Stock Markets

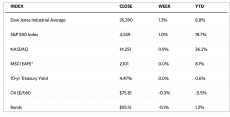

The past week was a holiday-shortened trading week as the Thanksgiving celebration closed the markets on Thursday while Friday saw a truncated trading session that ended at 1 p.m. EST instead of the usual 4 p.m. The major stock indexes ended up on mostly quiet trading. The Dow Jones Industrial Average (DJIA) advanced by 1.27% while the DJ Total Stock Market Index performed almost as well by gaining 1.25%. The broad-based S&P 500 Index gained 1.13% and the technology-tracking Nasdaq Stock Market Composite inched up by 0.97%. The NYSE Composite Index ascended by 1.70%. Investor risk perception eased as the CBOE Volatility Index (VIX) descended by 12.99%. The shortened trading session on Friday was also followed by bond markets which also closed early in observance of the holiday weekend.

The markets have historically performed well after Thanksgiving such that for three decades, the average return in December has been recorded at 1%. Three-fourths of the time, the market registered post-holiday gains, so much of the uptick may be attributed to seasonality, with market gains expected to continue the following year. Leading to Thanksgiving, the market trekked an upswing that added to a strong year-to-date gain. Going back to the 1950s, there were 19 instances when the market came into the holiday season with a year-to-date gain of 20% or more; the average return was 17% in the year that followed.

This week, there was one third-quarter earnings report carefully monitored by investors. NVIDIA is an artificial intelligence chipmaker that was recently the world’s sixth-largest company by market capitalization. The company beat earnings and revenues estimates in its earnings report this week but issues forward-looking cautious guidance due to export restrictions to China. The weakness in NVIDIA’s stock prices impacted Nadaq’s Composite Index, although overall, growth stocks outperformed value stocks

U.S. Economy

A couple of notable economic releases punctuated an otherwise quiet holiday trading week. The Commerce Department on Wednesday reported that durable goods orders in October had fallen by 5.4%, chalking up the second-biggest decline since April 2020. The slide was largely attributable to a steep drop in highly volatile civilian aircraft orders. However, orders excluding aircraft and defense purchases (typically considered a proxy for business investment) also lost ground slightly for the second straight month.

The second market-moving economic news was released by S&P Global on Friday regarding its estimates of growth in business activity in November. The report reflected the fastest pickup in the services sector in the last four months, compensating for a bigger-than-expected slowdown in manufacturing. S&P also noted, however, that “relatively subdued demand conditions and dwindling backlogs led firms to cut their workforce numbers for the first time since June 2020,” tempering market sentiment that perked at the reported acceleration in services.

Metals and Mining

While gold appears stuck in range trading, its striking distance of close to $2,000 can be viewed optimistically. The fact that it has reached this important milestone while most Western investors have shunned the market hints at exciting possibilities for gold as an investment even as it treads water. Simultaneously, the precious metal is approaching its best seasonal period of the year. Analysts noted that in the last six years, gold prices had seen an average return of 4% in December while silver prices have seen an average return of 7.25%. While there is reason for healthy optimism, potential risks still exist. The cease-fire between Israel and Hamas tends to reduce safe-haven demand for gold. The Federal Reserve also continues to hold sway over the future of precious metals. The minutes of the November monetary policy meeting of the Fed released this past week signaled policymakers’ continued intention towards a restrictive monetary policy for the foreseeable future.

The spot prices of precious metals went up this week. Gold closed the week at $2,000.82 per troy ounce, 1.01% above last week’s closing price of $1,980.82. Silver ended at $24.33 per troy ounce, 2.57% higher than the week ago’s $23.72 close. Platinum settled at $934.75 per troy ounce, higher by 3.55% from last week’s close at $902.72. Palladium ended at $1,073.00 per troy ounce for the week, gaining 1.53% from the previous week’s close at $1,056.78. The three-month LME prices of industrial metals were mixed. Copper gained by 1.72% from the prior week’s closing price of $8,267.00 to end the week at $8,409.50 per metric ton. Zinc, which closed at $2,555.00 a week ago, ended this week at $2,537.50 per metric ton for a slight loss of 0.68%. Aluminum, which came from a closing price of $2,207.00 the week previous, closed this week at $2,224.50 per metric ton to lock in a gain of 0.79%. Tin slid by 1.51% from last week’s closing price of $24,852.00 to finish this week at $24,476.00 per metric ton.

Energy and Oil

The volatility in oil prices over the past weeks was settled down as market participants await the results of the next OPEC meeting. The event was postponed from its original schedule this week to November 30 and was revised from an in-person summit to an online conference due to quota spat. Speculations ran rife that the negotiation of production quotas with African oil producers Angola, Nigeria, and the Congo, has been met with significant resistance. OPEC+ said after its last meeting in June that the 2024 output quotas of the three were conditional on reviews by outside analysts. Other members of the group defy calls to chip in with cuts. The surprise delay of the meeting sent oil prices sliding, The ICE Brent front-month futures have settled within a narrow range of $81-83 per barrel for the entire week, with the main developments firmly focused on the Eurasian landscape in light of the Thanksgiving holidays in the U.S. Higher U.S. inventories offset a better outlook for China’s property sector, thus the trendsetter for the next weeks’ pricing direction remains with the OPEC+ impending meeting.

