semiconductor industry. It licenses the fundamental set of instructions that software uses to communicate with chips. The company also provides so-called design blocks that companies such as Qualcomm Inc. use to build their products.

Under Haas, Arm has been moving toward providing more complete layouts that can be taken directly to the manufacturing stage. That shift makes it more useful to some customers, such as cloud computing companies like Amazon.com Inc., but also more of a rival to some traditional clients, like Qualcomm.

Cambridge, England-based Arm is still 90%-owned by SoftBank Group Corp., which acquired the business in 2016 for $32 billion. An initial public offering last year raised $4.9 billion, marking the biggest debut on a US exchange in 2023.

Arm’s licensing sales rose 18% to $354 million last quarter, and royalty revenue gained 11% to $470 million.

Arm’s customer list spans the technology industry. Apple Inc. uses its instruction set for the processors that power the iPhone and Mac computers. Amazon relies on Arm designs for its Graviton server processors for data centers. And Qualcomm and MediaTek Inc. are major users of Arm’s blueprints for smartphone processors.

“What you’re seeing coming to life are all of the strategies we’ve been working on for a number of years,” Haas said on the conference call. “As good as the last couple of quarters are, we’re just at the beginning.”