Nvidia isn’t just fluff; it could soon be the world’s largest semiconductor business by revenue.

Thanks to all the kerfuffle surrounding generative AI (like ChatGPT) this year, Nvidia (NVDA -2.43%) is already the world’s most valuable semiconductor company with a market capitalization of nearly $1.2 trillion. This ranks it in a class far above its closest peers and puts it in company with tech giants like Microsoft, Apple, Alphabet, and Amazon.

Interestingly, though, Nvidia’s revenue over the past year pales in comparison to these tech titans.

DATA BY YCHARTS.

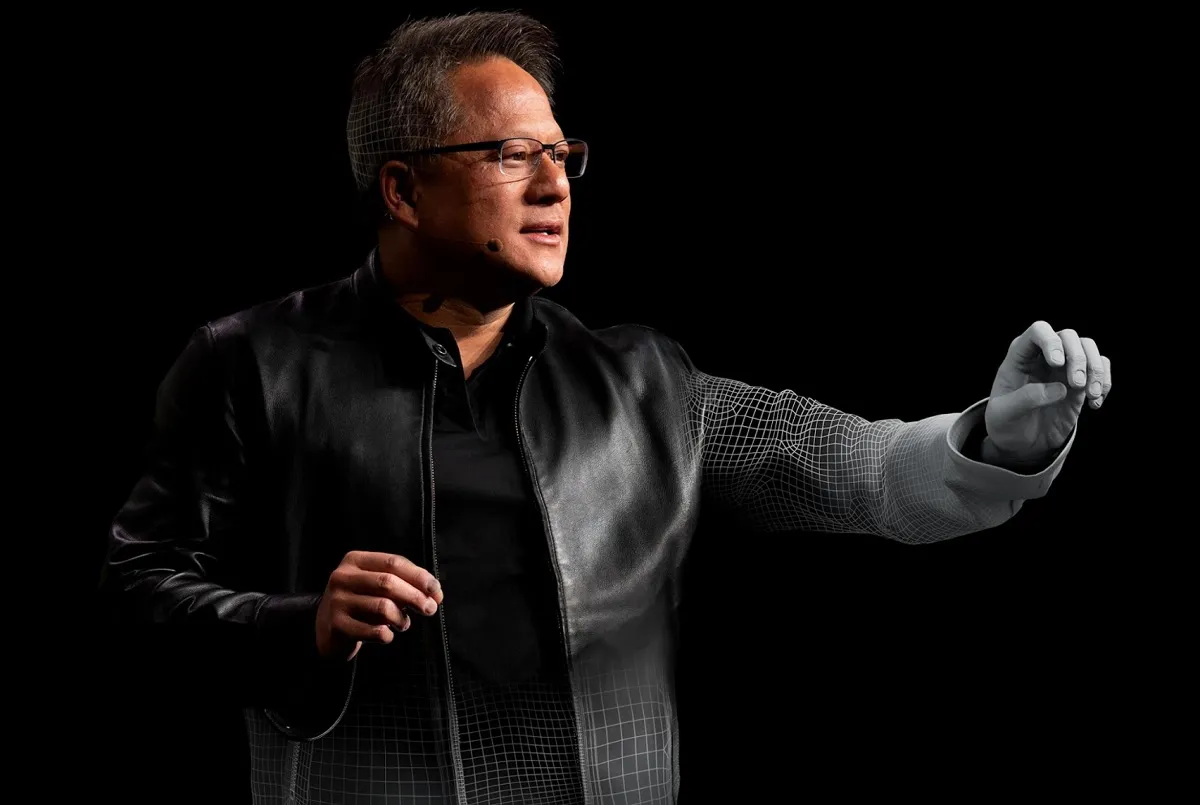

Nevertheless, Nvidia co-founder and longtime CEO Jensen Huang said on the latest earnings call that “a new computing era has begun.” Could this help Nvidia narrow the gap on sales with other big tech, and will it justify the stock running even higher?

What does this “new computing era” look like?

Huang explained on Nvidia’s second-quarter fiscal 2024 earnings call (for the three months ended in July) that there are really two major secular shifts taking place in the computing technology world. They are as follows:

- Accelerated computing: CPUs (central computing units) are still very much in need, but they are for general computing purposes. Nvidia’s decades-long work on GPUs (graphics processing units), originally for high-end video game graphics, are now being applied to the cloud and other high-performance uses to speed up computing times by an order of magnitude greater than the CPU can accomplish alone.

- Generative AI: This is but one example of a new type of high-performance computing workload, but a promising one that has grabbed the spotlight in 2023. The ability to create an AI algorithm once, and then use its ability to “create” content like text, images, video, software code, and even make robotics decisions (like self-driving car tech) for many years has obvious financial appeal.

Huang cited estimates that the world’s total data center infrastructure is currently worth about $1 trillion, and this infrastructure tends to get refreshed with new hardware (semiconductors, other components, and construction materials) about every three to five years — equating to some $200 billion in global spending each year.

But now, thanks to Nvidia’s pioneering work in computing acceleration, a massive upgrade cycle is underway to refocus these data centers on the type of chips Nvidia designs, to address new use-cases like generative AI and other high-performance computing workloads.

The result for Nvidia is a massive scale-up in its revenue, especially its data center (including AI) segment.

IMAGE SOURCE: NVIDIA.

Total revenue in Q2 was $13.5 billion, and Q3 is expected to haul in about $16 billion. Management said it has great visibility on demand well into calendar 2024 and expects to rapidly ramp up supply (and thus final sales) in each quarter well into next year.

How big could Nvidia really get?

All of this means that Nvidia is on a path to surpass $50 billion in annual revenue this year. If it keeps growing well into next year (fiscal 2025 for Nvidia), it could soon become the world’s biggest semiconductor business by revenue.

| FISCAL PERIOD* | REVENUE |

|---|---|

| Q1 2024 | $7.2 billion |

| Q2 2024 | $13.5 billion |

| Q3 2024 (est.) | $16 billion |

| Q4 2024 (est.) | >$16 billion |

| Full-Year 2024 (est.) | >$53 billion |

DATA SOURCE: NVIDIA. *NVIDIA’S FISCAL YEAR ENDS IN JANUARY 2024

For reference, at its peak a couple of years back, Intel held the top semiconductor sales title at nearly $80 billion in annual revenue. Today, the largest company by revenue is Taiwan Semiconductor Manufacturing.

DATA BY YCHARTS.

Now, does that justify Nvidia’s market capitalization, which sits now among the mega tech stocks? Only if it continues to rapidly expand, and at a very high level of profit (net income profit margin was a crazy high 46% in Q2). Whether it can sustain its current spate of growth beyond next year (2024, or Nvidia’s fiscal 2025) is now the question.

Nvidia stock is up a whopping 174% over the last 12-month stretch alone. Don’t expect anything close to that performance now that Nvidia is in the $1 trillion valuation club. As impressive (and historic) as the company’s financial results have been as of late, the share price’s ability to appreciate further could be severely limited over the next year or so.

Historically, Nvidia stock has been hit with sizable downturns, like it was in 2022. If you feel like you need to pile onto the Nvidia train, exercise some patience at this point. In the meantime, there are other chip companies also participating in this exciting new computing era that Nvidia has helped pioneer.