Stock Markets

All major stock indexes ended in positive territory for the week as the first half of 2023 came to a close with an overall sense of optimism. The Dow Jones Industrial Average (DJIA) ended 2.02% higher while the total stock market index gained by 2.56%. The broad S&P 500 Index mirrored the total stock market index with a 2.35% gain – its best weekly gain since the end of March – and the Nasdaq Stock Market Composite climbed by 2.19%. The NYSE Composite surged by 2.63%. The CBOE Volatility Index rose by 1.12% suggesting that even while stocks ascended, investors’ risk perception of incremental increased as well.

It is undeniable that the first semester of the year was rewarding for the market in general, supported by a more favorable outlook for Fed policy and inflation and underscored by a notably resilient economy. The week also ended a solid quarter, with small-caps and value shares outperforming in a broadening market rally. The technology tracker Nasdaq Composite stands well ahead of the other benchmark indexes for the year-to-date, with a six-month gain of almost 32%, its most sterling first-semester performance since 1983. Among the tech counters, Apple overperformed with a market capitalization higher than $3 trillion when it closed trading on Friday. This marked a first for a publicly traded company. The valuation of this one tech stock has exceeded those of five of the S&P’s eleven sectors in their entirety (i.e., materials, real estate, utilities, energy, and consumer staples).

U.S. Economy

Many economic reports released this week provided a much-needed boost to investor sentiment. Inflation data that was released on Friday by the Commerce Department showed that personal consumption expenditure (PCE) price index inched up by 0.1% in May and brought the year-over-year increase down to 3.8%, the lowest level it has been since April 2021. The core PCE index (which excludes volatile components food and energy), the Federal Reserve’s preferred inflation gauge, dropped to 4.6% year-over-year. While this is still well above the Fed’s 2% target inflation rate, the slight improvement appeared to calm fears that prices will be subjected to further upward pressures such as April’s surprise increase.

Other indicators were pointing to the growing strength of the economy. According to Commerce Department reports, private sector incomes ticked upward by 0.5% in May, which significantly exceeded a 0.1% increase in consumer spending. Contrary to expectations, weekly jobless claims fell by 26.000 from a 20-month high to 239,000, which is the sharpest drop since October 2021. Also surprising on the downside were continuing claims, which fell to its lowest level in four months. The University of Michigan revised its gauge of consumer sentiment, pushing it upward to its best level in four months. The surprising upswing was attributed by the survey’s chief researcher to the resolution of the debt ceiling standoff as well as increased confidence over softening inflation.

In May, durable goods orders rose by 1.7%, defying consensus expectations for a decline of 1%. Significantly, orders excluding the volatile defense and aircraft segments (generally considered the best proxy for business investment) climbed by 0.7% after a decline in the previous month. Likewise, new home sales in May outpaced expectations for a modest decline, instead rising by 12.2%. This was the fastest pace that monthly home sales grew since February 2022, when rates for fixed 30-year mortgages were almost 300 basis points (three percentage points) lower.

Metals and Mining

A challenging economic environment continues to face the gold market due to continued support for rising bond yields exerted by hawkish monetary policies worldwide. Top officials from the European Central Bank, the Bank of England, and the Federal Reserve said in a panel discussion this week that interest rates will have to climb higher to bring inflation down to its 2% target level. The Bank of Japan governor likewise hinted at a hawkish outlook in the future, opening the door to prospects that the BoJ will one day abandon its ultra-easy policy. It is, therefore, not surprising that following the comments of the heads of four central banks, gold is testing its support at $1,900. Despite the precious metal holding at this critical psychological support level, analysts expect this support to break, at which point gold prices may be pushed down to their 200-day moving average around $1,860 per ounce.

The spot prices of precious metals moved sideways for the week. Gold ended with a slight 0.10% loss from its week-ago price of $1,921.21 to its closing price this week of $1,919.35 per troy ounce. Silver moved up by 1.52% from its previous week’s close at $22.43 to this week’s closing price of $22.77 per troy ounce. Platinum, which ended the previous week at $921.70, moved down by 1.67% to end this week at $906.30 per troy ounce. Palladium dipped by 4.49% from its previous week’s closing price of $1,288.28 to end this week at $1,230.42 per troy ounce. The three-month LME prices of industrial metals moved lower for the week. Copper closed lower by 4.62% from its closing price a week ago of $8,574.00 to this week’s closing price of $8,177.50 per metric ton. Zinc closed this week at $2,341.50 per metric ton, 4.66% lower than its price the week before of $2,456.00. Aluminum ended this week at $2,160.00 per metric ton, down by 1.86% from its previous week’s close at $2,201.00. Tin closed this week at $26,098.00 per metric ton, lower by 3.62% from its previous week’s close at $27,079.00.

