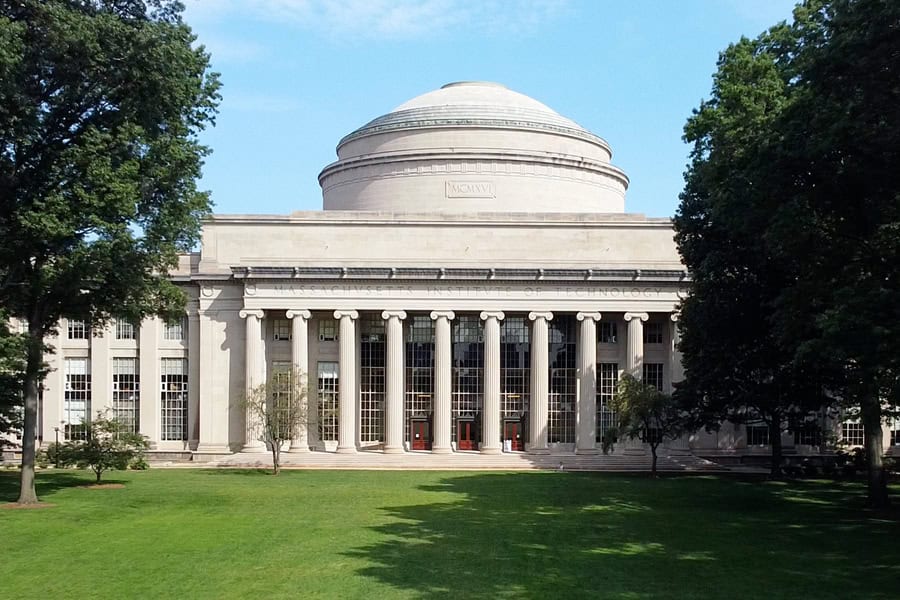

A recent report from MIT AgeLab suggests that some of the old ideas around work and retirement may not hold up as well as they used to because people are living longer.

The average lifespan in the U.S. was just 68 years in 1950 and reached 76 in 2021. And although the average lifespan has dropped over the past few years, it’s still significantly higher than it was decades ago, according to data from Harvard Health. And with these longer lifespans, there are new challenges for retirement planning.

“The traditional three-part career map of education, work, and retirement is out of date,” part of the MIT study executive summary stated.

Here’s how the traditional idea of retirement is changing and how you can prepare for it.

How retirement planning is different these days

Longevity is the biggest factor affecting people’s retirement these days. JPMorgan data shows that a non-smoking 65-year-old woman in excellent health has a 1-in-3 chance of living to 95, and a man in the same condition has a 1-in-5 chance.

And while that’s great news for those of us looking forward to a long life, it also means that people are spending a far larger portion of their adult lives in their retirement years than ever.

Unfortunately, the reality is that most people often retire earlier than they planned, which can result in less money saved. According to U.S. Census Bureau data, about 42% of working baby boomers aged 55 to 64 have no retirement account at all, and 58% of retirees in their 60s and 70s reported that they entered retirement earlier than they wanted, the MIT AgeLab survey noted.

How to get your retirement plan on track

So people are living longer, and they are retiring earlier than they want. That sounds a little unnerving, especially considering that the MIT data showed that 33% of workers believe they won’t have enough money to stop working when they reach retirement age.

Fortunately, you can do a few things to get your retirement plan into better shape if you feel like you’re falling behind. One great way to do that may be by opening a brokerage account and setting up an individual retirement account (IRA).

IRAs typically offer a lot of control over managing your retirement investments. For example, you can buy and sell individual stocks in your IRA or even buy low-cost exchange-traded funds if you’re not interested in picking stocks.

When setting up your account, you can also choose either a Roth IRA or a traditional IRA. Both have tax advantages, so compare a traditional IRA to a Roth IRA to determine which is best for you. In 2023, you can contribute up to $6,500 into your IRA account — or $7,500 if you’re 50 or older.

One of the main differences between the two is that with a traditional IRA, you get a tax deduction in the year you make the contributions. You don’t get that benefit with a Roth IRA, but you do get to withdraw money in retirement tax-free.

There are other ways to help improve your retirement planning as well, including opening a 401(k) account through your employer, signing up for an employer match program if it’s available, or even pursuing additional sources of income to boost your savings rate.

Focus on what you can control

It can be discouraging if you think you don’t have enough money saved for retirement, but it may be best to focus less on past financial decisions and more on what you can control right now.

If you need help figuring out where you should begin, check out our personal finance hub, where you can learn more about financial planning, paying off debt, how brokerage accounts work, and much more.