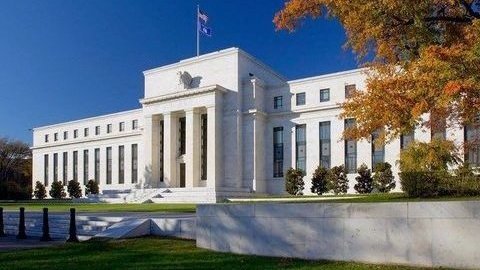

The Federal Reserve has proposed lowering the debit interchange fees banks can charge merchants by nearly 30% and reviewing the cap every two years.

For the last 12 years, merchants have paid banks 21 cents plus 0.05% of the transaction cost for each debit card payment. There is also a one cent fraud prevention adjustment if issuers meet certain standards.

In 2021, interchange fees across all debit and general-use prepaid card transactions totalled $31.59 billion, an increase of 19.1% on 2020.

However, as the Fed notes, since 2011 costs incurred by issuers have “declined significantly”.

Therefore, it is proposing reducing the base component to 14.4 cents and the ad valorem to 0.04% of the transaction, but raising the fraud prevention adjustment to 1.3 cents. This would lead to an overall decrease of about 28%.

The Fed then plans to update the cap every other year, directly linking it to data from the central bank’s biennial survey of large debit card issuers.

The proposal now faces a comment period.

The National Retail Federation welcomed the “significant” reduction but says that it still does not match the falling costs for issuers.

“The Fed found the average cost was 7.7 cents per transaction and proposed a cap of up to 12 cents but settled on 21 cents after lobbying by banks,” says a statement.