Americans think they’ll need to save $1.8 million for a comfortable retirement, according to a new survey. But for many of them, that’s just a shot-in-the-dark guess.

Many have no idea how much they should save or how to invest whatever money they sock away. They’re baffled by many other essential facets of retirement planning, the survey released this week from Charles Schwab showed.

That’s a real problem because what Americans save is supposed to become a major source of income in retirement, and, if they’re clueless on the basics, many may under-save and face a shortfall in their old age.

“The workers we surveyed may be 5, 10, 20, or even 30 or more years away from retirement, but the gap between now and the future can make it difficult for savers to nail down specifics about what they imagine their lives will look like in retirement,” Marci Stewart, director, communication consulting and participant education for Schwab Workplace Financial Services, told Yahoo Finance.

“That raises the bar on providing access to quality education and professional advice.”

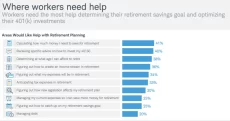

Here are the five biggest things that confuse Americans about retirement, according to the Schwab poll.

How much should I save?

More than four in 10 workers (41%) polled said they need help calculating how much money they need to save for retirement. In fact, a recent survey from Transamerica Center for Retirement Studies actually found that 45% of workers said they guessed the amount they need to save for retirement.

“Retirement calculators are widely available online and they are great tools to help people get a sense of whether they are on track,” Stewart said. Check out AARP, Bogleheads, Fidelity, Schwab, or Vanguard to start.

Plan on some soul-searching and sleuthing.

“Consider what you need to enjoy the life you want to in retirement,” Liz Davidson, CEO and founder of Financial Finesse and author of “Money Strong: Your Guide to a Life Free of Financial Worries,” told Yahoo Finance. “That number may be significantly lower than what you need right now. From there, consider what income sources will be there for you in retirement, like Social Security or even a pension.”

If you have a personal my Social Security account, you can get an estimate of your future monthly retirement benefits and see the impact of different retirement age scenarios from retiring right now to your full retirement age or at age 70 based on your actual Social Security earnings record. If you don’t have an account yet, you can set one up on the site. You might factor in a scenario where Social Security benefits are reduced 25% compared to your estimated statement to take into account the potential for the 2034-35 estimate for depletion of the Social Security Trust Fund.

One way to boost retirement savings is to check to be sure you are saving enough of your income in your employer-provided plan to score matching funds they contribute, Davidson said.

Employers contribute on par with what you contribute up to a certain percentage. Most employers who offer this benefit match 4% to 6% of your salary, so at least save that amount.

If you can save 15% for retirement every year – the combination of your employer’s contribution and yours — that’s a goal. Start small, then automatically set that amount to escalate a percentage or two each year.

What should I invest in?

SOS. The average employer 401(k) plan has more than 17 mutual funds to choose from and some offer company stock as well, according to the “How America Saves 2023” report by Vanguard.

Sorting through the myriad options can be a stumper. Four in 10 workers said they want help on how to invest their 401(k), while almost three-quarters said personalized investment advice for their 401(k) would ease their fear of making the wrong choices, according to the Schwab poll.

Just over a quarter (27%) of workers feel “very confident” making 401(k) investment decisions on their own. Confidence nearly doubles to 49% when those decisions are made with professional help, according to the Schwab survey.

“The workers we surveyed remind us that sometimes it takes a human connection to feel more confident about important financial decisions, especially when markets are volatile,” Stewart said.

That said, not everyone has access to gratis and unbiased financial coaching as an employee benefit.

“Premixed options like target date funds can help,” Davidson noted.

Most employer 401(k) plans offer target funds that invest your savings based on when you want to retire. So you begin heavy in stocks and glide on down as you get closer to retirement to a bigger portion of less risky investments. The simplicity is that you don’t have to make a lot of important decisions solo.

When should I retire?

About four in 10 workers (38%) are flummoxed when it comes to figuring out what age they will be able to afford to retire. This calculation is tricky and riddled with variables from health problems, a disability, or caregiving duties that can derail even the best of retirement planning efforts.

According to a survey by the Employee Benefit Research Institute (EBRI) and Greenwald Research that polled 1,320 workers and 1,217 retirees online in January, there is a big gap between when active workers expect to retire and when retirees say they actually did.

Workers continue to report an expected median retirement age of 65, while retirees report they retired at a median age of 62. One in three (33%) workers expect to retire at 70 or beyond or not at all, while only 6% of retirees do so, according to EBRI’s research. Just 11% of workers say they plan to retire before age 60, compared with 33% of retirees who retired that early.

The best way to get a read on what age you might be able to retire is to pull up that online retirement calculator and take a stab at a rough estimate.

“It helps to take away the stress of wondering if what you are currently doing is working,” Davidson said.

How do I create an income stream in retirement?

Paying themselves in retirement is a conundrum lots of retirees face. After years of regular paychecks it’s disconcerting to not have funds automatically available in your checking account every two weeks. Not surprising, then, that more than a third (36%) of workers say they need help figuring out their income stream in retirement, according to the poll.

Traditional counseling says not to spend more than 4% of your retirement savings in the first year to protect yourself from going bust in your golden years. You can tweak that percentage annually depending on your circumstances.

One way to calculate a reasonable annual retirement income stream is to multiply your retirement savings by 4%, Davidson said. So if you retired this year with $1 million saved for retirement, you would take out $40,000 in 2024. “There is, of course, a lot of nuance to this, so as you near retirement, it’s a good idea to talk to a professional about your numbers to make sure you have a plan you are comfortable with,” she added.

One important thing in your control is to make sure you have enough cash set aside in savings accounts – not in the market – so you aren’t caught off-guard in uncertain market years to avoid selling investments when prices are down.

How can I know what my expenses will be in retirement?

A sizable 34% of those polled by Schwab are throwing their hands in the air when they try to get a grip on what they might expect their expenses to be in retirement. And that’s understandable.

Retirement experts say folks typically need about 70% to 80% of their current income in retirement.

“As you get closer, you may want to look at your bank and credit card statements to see what you spend and then think about how your spending may change in retirement,” Davidson said.

Folks who relocate to a town or city where the cost of living is lower will have a completely different budget than they had pre-retirement. However, factors like climate change, for example, and its impact on electric bills that mount from running air conditioners in states like Florida and Arizona, and medical costs, which vary widely across the country, may skew these figures in the years ahead.

Healthcare costs are likely to be a bigger chunk of your budget than you might anticipate.

About 15% of the average retiree’s annual expenses will be health-related, per Fidelity. The after-tax cost for medical expenses throughout retirement for a single, 65-year-old retiree is $157,500 ($315,000 for the average retired couple at the same age), according to Fidelity’s 2023 Retiree Health Care Cost Estimate, which tracks retiree healthcare expenses annually.

There are ways to help prepare now to meet those future cost challenges such as a health savings account (HSA), which allows investors to contribute, invest, and withdraw money tax-free when used for qualified medical expenses. If you use your HSA money on something other than qualified medical expenses, your withdrawal will be subject to income tax, plus a 20% penalty. At age 65 and older, you can take penalty-free distributions from the HSA for any reason. However, in order to be both tax-free and penalty-free the distribution must be for a qualified medical expense.

HSAs are not an option for everyone, though — some workers do not have access to this type of account at their jobs, while for others it may be unaffordable since they’re tied to high-deductible health plans.

While no amount of hand-holding is going to assuage folks who are prone to be nervous Nellies, taking a crack at ramping up your financial acumen and pushing yourself to put together a retirement plan can bring some clarity.

“We see confidence jump once people have a specific plan for their individual situation in place,” Stewart said.