Electric car battery prices are starting to go back down after a temporary rise along with inflation. And it looks like they are going back down faster than expected, according to new data from Goldman Sachs.

The EV revolution was enabled by lithium battery prices dropping significantly over two decades, but the trend was broken over the last few years, with prices actually going up amid a spike in the cost of some metals and general inflation.

Now, we are going back to a price drop and potentially a faster one.

Goldman Sachs updated its battery price forecast and noted that prices are starting to come down again:

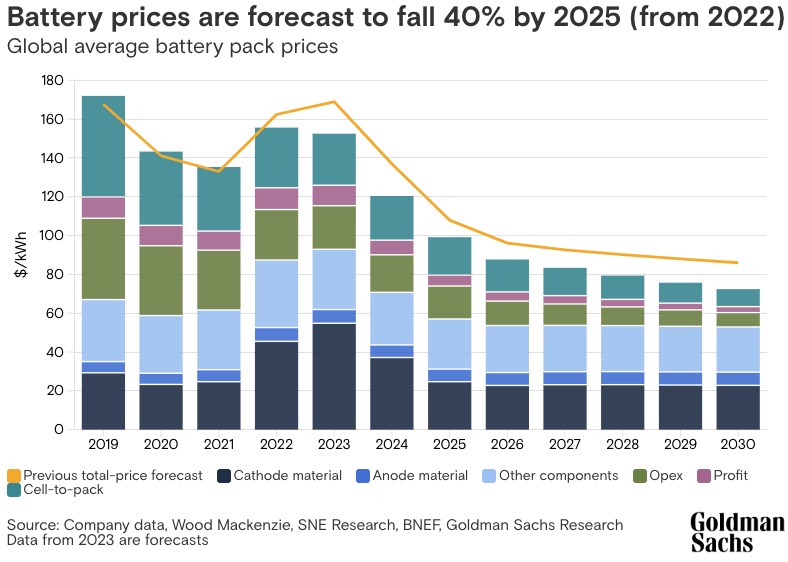

Goldman Sachs Research now expects battery prices to fall to $99 per kilowatt hour (kWh) of storage capacity by 2025 — a 40% decrease from 2022 (the previous forecast was for a 33% decline). Our analysts estimate that almost half of the decline will come from declining prices of EV raw materials such as lithium, nickel, and cobalt. Battery pack prices are now expected to fall by an average of 11% per year from 2023 to 2030, writes Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research, in the team’s report.

The firm believes that a particularly large price drop is coming in 2024:

It’s important to note that Goldman Sachs is looking at the cost at the pack level and not the cell level.

At the pack level, the prices vary greatly in the EV industry as automakers have a lot of different ways to produce battery packs.

Therefore, some automakers might already be way below the current reported level of $140 per kWh and others way above.

Regardless, a drop of the average to $100 per kWh within the next two years should have a massive impact on the industry as a whole.

Bhandari commented:

The reduction in battery costs could lead to more competitive EV pricing, more extensive consumer adoption, and further growth in the total addressable markets for EVs and batteries.

It should make the next few years very interesting in the auto industry.