Natural Gas

Colombia’s national oil company Ecopetrol is planning to start importing natural gas from Venezuela. The move is prompted by the cheaper cost offered by Venezuela at $5 per MMCf which is significantly lower than Colombia’s current import options. In other developments, the U.S. Federal Energy Regulator Commission greenlighted Freeport LNG’s request to ramp up production to full capacity, bringing Phase II infrastructure back and taking the total liquefaction rate back to 2.1 billion cubic feet per day.

World Markets

The pan-European STOXX Europe 600 Index rose by 0.91% in local currency terms amid hopes that central banks may start cutting interest rates in the next year’s first semester. The major stock indexes in the region were listless in the absence of any strong trend. Germany’s DAX climbed by 0.69% and France’s CAC 40 Index did a bit better by rising 0.81%, but Italy’s FTSE MIB dipped by 0.22% and the UK’s FTSE 100 slid by 0.21%. European government bond yields moved higher. Germany’s 10-year government bond edged up from a more than two-month low of 2.516% earlier in the week. The yields climbed after Germany was reported to contemplate suspending debt limits for the fourth consecutive year. Additional support was due to statements suggesting that the European Central Bank (ECB) policymakers are determined to keep monetary policy tight for the time being. French and Swiss bond yields also rose. In the U.K., the Purchasing Managers’ Index (PMI) unexpectedly rose into positive territory in November, moving the yield on the 10-year benchmark bond higher. The ECB tried to dampen hopes of any impending rate cuts by reiterating that the fight to rein in inflation was not finished and may last for “the next couple of quarters.”

Japan’s equities markets recorded modest returns for the week as the Nikkei gained by 0.1% and the broader TOPIX remained flat. In early optimistic trading during the week, the Nikkei rose to its highest level since 1990 on the back of a strong domestic corporate earnings season. Manufacturers’ earnings benefited from weakness in the yen and easing supply chain constraints. Sentiment was also supported by expectations that the U.S. interest rates may have peaked, pushing growth stocks noticeably higher. Economic news also created some impact, with a hot October consumer inflation report stoked speculation that the Bank of Japan (BoJ) may push further monetary policy normalization. According to flash PMI data, private sector activity stalled in November, due mainly to further deterioration in business conditions in manufacturing. Based on these developments, the yield on the 10-year Japanese government bond (JBG) ascended to 0.77% from 0.72% at the end of the previous week. For the second consecutive week, the BoJ reduced its JGB purchase operations. In the currency market, the yen finished the week mostly unchanged despite initially strengthening to its highest level in more than two months and amid general weakness in the U.S. dollar. The yen remained at about JPY 149 against the greenback.

Chinese stocks retreated despite news that Beijing may introduce fresh stimulus measures for the property sector as investors viewed the announcement as inadequate to alleviate the country’s broader economic concerns. The Shanghai Composite Index dipped by 0.44% while the blue-chip CSI 300 gave up 0.84%. Hong Kong’s benchmark Hang Seng Index inched up by 0.6%. A funding plan was formulated by Chinese regulators for property developers in the hope of staving off an ongoing property crisis. Reportedly including 50 private and state-owned developers, the list will act as a guide for financial institutions to deliver a range of financial measures to strengthen balance sheets. In a separate move, the National People’s Congress, China’s parliament, encouraged banks to accelerate support measures for real estate developers to reduce the risk of further defaults and ensure the completion of outstanding housing projects. The reports dovetail with recent property data underscoring a current downturn in a crucial sector of China’s economy. Property investment, sales, and new home prices plummeted in October. Economists expect that Chinese government advisers may propose an economic growth target of 5% in 2024 at the annual Central Economic Work Conference scheduled in December. The measure will aim to promote job growth and to ensure that long-term development goals remain attainable.

The Week Ahead

Among the important economic data scheduled for release in the coming week are the November ISM manufacturing report, the Personal Consumption Expenditures (PCE) inflation data, and the first revision for the third quarter Gross Domestic Product (GDP).

Key Topics to Watch

- New home sales for October

- S&P Case-Shiller home price index (20 cities) for September

- Consumer confidence for November

- Fed Gov Christoper Waller speaks

- Chicago Fed President Austan Goolsbee speaks (Nov. 28)

- Fed Governor Michelle Bowman speaks

- Fed Governor Michale Barr speaks (1:05 p.m., Nov. 28)

- Fed Governor Michale Barr speaks (3:30 p.m., Nov.28)

- GDP (first revision) for Q3

- Advanced U.S. trade balance in goods for October

- Cleveland Fed President Moretta Mester speaks

- Fed Beige Book

- Initial jobless claims (Nov. 25)

- Personal income (nominal) for October

- Personal spending (nominal) for October

- PCE index for October

- Core PCE index for October

- PCE (year-over-year)

- Core PCE (year-over-year)

- New York Fed President John Williams speaks

- Chicago Business Barometer (PMI) for November

- Pending home sales for October

- Fed Governor Michael Barr speaks (Dec. 1)

- ISM manufacturing for November

- Construction spending for October

- Chicago Fed President Austan Goolsbee speaks (Dec. 1)

- Fed Chair Jerome Powell speaks (Dec. 1)

- Fed Chair Jerome Powell and Fed Governor Lisa Cook talk to local leaders in Atlanta

- Auto sales for November

Markets Index Wrap-Up