Stock Markets

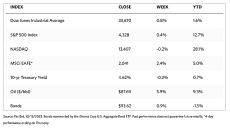

The major stock markets closed this week with mixed results, with investors tentatively assessing inflation data and dovish signals from Federal Reserve officials. According to the Wall Street Journal Markets report, markets ending with gains for the week were the Dow Jones Industrial Average (+0.79%), the DJ Total Stock Market Index (+0.24%), the S&P 500 Index (+0.45%) and the NYSE Composite Index (+0.72%). Ending lower for the week is the technology-heavy Nasdaq Stock Market Composite Index (-0.18%). The CBOE Volatility Index (VIX), which indicates investors’ risk perception, went up by 10.72% for the week. Large-cap value stocks performed well due to positive earnings news from Citigroup, Wells Fargo, and JP Morgan Chase. The banking giants realized healthy profits due to higher interest rates and their releases this week kicked off the start of the third-quarter earnings report season.

Energy shares and defense stocks received a boost from news about the likelihood of a broader Middle East war due to Hamas’ attack on Israel. Prospects of its escalation, however, weighed down airlines and cruise operators. News of Nordisk’s new dialysis drug, widely used to treat obesity, also demonstrated success in treating kidney disease caused Dialysis provider Da Vita to fall sharply. In a broader sense, however, the market seemed to gain optimism from an apparent shift in the official thinking of the Feds regarding inflation and the likelihood of a recession. The minutes of the Fed’s September meeting released midweek suggested that while rates will remain restrictive for some time, the communication has evolved from “how high to raise rates” to “how long to hold rates.” During the week’s end, federal fund futures were pricing in only a 5.7% probability of a rate hike when the Fed meets next in November, as against 27.1% likelihood during the week before.

U.S. Economy

The recent reading on the inflation rate has come below the Fed’s policy rate and will likely continue to moderate, providing further hope that the rates have peaked. Even the slightly higher-than-expected inflation reading did not cause investors to panic, given the volatility of the global geopolitical developments this week. The Labor Department reported on Wednesday that core (excluding food and energy) producer prices increased by 0.3% in September which is a tick above expectations. However, the 2.7% increase in year-over-year core producer prices surprised analysts as it was the highest level since May. This resulted from a significant upward revision in the previous month. The core consumer price index (CPI) inflation data that was released on Thursday, which rose by 4.1% for the year ended September 30, was in line with expectations and its slowest pace in two years.

Metals and Mining

This week, gold prices registered their strongest performance since early spring as it was driven by short covering and a strong safe-haven bid at the start and the end of the week. during a survey conducted this week, market analysts and retail investors have expressed an almost identical bullish consensus about gold’s prospects for the coming week, ending October 20. The massive price surge in the morning of Friday is evidence of when the market opens with full participation, possibly taking a long position in the yellow metal. In the coming week, there may be some slight pullback as some players take profits, but this precious metal will likely move back and forth as it consolidates before another possible breakout.

The spot prices for precious metals rose mostly for this week. Gold surged by 5.45% from its previous week’s close at $1,833.01 to this week’s close at $1,932.82 per troy ounce. Silver also climbed by 5.19% from its close last week at $21.60 to its close this week at $22.72 per troy ounce. Platinum gained by 0.29% from its closing price last week at $881.56 to this week’s closing price of $884.13 per troy ounce. Palladium bucked the trend, losing by 1.05% from its price last week of $1,162.78 to its price this week of $1,150.56 per troy ounce. The three-month LME prices of base metals were mostly down this week. Copper ended 1.21% lower from last week’s close at $8,046.00 to this week’s close at $7,949.00 per metric ton. Zinc lost 2.51% of its previous week’s price of $2,509.00 to this week’s closing price of $2,446.00 per metric ton. Aluminum gave up 1.79% of last week’s price of $2,239.50 to end this week with the price of $2,199.50 per metric ton. Tin defied the odds and gained 1.80% from last week’s closing price of $24,644.00 to end this week at the price of $25,087.00 per metric ton.

Energy and Oil

Sanctions imposed by the Biden administration this week had the unintentional effect of supporting oil prices. The U.S. government has slapped sanctions on two tanker owners (one based in Turkey and the other in the UAE) that allegedly transported Russian oil above the G7 price cap of $800 per barrel. ICE As the U.S. seeks to close loopholes in its sanctions mechanisms, Brent was set to finish the week at the unlikely price of $88 per barrel given the large U.S. inventory builds reported in the middle of the week. On the other hand, a promised increase in Russia’s oil price cap enforcement kicked off with two sanctioned tankers, and the rising market expectation that more sanctions will emerge on Iran in light of the Israel-Palestinian conflict have raised geopolitical risks and increased the possibility that the $90-per-barrel is once more within reach.

