When employees who contribute to a 401(k) plan leave a company, they have options for what to do with that money.

Depending on what the employer retirement savings plan allows, exiting employees may be able to keep the money in the current plan, roll it over into an IRA, or buy an annuity. In some cases, employers can force out small accounts.

The guidance investors receive from a financial professional or firm about handling old 401(k)s has been exempt from investment advice rules. And, there are different standards for financial advice. Being a “fiduciary” is the highest standard, meaning the advice must be in the client’s best interest.

The Biden administration wants investment advice given when making these decisions to come from a fiduciary — and the Department of Labor has proposed rules to make that happen.

Some in the financial industry have pushed back against the Labor Department’s proposed rule, saying it would create a regulatory burden that would shut out millions of Americans from receiving guidance from financial professionals compensated by commission-based sales. They also argue that existing laws have been established to safeguard consumers seeking financial advice.

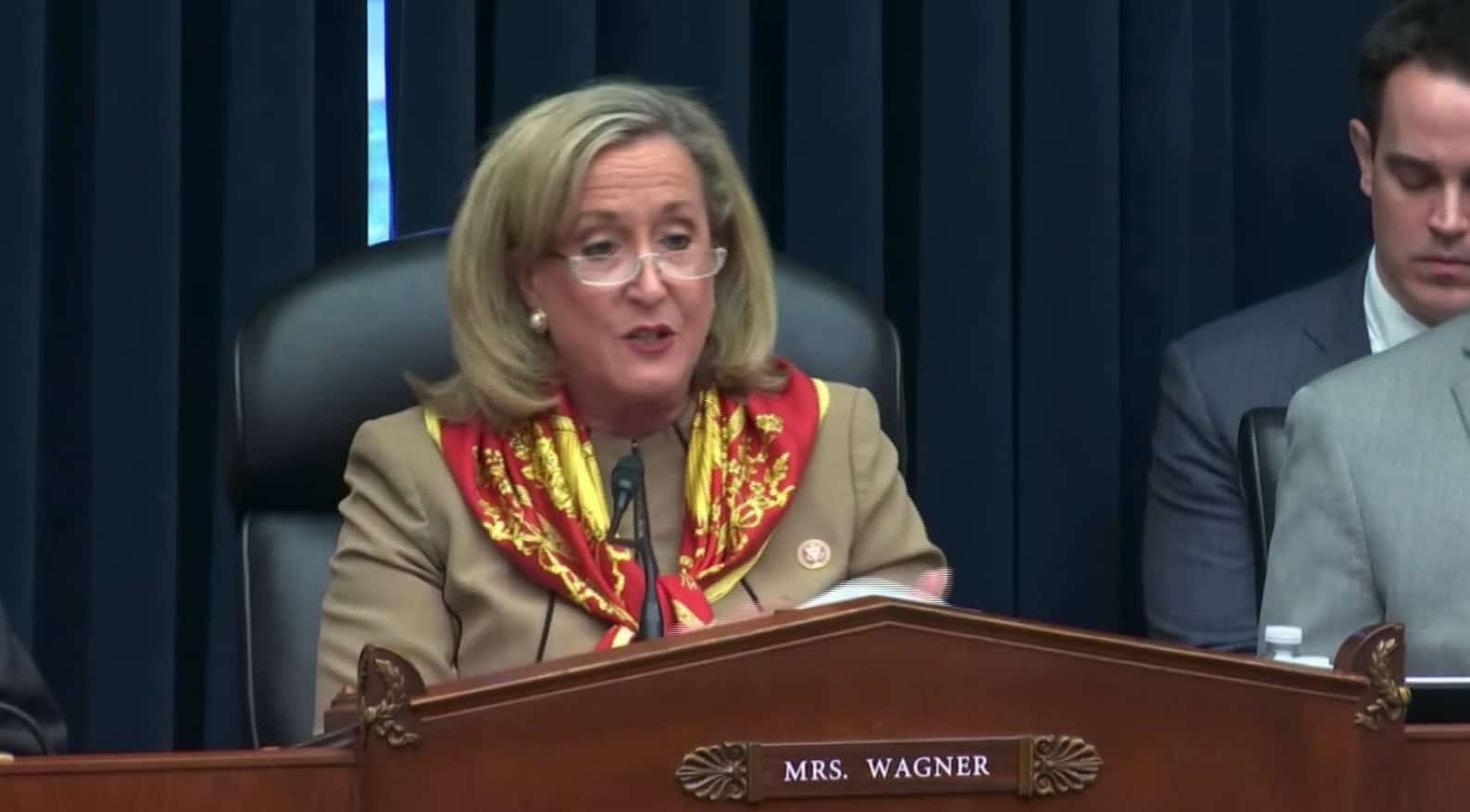

Some lawmakers share those concerns. “We would be left with two classes of investors: those who can afford investment advice and those who cannot,” said Rep. Ann Wagner, R-Mo., chair of the Financial Services Subcommittee on Capital Markets, which recently held a hearing on the new rule.

Others contend that consumers who reach out to a financial professional for a one-time event such as a rollover may not get advice in their best interest.

“I met recently with a woman whose former financial professional recommended that she use her modest retirement nest egg to buy an insurance product that wasn’t right for her,” certified financial planner Kamila Elliott told the subcommittee at a hearing Wednesday. Elliott, the CEO of Collective Wealth Partners in Atlanta, is a member of the CNBC FA Council.

“Had she invested in a diversified portfolio and a qualified retirement plan, she would now have tens of thousands of dollars more in accumulated retirement assets,” Elliott said.

As the debate continues, experts say retirement savers should keep asking questions of professionals who help them make critical financial decisions, like what to do with money in a 401(k) or 403(b) account after leaving an employer. Here are some tips:

Review investment options and fees

To protect your nest egg, reviewing and understanding your options is essential. Sometimes brokers from the plan administrators don’t consider if you are married or other assets you can access in retirement when making recommendations.

Find out what fees will be incurred for your investment choices, such as rolling over 401(k) money into an IRA or buying an annuity. Investment funds in 401(k) plans can be less costly than their IRA counterparts.

For many people, staying in their former employer’s plan may be a good option.

“Larger companies take the 401(k) plan very seriously, and are looking to work with professional institutional investment consultants to vet the investments that are placed into that plan, setting up access to generally low-cost investment options,” said Christopher Lazzaro, founder and president of Plan For It Financial, a fee-only, advice-only financial planner in Swampscott, Massachusetts.

Know how the advisor is compensated

Ask how the financial professional is paid.

Knowing the benefits financial professionals may receive can be an essential factor in helping you figure out whose advice you should trust and follow. Advice to roll over funds into an IRA or buy an annuity can generate compensation like a commission for the broker or agent.

Fee-only advisors, in contrast, only make money from direct fees from clients. Those fees may be based on a percentage of the money they manage, or charged on a fee-for-service or hourly basis.

Find fiduciary financial advisors, and vet them

Use search features on the National Association of Personal Financial Advisors, the CFP Board, and the Garrett Planning Network to identify potential financial professionals.

The Securities and Exchange Commission also has tools to find registered investment advisors that include their years of experience and if there have been consumer complaints against them.