Ether (ETH) is poised to outperform bitcoin (BTC) in September and October as it benefits from stronger momentum related to a likely exchange-traded fund (ETF) listing, crypto market analytics firm K33 Research said Tuesday in a report.

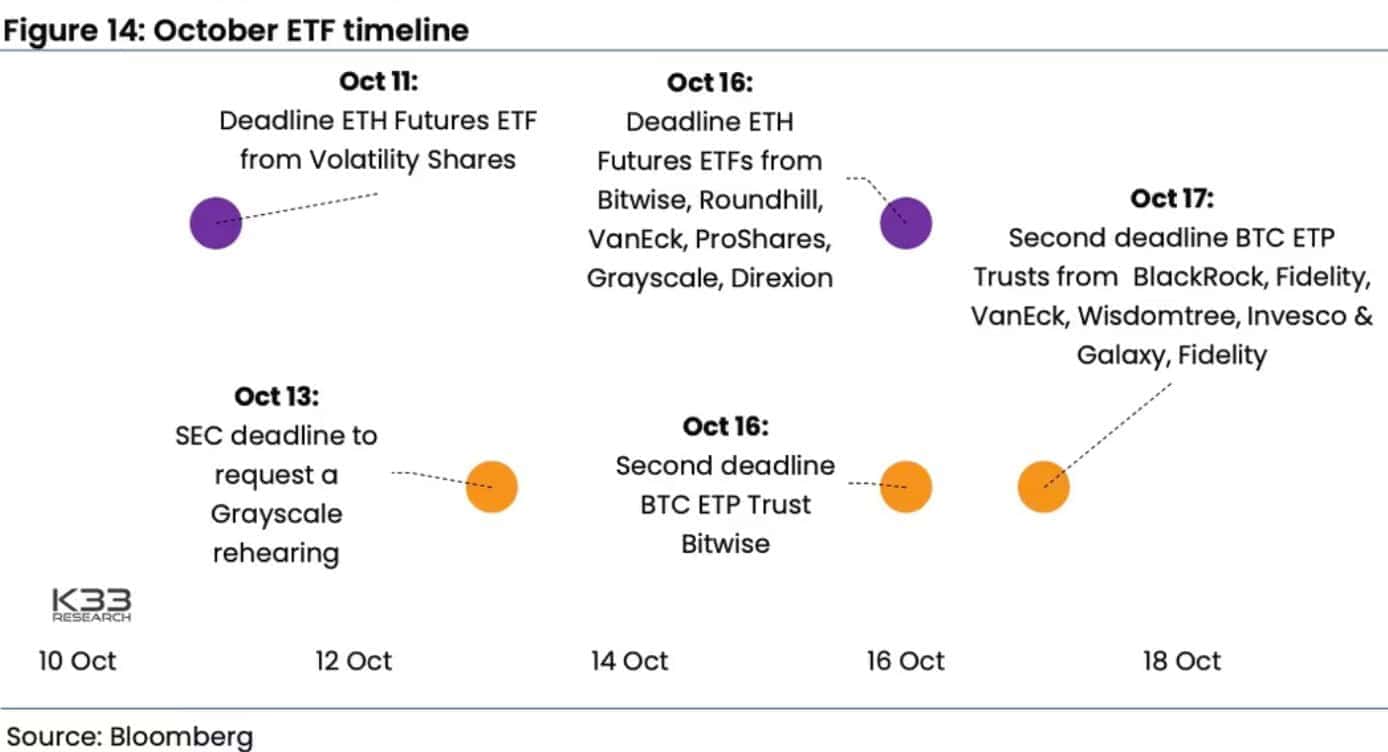

The U.S. Securities and Exchanges Commission’s (SEC) final deadline to approve or deny the first ether ETF is in mid-October, and the chances are high that the agency will green-light the product.

The development can potentially boost ether’s price, K33 senior analyst Vetle Lunde explained, noting bitcoin gained 60% in the three weeks ahead of the launch of its first futures-based ETF two years ago.

“The odds are stacked in favor of ETH,” Lunde said, calling it a “strong relative buy” versus bitcoin. “ETH/BTC trades near 2.5-year range lows, with considerable wiggle room for relative upside.”

Impact of spot bitcoin ETF is under-appreciated

Bitcoin has received a fair share of fanfare with respect to ETFs since asset management giant BlackRock filed for a spot product in June, shortly followed by applications from a slew of other asset managers, Fidelity among them.

Last week, the probability of the SEC approving a spot bitcoin ETF seemingly improved after Grayscale’s victory over the agency in a lawsuit about converting its closed-end Grayscale Bitcoin Trust (GBTC) into an ETF.

Excitement over the court decision quickly faded, however, and the SEC poured a bit more cold water on sentiment later in the week when it delayed any decision on the June spot product filings by BlackRock and the others. After initially surging to above $28,000 on Grayscale’s court victory, bitcoin quickly gave up any gains and more, slumping to near a six-month low just above $25,000 by last Friday afternoon.

“The market seems to underestimate the potential impact [of a spot bitcoin ETF],” Lunde said. “A spot ETF approval should attract enormous inflows, creating significant buying pressure on BTC. Conversely, if the BTC spot ETFs are rejected, nothing changes.”

September is historically a difficult period for BTC’s price, with the crypto recording negative monthly returns that month in every year since 2016. Crypto asset manager QCP Capital forecasted that the largest crypto asset could sink to as low as $23,000 by the beginning of October.

Still, current price levels – $25,720 at press time – provide a buying opportunity for investors with a longer time horizon, according to Lunde. “This is, by all accounts, a buyer’s market, and it’s reckless not to aggressively accumulate BTC at current levels,” he said.