Natural Gas

For the report week beginning Wednesday, October 4, and ending Wednesday, October 11, 2023, the Henry Hub spot price rose by $0.27 from $2.91 per million British thermal units (MMBtu) to $3.18/MMBtu. The Henry Hub spot price rose above $3.00/MMBtu for the first time since January of this year. Regarding the Henry Hub futures price, the price of the November 2023 New York Mercantile Exchange (NYMEX) contract increased by $0.415, from $2.962/MMBtu at the start of the report week to $3.377/MMBtu at the end of the week. The price of the 12-month strip averaging November 2023 through October 2024 futures contracts climbed by $0,269 to $3.529/MMBtu. The NYMEX futures price at the Henry Hub has been steadily increasing since September 21 when the front-month contract settled at $2.61/MMBtu.

The international natural gas futures price changes were mixed for this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased by $0.26 to a weekly average of $14.18/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $1.17 to a weekly average of $13.28/MMBtu. In the week last year corresponding to this report week (from October 5 to October 12, 2022), the prices were $34.81/MMBtu and $45.83/MMBtu in East Asia and at the TTF, respectively.

World Markets

Optimism from dovish comments from the Federal Reserve policymakers and reports that China was considering more economic stimulus measures drove European stocks up this week to end three consecutive weeks of losses. The pan-European STOXX Europe 600 Index closed 0.95% for the week in local currency terms. However, major stock indexes were mixed in the region. Italy’s FTSE MIB rallied by 1.53% higher. Germany’s DAX slid by 0.28%, while France’s CAC 40 Index fell by 0.80%. The UK’s FTSE 100 Index tacked on an additional 1.41%. European bond yields declined as investors flocked to safe-haven assets after the eruption of Hamas violence in the Middle East. Strong U.S. inflation data slowed the drop in yields. The benchmark 10-year German government bond yield closed near 2.75%. Furthermore, the minutes of the European Central Bank’s (ECB’s) September meeting showed that a solid majority of policymakers cast their votes in favor of raising the key deposit rate to 4.0%, a record high. The increase was intended to show the ECB’s determination to rein in inflation since headline and core inflation remained above 5%.

Japan’s stock markets rose over the week as they continued their strong year-to-date gains. The Nikkei 225 Index climbed by 4.3% while the broader TOPIX Index gained by 2.0%. Historic weakness in the yen lent ongoing support, particularly for stocks whose companies are raking in higher dollar-denominated earnings. The yen weakened from about JPY 149.2 the week before to approximately JPY 149.6 against the U.S. dollar this week. The currency continued on its downward spiral despite attracting some support from investor demand for safe-haven currencies in light of the increased geopolitical uncertainties in the Middle East. Japanese authorities continued to emphasize that they would not hesitate to intervene if excess currency volatility develops, without ruling out any options. However, there has been no evidence of the government’s intervention in the markets to stem the yen’s drop. In other developments, the International Monetary Fund (IMF) revised its forecast for Japan’s economic growth in 2023 to 2.0% from 1.4% previously, as published this week in its October World Economic Outlook. A range of factors including pent-up demand, rebounding inbound tourism, accommodative monetary policy, and easing supply chain constraints boosting auto-expansion, are seen to support the country’s economic expansion.

In China’s first full week of trading after the Golden Week holiday, stocks declined as softer inflation and trade data renewed concerns that the economy may once more approach deflation. The Hong Kong benchmark Hang Seng climbed by 1.87%. Following August’s 0.1% rise, China’s year-on-year CPI remained unchanged in September mainly due to weaker food prices. Producer prices fell year-on-year by 2.5%, more than consensus estimates, although it eased from the 3.0% drop the previous month. Although trade and lending data remained weak, they nevertheless came in above expectations. Overseas exports fell by 6.2% in September from their year-ago figures, which was slower than the 8.8% August drop. Imports fell by 6.2% which was still better than the August contraction of 7.3%, marking the seventh consecutive monthly decline. The data shows that while some segments of China’s economy are stabilizing, it remains insufficient to dispel concerns about China’s weakening growth prospects.

The Week Ahead

This week, among the important economic data to be released are the retail sales, housing starts, industrial production, and capacity utilization reports.

Key Topics to Watch

- Empire State manufacturing survey for October

- Philadelphia Fed President Patrick Harker speaks (a.m.)

- Philadelphia Fed President Patrick Harker speaks (p.m.)

- U.S. retail sales for September

- Retail sales minus autos for September

- Industrial production for September

- Capacity utilization for September

- Fed Gov. Michelle Bowman speaks

- Business inventories for August

- Home builder confidence index for October

- Richmond Fed President Tom Barkin speaks

- Minneapolis Fed President Noel Kashkari speaks

- Housing starts for September

- Building permits for September

- Fed Gov. Chris Weller speaks

- New York Fed President John Williams speaks

- Fed Beige Book

- Fed Gov. Lisa Cook speaks

- Initial jobless claims for Oct. 14

- Philadelphia Fed manufacturing survey for October

- Existing home sales for September

- U.S. leading economic indicators

- Fed Chairman Jerome Powell speaks

- Chicago Fed President Austan Goolsbee speaks

- Fed Vice-Chair for Banking Michael Barr speaks

- Atlanta Fed President Raphael Bostic speaks

- Dallas Fed President Lorie Logan speaks

- Cleveland Fed President Loretta Mester speaks

Markets Index Wrap-Up