Future retirees may be leaving a significant amount of Social Security income on the table.

For the past 22 years, national pollster Gallup has been conducting surveys to gauge how reliant retirees are on Social Security income to make ends meet. At no point in those 22 years has this reliance varied between 80% and 90%. As of 2023, only 10% of retirees responded that they didn’t need their monthly Social Security check to cover their expenses.

It’s a somewhat similar story for future retirees, as well. Over 23 years, Gallup has found that between 76% and 88% of non-retirees anticipate needing Social Security income in some capacity to cover their expenses during their golden years.

In other words, getting the most out of Social Security is incredibly important for seniors. However, an unpleasant Social Security surprise may await around half of America’s future retirees.

The ins and outs of how Social Security monthly benefits are calculated

Quite a few factors go into determining what you’ll be paid each month by Social Security, as well as how much of that income you’ll get to keep. Yes, under certain circumstances, Social Security benefits can be taxed at the federal level and in a dozen U.S. states. Likewise, benefits can be withheld by the Social Security Administration for early filers who earn too much.

But when boiled down to the basics, four elements are paramount to calculating your monthly Social Security benefit: earnings history, work history, full retirement age, and claiming age.

The first two are linked at the hip. To calculate your monthly Social Security benefit, the Social Security Administration takes your 35 highest-earning, inflation-adjusted years into account. A $0 is averaged into your calculation for every year less than 35 worked, which can really hurt your monthly payout.

The third factor, your full retirement age, is something you have no control over. Your full retirement age — the age you become eligible to collect 100% of your retirement benefit — is based on your birth year. Anyone born in 1960 or later has a full retirement age of 67.

The fourth factor, which I’d argue can move the needle more than any other factor, is your claiming age. If you begin receiving a Social Security check prior to reaching your full retirement age, you’ll be accepting a permanent lifetime reduction to your monthly payout.

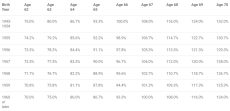

Comparatively, if you were to wait to take your benefit until after your full retirement age, your monthly check can rise above and beyond 100%. Every year you hold off on taking your benefit, your payout can grow by up to 8%, beginning at age 62 (the first year of retirement benefit eligibility) and ending at age 70, as shown in the table below.

Close to 50% of future retirees may be in for a surprise

You might think that a larger monthly check would entice retirees to wait until their full retirement age or even after to claim their Social Security benefit — but you’d be wrong. Historically, most retirees have begun taking their monthly payout prior to reaching their full retirement age, and this is a trend that may not change anytime soon.

Last year, independent investment firm Schroders released its annual 2022 U.S. Retirement Survey. This poll, which questioned 1,000 non-retirees aged 45 and up, found that 48% plan to begin taking their Social Security benefit between ages 62 and 65. That’s compared to 19% between ages 66 and 69, 11% at age 70, and 22% who were unsure of what age they’d begin taking their Social Security check.

Statistically speaking, early claims have a poor track record of working out for retired workers.

Back in 2019, financial planning and investment management company United Income used data from the University of Michigan’s Health and Retirement Study to extrapolate the claims decisions of approximately 20,000 retired workers to determine whether they’d made an “optimal” choice. By optimal, I mean the claiming decision that generated the most lifetime income possible from Social Security. Note the emphasis on lifetime income, not monthly.

The results showed that only 6.5% of combined claimants aged 62 and 63 made an optimal choice. That’s compared to 57% of retired workers who would have been best off taking their payouts at age 70. In fact, the three best claiming ages (70, 67, and 69) all involved waiting.

The point is that if nearly 50% of future retirees aim to take their payouts prior to reaching their full retirement age, there’s a reasonably good chance they’ll be leaving Social Security dollars on the table. That’s an unpleasant, after-the-fact surprise.

Statistically speaking, waiting makes sense — but here’s why that’s so difficult

If back-tested studies pretty clearly show that waiting until age 70 will give retirees the best odds of maximizing their lifetime Social Security income, you might be wondering why more eligible beneficiaries don’t choose to wait. The answer has to do with a combination of uncertainty and misconceptions.

First, none of us knows with any certainty whether we’re making an optimal Social Security claims decision ahead of time. The only way we could know if we’re on track to collect the maximum lifetime benefit from Social Security is if we knew the date of our “departure.” Since we, thankfully, don’t know when we’ll pass, our claiming decision will always be, to some degree, uncertain.

The factors most retirees are going to consider are their health, marital status, and financial needs. No two people will have the exact same variables, which means there’s no precise formula for when to claim benefits.

Secondly, claiming decisions tend to be influenced by misconceptions about the Social Security program. As an example, Schroders 2022 U.S. Retirement Survey found that 32% of respondents planned to take their Social Security benefit early because they were concerned the program would run out of money or stop making payments.

Although the annually released Social Security Board of Trustees Report has been warning of a funding obligation shortfall since 1985, America’s top retirement program is incapable of going bankrupt or becoming insolvent. It generates 90% of its revenue from the payroll tax on earned income. As long as Americans keep working and paying taxes, Social Security will keep doling out benefits. This misconception of Social Security running out of money or halting payments is coercing future retirees into poor decisions.