Check out which state is actually sending $675 tax rebates in August and how to claim it

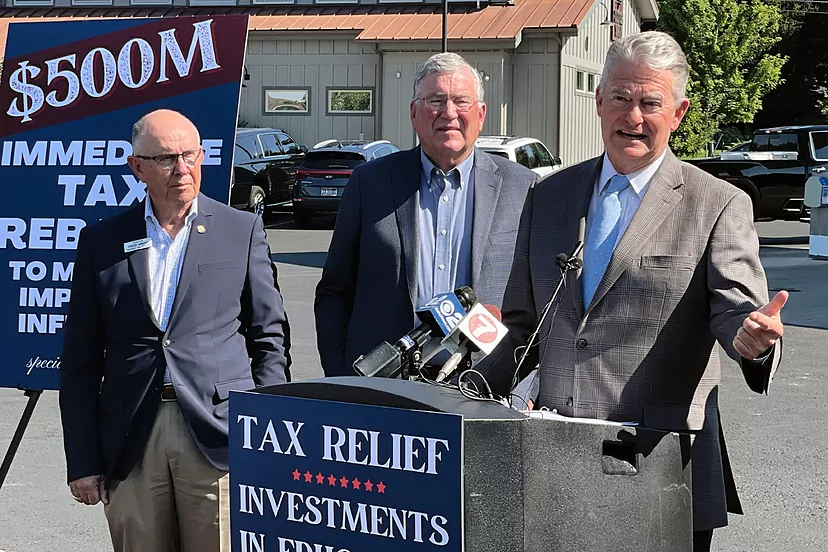

That’s right, more tax rebates are coming our way during the month of August. It is happening through direct payments of $675 but not everybody can claim these payments because it all depends on the state. In Montana, these tax rebates are coming as homeowners will be able to look forward to short and long-term property tax relief. There are two new laws that claim eligible homeowners are getting two different Montana property tax rebates and long-term property tax cuts. It is a deal that Governor Greg Giaforte secured for over $470 million during the most recent session. These tax rebates come as a massive aid for all Montana residents who will be able to claim them.

How do I get my property tax rebate in Montana?

Out of these two Montana property rebates, they will be valued up to $675 and they will be available to eligible homeowners. One of these rebates is for property taxes paid in 2022, and the other one is for property taxes paid in 2023. Some homeowners may get smaller amounts because their property tax rebate cannot exceed the taxes they paid during the tax year. That’s the reason the highest amount they can get is $650, even if they paid a higher amount. As an example, they will get a $500 rebate if they paid $500 in property taxes. If they paid $1,100 in property taxes, the rebate amount is $650 and it can’t go higher than that.

In order to claim a property tax rebate, you need to meet all the criteria. Starting with people who owned and lived in Montana residence for at least seven months. They need to have had property taxes billed on the residence. Also, you must have paid the billed property taxes on the residence in the past. In order to claim this benefit, eligible homeowners can claim it throught he state’s TransAction Portal or by paper starting August 15. You have until October 1, 2023 to claim your 2022 tax rebate. Applications for 2023 property tax rebates will not open until August 2024.