Energy and Oil

Despite growing optimism about the strengthening economic recovery, oil prices continue to trade within a narrow range. U.S. stock has declined by almost 10 million barrels, providing a fir pricing floor for oil prices this week. However, the macroeconomic news that has been released this week – in particular, a still highly resilient U.S. labor market – appears to be prompting the Federal Reserve to continue its policy of hiking interest rates. The tenuous inflation situation continues to limit the upside of oil prices despite declining oil stores. As the Argus Mars price assessment, the pivotal Americas medium sour crude benchmark is now trading at $1 per barrel above WTI, prospects look bleak for the U.S. benchmark as it is showing weakness during the prime summer driving season, a time when it historically should be strong. Next week, the OPEC members will be gathering in Vienna for a two-day deliberative forum called the OPEC Seminar. Not all are welcome, however, as the organization has banned Thomson Reuters, Bloomberg, and the Wall Street Journal from attending the event.

Natural Gas

Working natural gas exceeded the five-year average and the year-ago levels by significant margins, and forecasts for the rest of the year show that natural gas production will remain relatively flat and natural gas use will increase in the electric power sector to meet cooling demand. Nevertheless, accounting for the current surplus, working natural gas stocks are expected to remain above the five-year average for the rest of 2023.

For the report week from Wednesday, June 21, to Wednesday, June 28, 2023, the Henry Hub spot price rose by $0.47 from $2.23 per million British thermal units (MMBtu) at the start of the week to $2.70/MMBtu by the week’s end. The July 2023 NYMEX contract expired on June 28 at $2.603/MMBtu, up by $0.01 from June 21, The August 2023 NYMEX contract price decreased to $2.668/MMBtu, down by $0.01 for the week. The price of the 12-month strip averaging August 2023 through July 2024 futures contracts declined by $0.05 to $3.185/MMBtu.

International natural gas futures price movements were mixed for this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.46 to a weekly average of $11.96/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $1.45 to a weekly average of $10.72/MMBtu. In the week last year that corresponded to this week (the week that ended on June 29, 2022), the prices were $37.10/MMBtu and $40.74/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stock markets were generally up for the week. The pan-European STOXX Europe 600 Index advanced by 1.94% in local currency terms on expectations that China would assume a greater role in boosting consumption and hopes that interest rates are near their peak due to lower-than-expected inflation data. Although the Eurozone’s inflation has slowed for the third straight month, the European Central Bank has hinted at more interest rate hikes to come. Germany’s DAX climbed by 2.01%, France’s CAC 40 Index ascended by 3.30%, and Italy’s FTSE MIB surged by 3.75%. The UK’s FTSE 100 Index gained by 0.93%. The European bond yields maintained close to the week’s highs as inflation remained above the ECB’s 2% target. The yield on the benchmark 10-year German government bond moved closer to 2.4% while the yields on Italian sovereign bonds of the same maturity closed near their weekly highs despite data showing that manufacturers’ confidence had weakened.

Japan’s equities rose for the week as Japan’s equities proved to be among the world’s outperformers midway through 2023 in local currency terms. The yen’s weakness, however, tempered this performance to a more moderate degree in U.S. dollar terms. The Nikkei 225 closed the week higher by 1.2%, while the broader TOPIX Index ended up 1.1%. Japan’s monetary authorities assured investors that they were watching currency moves with an extremely high sense of urgency. All options are on the table to cope with the excess volatility in the foreign exchange markets following the yen’s recent descent to a near seven-month low. The yield on the 10-year Japanese government bond moved up to 0.39% from its level of 0.36% at the end of the previous week. Pressure on Japanese yields continues to be exerted by monetary policy divergence between the BoJ and the other major central banks. Both Japan and the U.S. reaffirmed their current policy stance during the week, although inflation accelerating into 2024 may lead to a shift by the BoJ away from its current ultra-loose monetary policy.

Chinese stocks ended mixed as well, as previous optimism that the government might implement additional measures to spur economic growth was offset by weak economic indicators. The Shanghai Stock Exchange Index added 0.13% in local currency terms; however, the blue-chip CSI 300 lost by 0.56%. Hong Kong’s benchmark Hang Seng Index moved up by 0.14%. Economic indicators released during the week were mixed, although officials highlighted the possibility of supportive measures. China’s official manufacturing Purchasing Managers’ Index (PMI) rose slightly to 49.0 in June, an improvement from the 48.8 reading in May and in line with expectations. However, a PMI rating below 50.0 still indicates a contraction in activity. The nonmanufacturing PMI eased down to 54.2 in June from 54.5 in May. Despite being below the consensus expectation, the numbers suggest that both the service and manufacturing industries continue to grow, although at a slower rate.

The Week Ahead

Among the important economic data scheduled to be released in the week ahead are manufacturing, services, and labor market data

Key Topics to Watch

- S&P flash U.S. manufacturing PMI

- ISM manufacturing

- Construction spending

- ADP employment

- Factory orders

- Minutes of Fed’s June FOMC meeting

- Initial jobless claims

- S. trade deficit

- Job openings

- S&P flash U.S. services PMI

- ISM services

- S. employment report

- S. unemployment rate

- S. hourly wages

- Hourly wages year over year

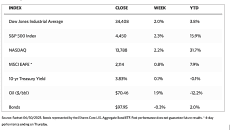

Markets Index Wrap Up