Stock Markets

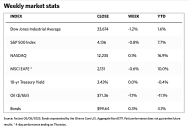

The major indexes were generally down due to the triple negative data reports released for the week. The Dow Jones Industrial Average (DJIA) fell by 1.24% and while its transportation and utilities averages rose, the total stock market slid by 0.77%. The broad S&P 500 Index lost by 0.80%, and the NYSE Composite declined by 1.06%. Bucking the trend was the Nasdaq Stock Market Composite, which managed to gain by 0.07%. The CBOE Volatility index, which tracks investor risk perception, advanced by 8.94% in reaction to the higher volatility in the market.

The negative developments during the week were the Federal Reserve interest rate hike of 0.25%, the ongoing turmoil in the banking system, and a key jobs report for April. The Fed may finally be considering a pause in its rate-hiking policy after raising interest rates by more than 5.0% in slightly over a year, however, the past year’s rate hikes may only now be starting to impact the real economy. Market volatility may increase following a market really, though it may be characterized by thin equity leadership. A bull market in stocks and bonds is still possible by year-end as the ongoing bear market loses its steam.

Despite Friday’s brief rally, the drop in the broad S&P 500 Index is seen as due to comments by Federal Reserve Chair Jerome Powell that suggested that anticipated interest rate cuts may not take place as quickly as investors had hoped. Sentiments may have also been weighed down by uneasiness surrounding the need to raise the U.S. debt ceiling. U.S. Treasury Secretary Janel Yellen notified congressional leaders that the agency may not be able to meet its debt obligations as early as June 1, raising prospects of a government default. The information technology sector fared the best and ended higher, as seen in the Nasdaq close. Yields on 10-year U.S. Treasuries slumped early in the week on the back of concerns surrounding regional banks and the debt ceiling, although the drop moderated during Friday’s trading session.

U.S. Economy

Over the weekend, California-based First Republic Bank was taken over by regulators due to its struggle with large deposit outflows similar to those earlier encountered by Silicon Valley Bank and Signature Bank. Most of First Republic Bank’s assets were acquired by JP Morgan Chase; deposits not covered by federal insurance did not suffer losses. Significant volatility in stock trading in this sector of the S&P 500 reflected heightened concerns regarding the potential for additional bank failures and the credit pressures that could materialize if the economy slows down and unemployment accelerates.

The uncertainty in the regional banking system and incremental tightening in lending standards, to a weakening in manufacturing and the housing sector, may be symptoms of the lagging effects of the accelerated interest rate hikes by the Fed. A mild recession is therefore likely, although the economy is still buffered by a relatively resilient labor market. Data from the U.S. Department of Labor indicated that the number of job openings shrank for the third straight month in March, dropping to 9.59 million from 9.97 million. Small businesses that have up to 49 employees carried the brunt of the decline. With 1.6 job openings for every unemployed person, the labor market remains tight. Layoffs were recorded at 1.8 million in the same report; this chalks an increase of 248,000, the highest level since December. Likewise, a nonfarm payrolls report that was issued on May 5 showed some strength in the labor market as the economy added 253,000 new jobs in April. This is higher than the consensus estimate of 179,000 and the 165,000 job gains recorded in March. Average hourly earnings rose by 0.5% month-over-month, compared with the reported uptick of 0.3% in March.

Metals and Mining

Gold prices this week tested record highs above $2,080 an ounce, once more showing investors the potential of the gold market to rally higher. While there is much long-term bullish sentiment in the market, the conditions for a sustained rally do not yet appear to be in place. Gold’s push to $2,085 per ounce came after the Fed raised interest rates by 25 basis points and shifted to a more neutral monetary policy. While the central bank appears to pause in raising interest rates further, Fed Chair Jerome Powell’s statements definitively indicate that they are in no position to be cutting rates anytime soon. According to Powell in Wednesday’s press conference, it is the Fed’s view that “inflation is going to come down not so quickly. It will take some time, and in that world, if that forecast is broadly right, it would not be appropriate to cut rates and we won’t cut rates.”

This past week, gold spot price closed at $2,016.79 per troy ounce, 1.35% higher than its close last week at $1,990.00. Silver, which previously closed at $25.05, rose by 2.48% to end this week at $25.67 per troy ounce. Platinum dipped 1.46% from last week’s close at $1,078.31 to end this week at $1,062.52 per troy ounce. Palladium came from the previous week’s close at $1,506.87 to this week’s close at $1,495.31 per troy ounce, for a loss of 0.77%. The three-month LME prices of base metals were mixed for the week. Copper, which was previously $8,595.50, ended this week at $8,581.50 per metric tonne for a slight drop of 0.16%. Zinc ended this week at $2,686.50 per metric tonne, a gain of 1.47% from the previous week’s end at $2,647.50. Aluminum came from last week’s price of $2,356.00 to this week’s ending price of $2,318.50 per metric tonne for a slight drop of 1.59%. Tin also lost by 0.09% from the previous week’s close at $26,088.00 to this week’s close at $26,064.00 per metric tonne.

Energy and Oil

The past week was one of the worst weeks for oil prices in recent memory. The doom and gloom surrounding the global economy failed to be shaken by any bullish news, and while a slight rebound in oil prices materialized on Friday morning that reduced the weekly loss, the sentiment remained decidedly bearish for the oil industry. Both the ICE Brent and WTI plunged by 10% week-on-week before Friday’s slight rebound. Bearish sentiment was driven by renewed concerns about a U.S. banking crisis contagion and lukewarm industrial figures from China. News that should have perked up oil prices, such as hijacked tankers on the Strait of Hormuz, falling U.S. inventories, and the lack of a deal to unlock Kurdish oil exports, all failed to offset the negative sentiment surrounding the macroeconomic scenario. In reaction to the precipitous plunge in oil prices this week, OPEC+ has confirmed that it will hold its policy meeting on June 4 in person in Vienna, which possibly hints at further tightening of production targets as the previous pledges ran out of steam.

Natural Gas

For the report week beginning Wednesday, April 26, and ending Wednesday, May 3, 2023, the Henry Hub spot price fell by $0.16 from $2.19 per million British thermal units (MMBtu) at the week’s start to $2.03/MMBtu by the week’s end. The May 2023 NYMEX contract expired on April 26 at $2.117/MMBtu. The June 2023 NYMEX contract price decreased to $2.170/MMBtu, down by $0.14 from the beginning of the week to the end of the report week. The price of the 12-month strip averaging June 2023 through May 2024 futures contracts declined by $0.10 to $2.942/MMBtu.

International natural gas futures prices decreased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia fell by $0.36 to a weekly average of $11.54/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, fell by $0.52 to a weekly average of $12.32/MMBtu. In the corresponding week last year (the week from April 27 to May 4, 2022), the prices were $24.08/MMBtu and $30.90/MMBtu in East Asia and at the TTF, respectively.

World Markets

European stocks ended the week marginally lower on the back of continued concerns about rising inflation rates and its likely impact on continued monetary policy tightening. There were also fears of a recession and the possibility of a banking contagion. The pan-European STOXX Europe 600 Index closed 0.28% lower over the past week’s trading. The major stock indexes were mixed, with Germany’s DAX up by 0.24% and France’s CAC 40 Index down by 0.78%. The UK’s FTSE 100 Index lost by 1.17%. European government bonds declined following the raising of interest rates by the European Central Bank (ECB) by 0.25%, scaling back from the previous 0.50% rate hike. The yield on the benchmark 10-year German government debt slowed to almost one-month lows. Yields in the UK were broadly unchanged, remaining close to one-month peaks at about 3.8% while investors anticipated more policy tightening from the Bank of England. Meanwhile, inflation in the eurozone advanced to 7.0% year-over-year in April, from the March figure of 6.9%. Core inflation (excluding food, energy, alcohol, and tobacco) nevertheless ticked down from a record level to 5.6%. The labor market tightened with the jobless rate falling to 6.5%. Germany’s jobless rate was the lowest among the bloc members at 2.8%.

Japan’s stock markets advanced for the first two days of the week and remained closed for the next days to the weekend due to the Golden Week national holidays. The Nikkei 225 Index returned 1.0% and the broader TOPIX Index climbed by 0.9%. The markets rallied on Monday due largely to a sell-off in the yen that boosted the outlook for Japan’s exporters. This followed the Bank of Japan’s (BoJ’s) decision to maintain its ultra-easy monetary policy stance during its April 27-28 meeting. Over the full week, however, the yen strengthened to around JPY 134.1 to the US dollar, from about JPY 136.3 to the greenback. A safe-haven demand supported the Japanese currency amid U.S. recession concerns and continued fears about the health of certain U.S. regional banks. Speculation was also fueled by the Fed’s signaling a pause in its interest rate hiking cycle. The yield on the 10-year Japanese government bond remained broadly unchanged at 0.42%.

Chinese equities closed the week mixed after a holiday-shortened week as sentiments were tempered by the release of surprisingly weak manufacturing data. The Shanghai Stock Exchange Index gained by 0.34% while the blue-chip CSI 300 fell 0.3% in local currency terms. Financial markets in mainland China were closed from Monday through Wednesday for the Labor Day holiday. China’s official manufacturing purchasing managers’ index (PMI) weakened from 51.9 in March to 49.2 in April, with 50 marking the border between contraction and growth. This marks a return to contraction for the first time since December when Beijing abandoned its zero-COVID policy. The nonmanufacturing PMI likewise softened in April albeit remaining in the expansionary territory above 50. Domestic tourism during the five-day holiday rebounded to pre-pandemic levels, increasing by 71% from a year earlier. Spending activity surged by 129% year-over-year, fueling optimism that a sustained recovery in the services sector may help offset the manufacturing sector’s weakness and a fragile property market recovery.

The Week Ahead

Next week, the important economic data scheduled for release include hourly earnings growth and the CPI and PPI indexes.

Key Topics to Watch

- Wholesale inventories

- Chicago Fed President Goolsbee television interview

- Fed Senior Loan Survey

- Fed Gov. Philip Jefferson speaks

- New York Fed President Williams speaks

- Consumer price index

- Core CPI

- CPI year over year

- Core CPI year over year

- Producer price index

- Core PPI

- PPI year over year

- Core PPI year over year

- Initial jobless claims

- Continuing jobless claims

- Fed Gov. Christopher Waller speaks

- Import price index

- Import price index minus fuel

- Consumer sentiment (preliminary)

- Louis Fed President Bullard and Fed Gov. Jefferson on panel on outlook for economy and monetary policy

Markets Index Wrap Up